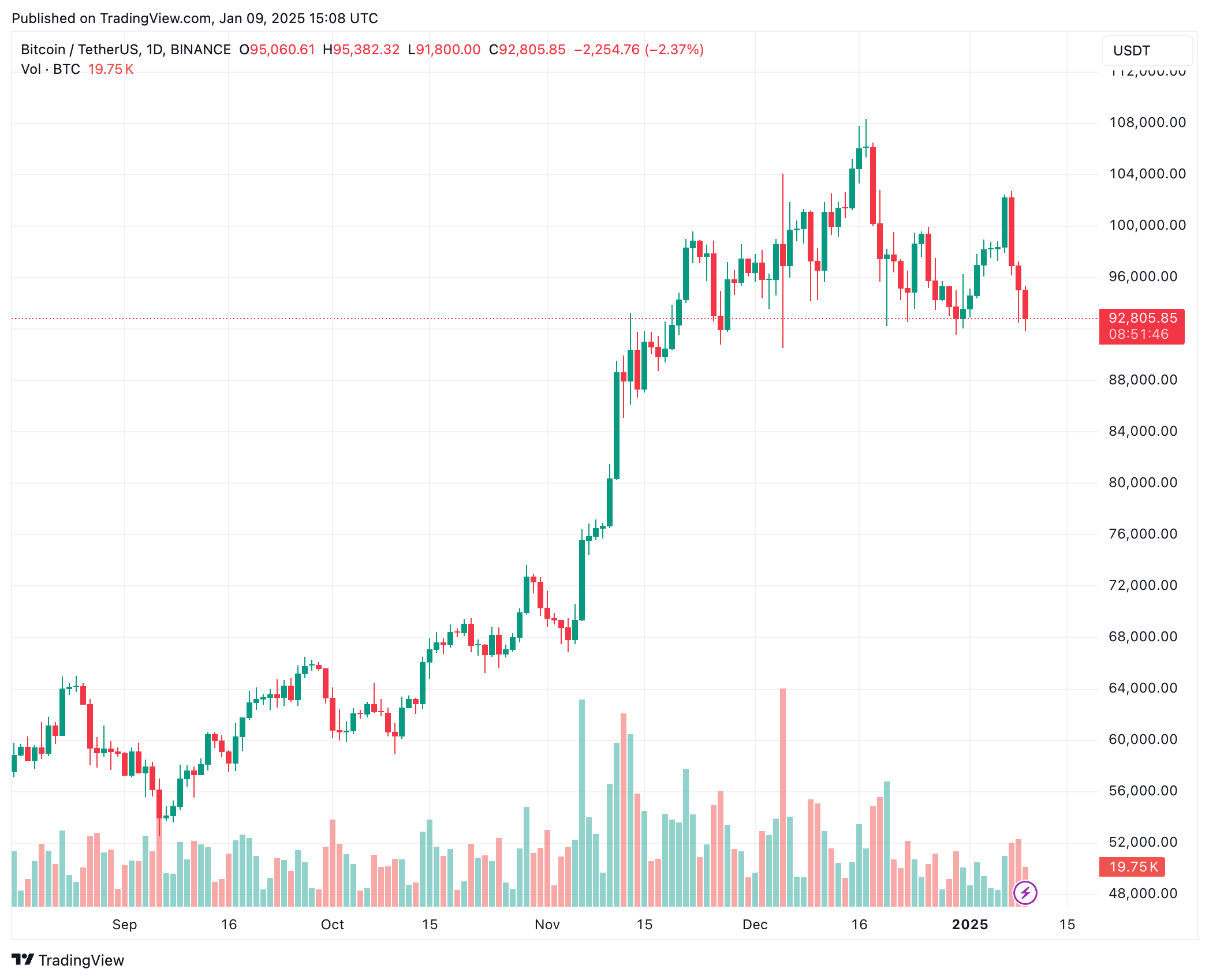

Regarding Bitcoin (BTC), it’s currently dipping towards the $90,000 level, and experts can’t agree on how much lower it might go before potentially rebounding. Nevertheless, seasoned market observers remain optimistic, pointing out that temporary price fluctuations don’t diminish their faith in Bitcoin reaching or surpassing a million dollars in the foreseeable future.

Bitcoin To Reach $1.5 Million By 2035

Cryptocurrency expert Timothy Peterson recently expressed his belief that Bitcoin could potentially surge to a whopping $1.5 million by the year 2035, according to Metcalfe’s Law. This estimation suggests a nearly 15-fold price increase from its current value over the next ten years.

To put it simply, Metcalfe’s Law means that a network’s worth or power is not just multiplied by the number of its users but rather, it’s increased dramatically as the square of those users. In other words, as more people join and utilize Bitcoin, its value tends to increase exponentially due to this law.

Peterson, who’s well-known for his optimistic viewpoint on Bitcoin, penned a much-debated article titled “Bitcoin’s Value Predicted through Metcalfe’s Law”. In this piece, he employs Metcalfe’s Law to foresee the price trend of Bitcoin. For quite some time now, Peterson has maintained that widespread acceptance of BTC is an unavoidable reality. His work posits:

In contrast to conventional currency models, Bitcoin’s value doesn’t conform; however, mathematical principles that describe network interactions provide a convincing rationale for its worth.

Peterson’s expertise is shown by his ability to accurately pinpoint significant shifts in market trends. As an example, he successfully predicted Bitcoin’s temporary low point in September of the previous year.

BTC To Dip Further Before Bounce?

Though Peterson’s optimistic $1.5 million forecast for Bitcoin excites its supporters, the recent price fluctuations may cause them some apprehension. At present, over half a billion dollars in liquidations have taken place within the last day, with approximately $136 million of that being Bitcoin itself.

Cryptocurrency expert Keith Alan commented on Bitcoin’s current price fluctuations, suggesting that “the drop in price may not have bottomed out yet.” In his analysis, Alan indicated that there is a strong pressure from sellers causing the price to decrease, while potential buyers appear to be holding off and looking for lower price points before making substantial investments. He elaborated:

It seems evident that the sellers are intentionally lowering the price. Whether the buy walls are connected to the same party manipulating the price down is uncertain, but it’s definite that they lack confidence in those price points, and some or all of this liquidity might be temporary or fake.

Alan marked off $91,500 as a possible support point and mentioned that $86,500 might serve as an additional safeguard if needed. He highlighted the presence of over $300 million in bid liquidity within this range, suggesting it’s likely that Bitcoin could recover from these price points due to this significant backing.

Alan additionally pointed out that a decrease to $86,500 would equate to a 20% drop from Bitcoin’s most recent record high ($108,135). But if this support level doesn’t maintain its strength, there could be potential for BTC to plummet even lower, reaching approximately $77,900 to fill the gap in CME.

However, crypto analyst Ali Martinez has highlighted a potential bullish outlook for Bitcoin, suggesting it could reach $275,000 due to the formation of the cup and handle pattern on the weekly chart. Currently, Bitcoin is trading at $92,805, representing a 3.3% decrease over the past day.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2025-01-10 09:40