Bitcoin‘s latest price swings have left investors feeling unsure, as this digital currency plummeted from close to $107,000 down to approximately $94,550. The unpredictability of these ups and downs prompts significant questions about whether Bitcoin can sustain its upward trend and if it will recover in the upcoming period.

Critical Support Levels Under Threat

Based on his analysis, Shayan, from CryptoQuant, suggests that Bitcoin’s price is aiming for stability slightly above the $92,000 mark. This level, according to him, serves as a significant point of support.

He observes that Bitcoin is maintaining its position around the $92,000 point, which he considers an important area of support. If Bitcoin falls below this point, it might initiate a series of long position closures and cause the price to drop towards the 100-day moving average at approximately $81,000. Furthermore, this level has shown resilience by drawing in buying activity and potentially acting as a protective barrier during any further declines.

Shayan emphasizes the importance of investor feelings (market sentiment) and specialized signals (technical indicators) in the analysis. Currently, Bitcoin is experiencing ups and downs near crucial support zones that were established at approximately $90K and Fibonacci retracement points at $87K and $82K. If these levels fail to keep Bitcoin stable, there might be increased selling activity with potential corrections.

Bitcoin Bullish Outlook Despite Bearish Fears

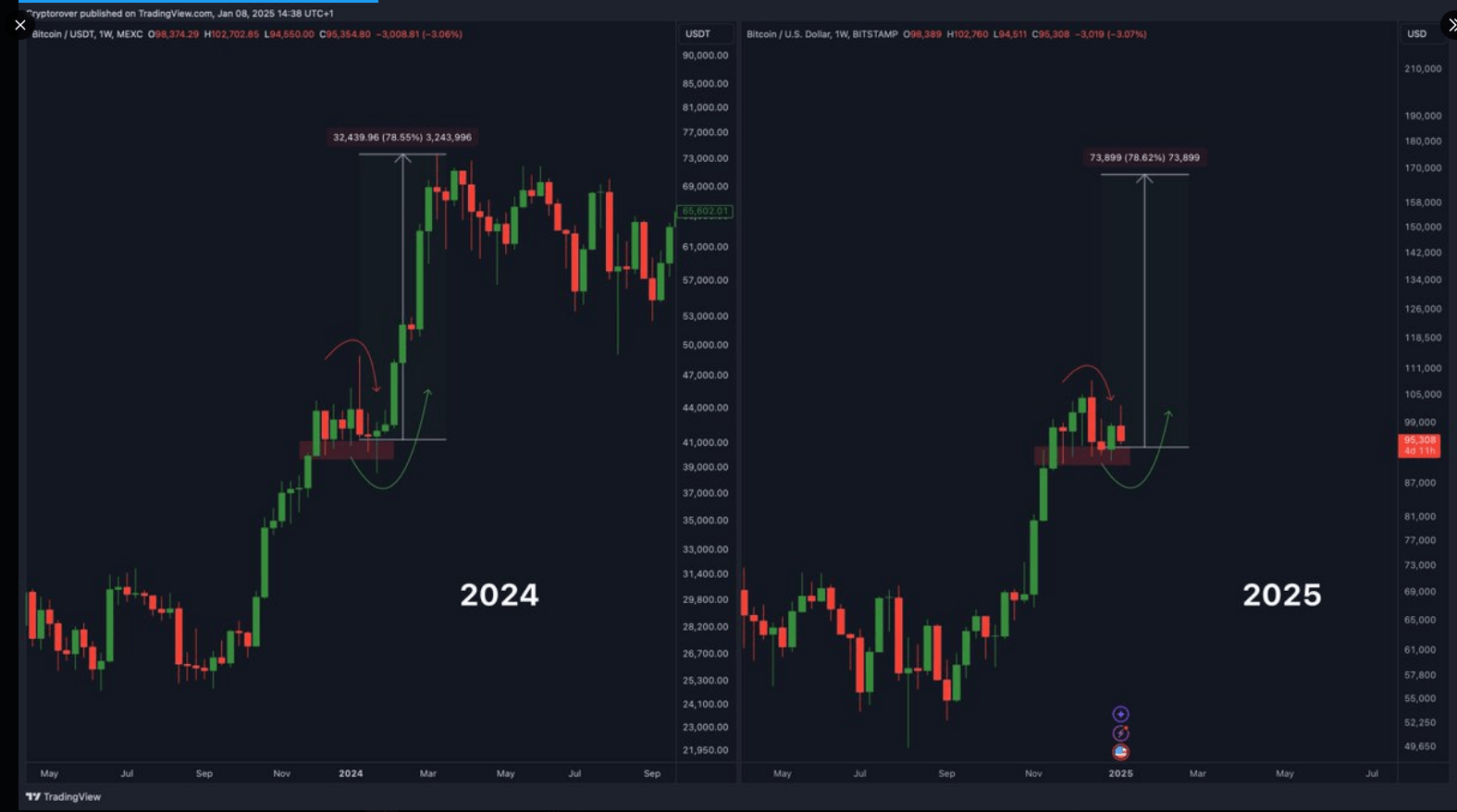

In spite of the current ambiguity, well-known cryptocurrency expert Crypto Rover is optimistic about Bitcoin’s future. By analyzing recent market behavior against historical patterns, he predicts that Bitcoin may exhibit favorable movements in January.

