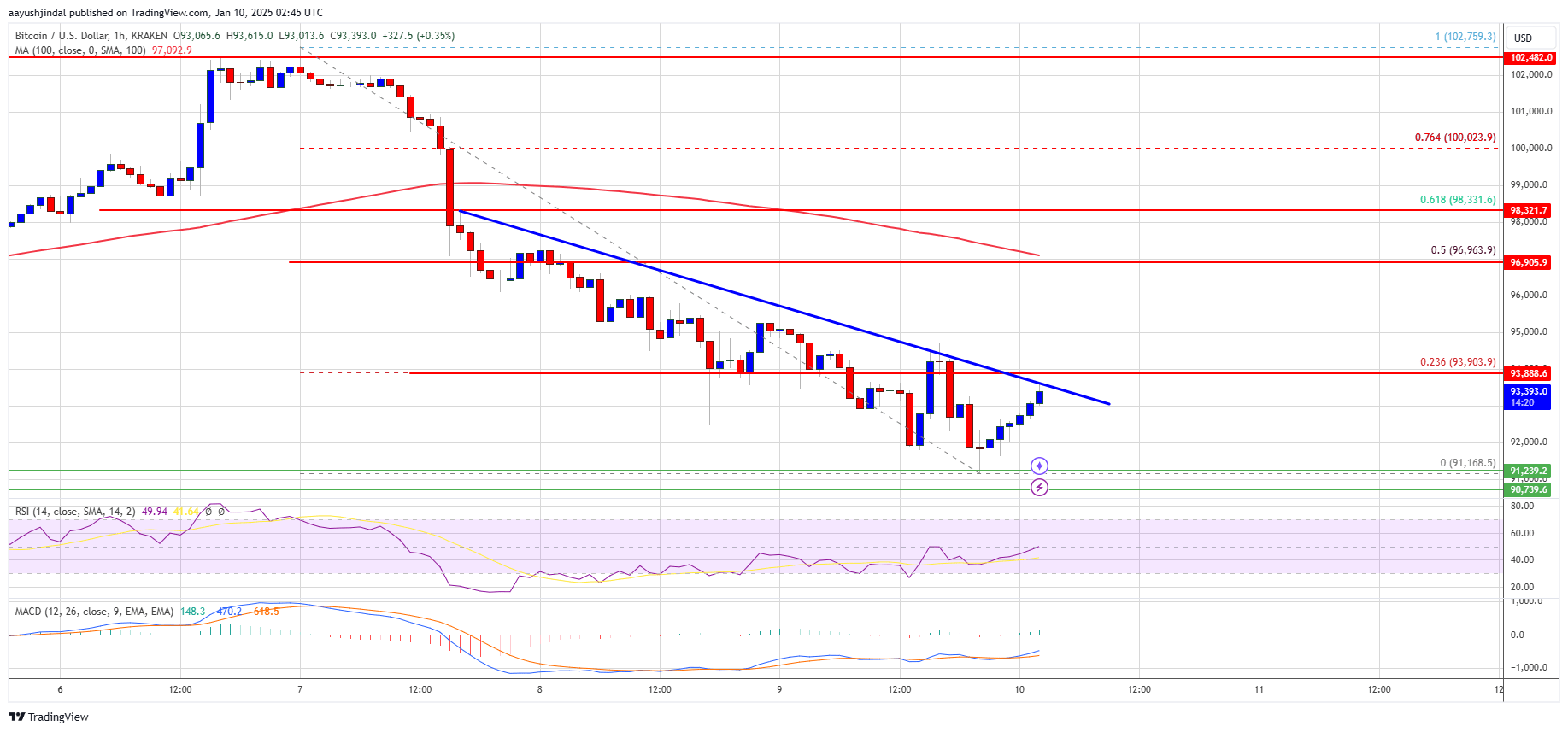

The price of Bitcoin continued to drop and fell below the $93,500 mark. At this point, Bitcoin appears to be correcting its previous gains and may find it challenging to rise above the $95,000 threshold again.

- Bitcoin started a fresh decline from the $95,500 resistance zone.

- The price is trading below $95,000 and the 100 hourly Simple moving average.

- There is a connecting bearish trend line forming with resistance at $93,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $91,200 support zone.

Bitcoin Price Turns Red Below $95K

Instead of bouncing back, the cost of a single Bitcoin didn’t manage to break through the barrier at $95,500. Consequently, Bitcoin continued to stay within a temporary negative phase, further dropping below the $93,500 mark.

Initially, the value dipped noticeably beneath the $92,000 safety net. In fact, it dropped below $91,200. The minimum was established at $91,168, and currently, the price is stabilizing with losses accumulated below the 23.6% Fibonacci retracement level of the recent downfall from the peak of $102,761 to the trough of $91,168.

Currently, Bitcoin’s trading price has dropped below $95,000 and is aligning with its 100-hour moving average. Looking ahead, potential obstacles for further growth can be found around the $93,500 mark. Additionally, a downward trend line is emerging on the hourly chart of Bitcoin versus the US dollar, with resistance at the same $93,500 level.

Initially, a significant barrier is found around the $95,000 mark. If we see a strong breakthrough above this barrier at $95,000, it could potentially push the price upward. The next potential obstacle might be at $97,000 or the 50% Fibonacci retracement level from the recent slide, which peaked at $102,761 and dipped to $91,168.

If the price breaks through the barrier of $97,000, it may continue to climb and reach the potential resistance at $98,000. If it overcomes this level, further increases could potentially take it towards the $98,800 mark.

Another Drop In BTC?

If Bitcoin doesn’t manage to break through the $95,000 barrier, there might be a potential drop in its price instead. The initial support for Bitcoin would likely be around $92,500 if it falls.

Initially, a significant level of support can be found around $92,000. Currently, another area of support is close to the $91,200 region. If prices continue to drop, they might move towards the nearby $90,000 support in the short term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $92,500, followed by $91,200.

Major Resistance Levels – $93,500 and $95,000.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Gold Rate Forecast

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- CNY RUB PREDICTION

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- Delta Force Redeem Codes (January 2025)

2025-01-10 06:04