After the recent fall in Bitcoin‘s value below $100,000, causing turmoil and doubt in the crypto market, a crypto analyst has posted an extended message on X (previously Twitter) detailing potential outcomes. This sharp drop is causing increased selling pressure and the analyst warns of key levels to monitor closely. They suggest that both broad economic trends and technical analysis hint at a complex short-term price trend for Bitcoin.

Key Levels To Watch After The Bitcoin Price Crash

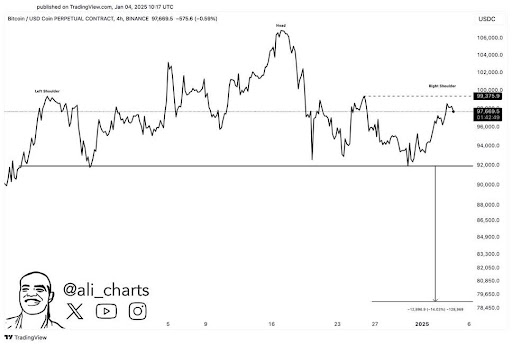

As per well-known crypto analyst Ali Martinez, Bitcoin’s price has dipped below $100,000 again, after briefly surpassing this figure earlier in the week. Martinez explained that on the previous day, Bitcoin crossed the upper part (right shoulder) of a Head and Shoulder technical pattern, which had previously suggested a bearish outlook. However, within 24 hours, Bitcoin erased these substantial gains, causing its price to fall back below the upper part of this technical pattern once more, thereby reviving bearish sentiments.

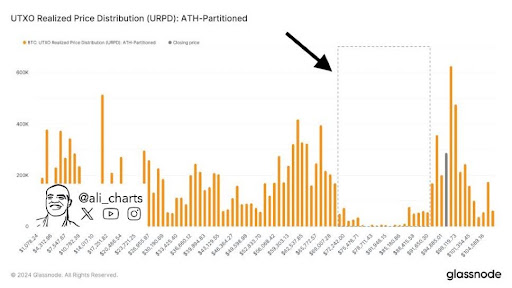

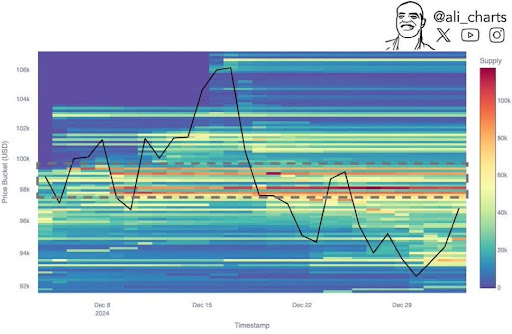

Due to a major drop in value below $100,000, Bitcoin has now fallen substantially beneath the crucial buying zone that ranges from $95,000 to $98,000. This region contains approximately 1.77 million wallets where more than 1.53 million Bitcoins were purchased, which is currently valued at over 141.3 billion dollars based on the current market price.

In contrast to most investors who usually keep their Bitcoin for potential gains, the recent Bitcoin price plunge has sparked worries that approximately 1.77 million wallet holders might be compelled to sell their Bitcoin to minimize losses. Martinez cautions that increased selling could drive the Bitcoin price below $92,000, possibly leading to a steeper and quicker fall without much support until it hits $74,000. Importantly, he describes a drop below $92,000 as “free fall territory,” implying that Bitcoin may continue to plummet as panic selling escalates and liquidity dwindles.

Amidst persistent uncertainties, the dip of Bitcoin beneath its Head and Shoulders chart formation’s right peak, along with the prevailing downward trend in the market, has sparked renewed anxiety among investors, causing them to prepare for potential further drops in price.

Rebound On The Horizon Or More Pain Ahead?

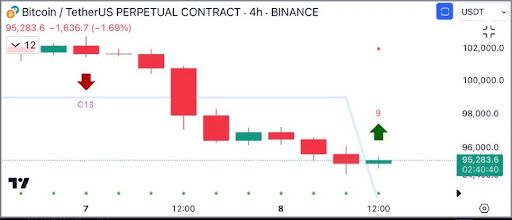

Although Bitcoin’s current trend appears bearish, analyst Martinez offers comfort to the crypto community by hinting at the possibility of a price increase. He revealed that Bitcoin’s TD sequential indicator recently showed a buy signal on the 4-hour chart, indicating that a potential recovery and rebound could be in progress.

It’s worth noting that traders on Binance continue to be optimistic about Bitcoin, predicting a near-term rise towards $98,600. This level is significant due to a potential liquidation zone of around $35 million that attracts market makers. However, for Bitcoin to shake off its current bearish trend and reach new record highs, it’s crucial that the price consistently surpasses the $100,000 mark first, as pointed out by Martinez.

If Bitcoin cannot recover above its current psychological level of $92,000 and instead drops below this point, it may be headed for additional decreases, possibly reaching new support levels between $78,000 and $74,000. Currently, the price of Bitcoin is at $94,154, so a fall to these lower levels would represent a significant drop of around 17.16% to 21.41%.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

2025-01-09 21:04