#Bitcoin history is exactly repeating.

January will turn green.

You’ll regret not buying more here.

— Crypto Rover (@rovercrc) January 8, 2025

As a researcher, I’ve noticed an intriguing pattern in Bitcoin’s history, and I believe we might be on the verge of a repeat. If January unfolds as predicted, Bitcoin prices could surge. I must admit, I think you might find yourself wishing you had bought more at this level if we break through the significant resistance at $100,000. Should that happen, Bitcoin could even surpass the $107,000 mark.

Big Capital Inflows

Rover finds his optimism boosted by massive investments into Bitcoin ETFs, totaling over $900 million from giants like BlackRock and Fidelity. This influx indicates growing institutional interest, suggesting faith in Bitcoin’s future potential. Yet, he also advises that if Bitcoin fails to surpass the $100,000 mark, it may experience a correction down to around $92,000, or potentially lower.

It seems that even the wider world of cryptocurrencies is experiencing stress, mirroring Bitcoin’s struggle to maintain its value. Notably, digital currencies like Ether and Solana have dropped by over 7% alongside this trend.

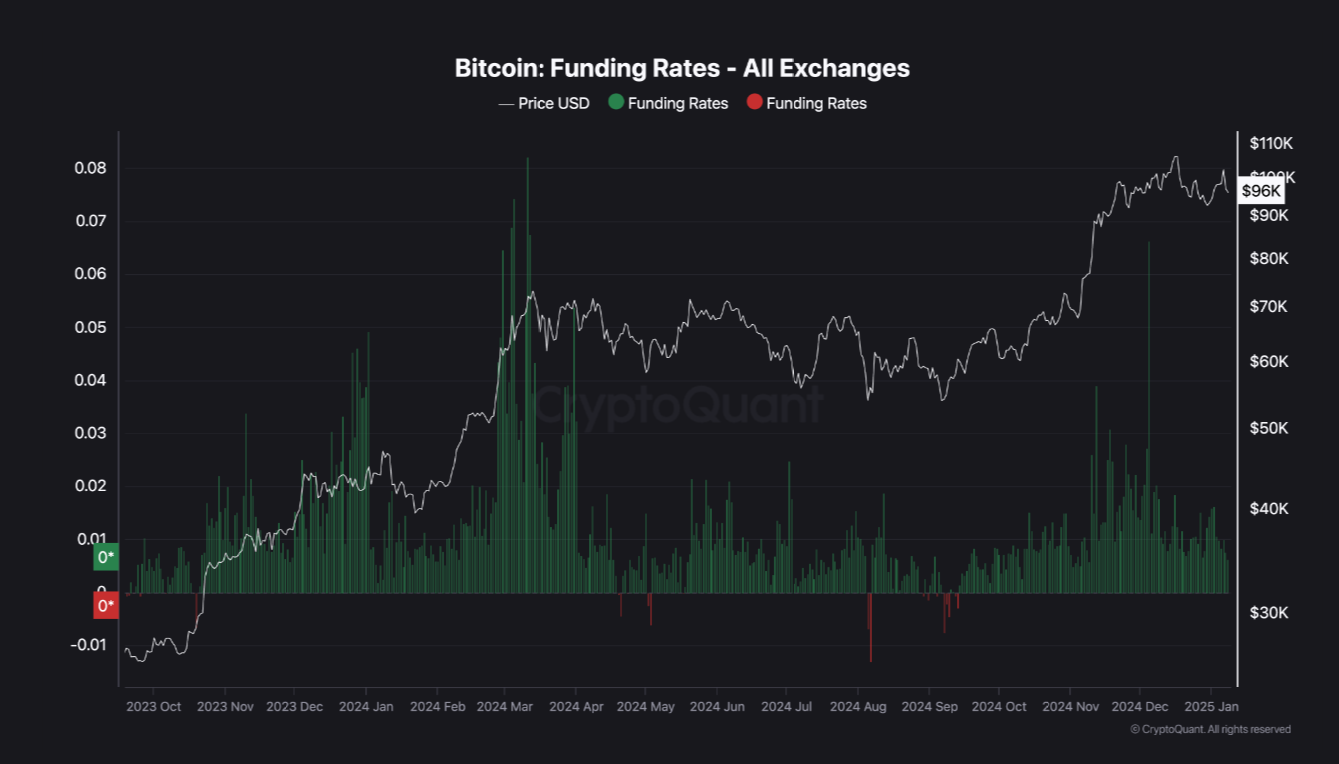

Established cryptocurrency companies like MicroStrategy and Coinbase have seen significant drops in their stock prices. The decline in funding rates within the derivatives market is adding to the negative sentiment about Bitcoin. Shayan explains that this decrease in funding rates indicates a decreasing demand for derivative products, which also influences Bitcoin’s price movements.

Read More

2025-01-09 22:16