Bitcoin has dropped below the $94,000 threshold, while Ethereum is finding it tough to maintain its positive momentum around the $3,300 mark. Currently, Ether is trading at approximately $3,298, with a slight recovery of 0.44% over the past 4 hours. The 24-hour volatility for Bitcoin stands at 1.8%, and its market cap is around $1.85 trillion, with a 24-hour volume of roughly $61.78 billion. For Ethereum, the 24-hour volatility is 1.5%, the market cap is approximately $397.23 billion, and the 24-hour volume stands at around $29.43 billion.

Ethereum Price Analysis Shines Focus on $3,300

On the 4-hour chart, Ethereum’s price movement shows a failed attempt to maintain an upward trend above the 61.80% Fibonacci resistance at approximately $3,667. This bullish failure led to a retracement, and as broader market turbulence intensified, this pullback grew into a correction rally.

Currently, the cost of Ethereum has dropped to approximately $3,300, which aligns closely with the 23.60% Fibonacci retracement level. The Ethereum price chart reveals a noticeable slowdown in bearish momentum as it has moved sideways, displaying multiple Doji patterns.

As the leading alternative cryptocurrency changes direction, this sideways move has triggered what’s known as a “death cross” event. Yet, the 4-hour Relative Strength Index (RSI) line hints at a bullish possibility due to a divergence occurring. Additionally, it is breaking free from the oversold area, suggesting a possible change in trend direction.

Analyst Finds an Extremely Bullish Pattern That Demands $2,900 Retest

Although there’s a significant possibility that Ethereum may experience a dip, analyst Ali Martinez suggests this could be a prime moment to buy at a lower price, given the potential for an inverted head-and-shoulder pattern visible on a 12-hour chart.

A dip in Ethereum’s price down to around $2,900 could present a fantastic buying opportunity, potentially leading us towards a goal of $7,000 in the future!

You can reap a $5,000 bonus without putting your personal funds at stake! Just use this link to visit SimpleFXcom: [Your Link Here]

— Ali (@ali_charts) January 9, 2025

This very optimistic graph shows where the line connecting the high points crosses the $4,000 level, a significant psychological threshold for Ethereum. As the probability of a drop in Ethereum increases, there’s a higher likelihood that the price will dip to around $2,900, forming a right-shoulder shape in the pattern. If this bullish trend holds true, the chart suggests a potential future high could be around $7,000.

For momentum traders, breaking the $4,000 barrier offers a more advantageous opportunity with reduced risk, as long as the bullish trend continues to hold strong.

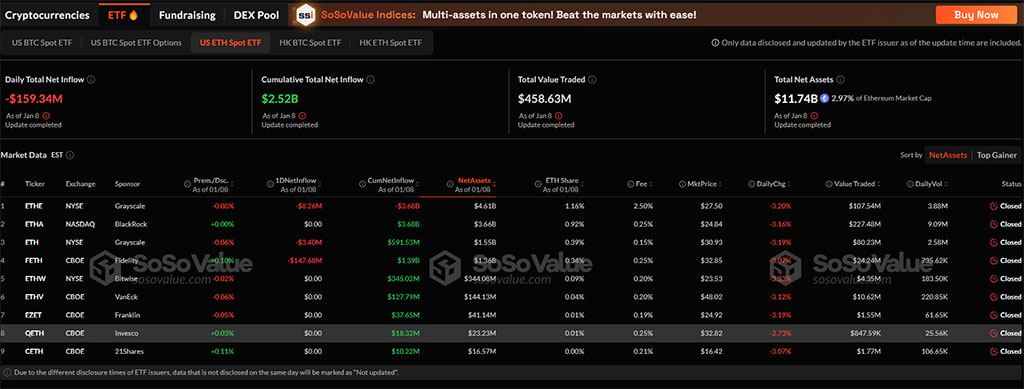

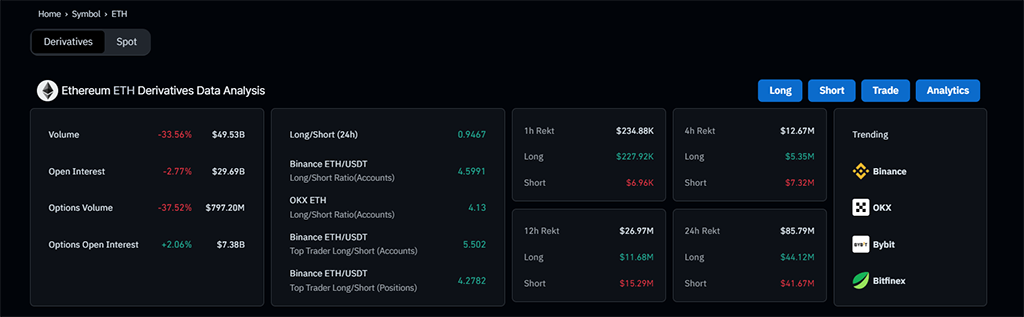

Ethereum Derivatives and ETFs Turn Red

Although there may be initial optimism for an increase in Ethereum’s value (bullish recovery), an analysis of its derivatives data suggests a dominant bearish trend. The open interest for Ethereum has decreased to approximately $29.69 billion, representing a 2.77% drop within the last 24 hours. Moreover, the ratio of long positions to short positions (long-to-short ratio) now stands at 0.9467, indicating a significant selling sentiment among traders.

In the last 24 hours, crypto market liquidations amounted to $480 million overall, with Ethereum specifically accounting for $85.79 million in these liquidations. Meanwhile, U.S. Bitcoin spot ETFs are experiencing their second-largest outflow on record, while the Ethereum spot ETF remains cautiously bearish.

As an analyst, I observed on January 8 that Ethereum spot ETFs experienced a significant outflow amounting to approximately $159 million. Leading this bearish trend was Fidelity’s FETH ETF, which saw an outflow of around $147.68 million. Additionally, Grayscale Trust and Minitrust combined recorded an outflow of roughly $11.66 million. The remaining ETFs reported a net zero outflow, marking this as the second-largest outflow ever for these Ethereum ETFs.

ETH Price Targets $3,500 Next Week

Over the next few days, Ethereum’s price movement might indicate a surge towards approximately $3,446, which represents half of the Fibonacci sequence. This prediction is based on a discrepancy in the Relative Strength Index (RSI). However, if Ethereum fails to maintain its position above $3,300 during the market-wide downturn, it could potentially drop back down to around $3,100.

Additionally, the extended pricing pattern by Ali indicates that there could be a possible return to the $2,900-$3,000 price range due to a potential reversal of the inverted head-and-shoulder configuration.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2025-01-09 14:54