Over the last three days, I’ve observed a significant drop in the total crypto market cap valuation from $3.5 trillion to $3.2 trillion, representing approximately a 9% decrease. The gloomy outlook on the cryptocurrency market seems to be intensifying, and as such, Bitcoin (BTC) has dipped below the $94,000 mark. In the past 24 hours, its volatility stood at 2.6%, with a market cap of $1.85 trillion, a 24-hour trading volume of $51.01 billion.

As liquidations rise and market conditions change dramatically during early 2025, there’s growing unease among cryptocurrency investors. Could this uncertainty lead to a drop in Bitcoin prices down to approximately $86,000?

Bitcoin Price Analysis

On the 4-hour scale, the Bitcoin price movement shows a significant correction period following resistance at approximately $102,000. The heavy selloff has led to a bearish cross between the 50 and 100 Exponential Moving Averages (EMA).

Additionally, the Relative Strength Index (RSI) line has touched the extreme sell signal point. Yet, Bitcoin’s price is approaching a significant support point at around $92,118.

As a crypto investor, I’m optimistic about a potential bullish recovery at this point, given that the Relative Strength Index (RSI) is showing a slight divergence while holding steady in its horizontal trend, despite Bitcoin’s downward movement.

Therefore, there’s a possibility that the price could drop towards $92,000 due to increasing selling pressure. Yet, if bullish momentum returns, we might witness a quick rebound aiming to surpass the 200 EMA line at around $96,397.

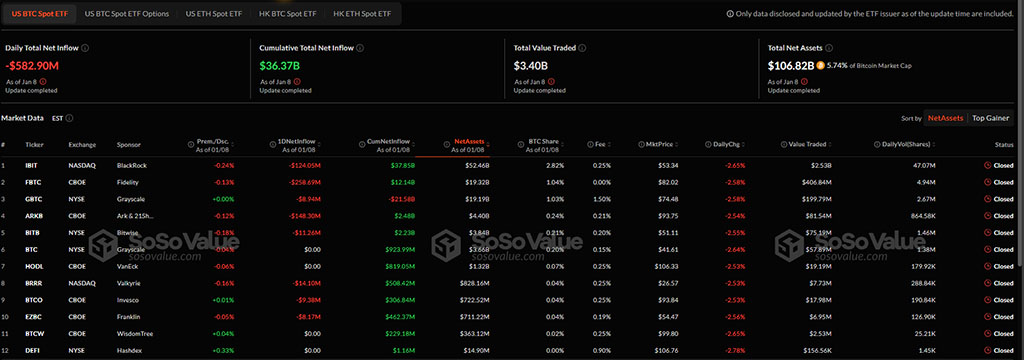

ETFs Record ~$580 Million Outflow, Second Single-day Largest Ever

Over the past period, institutional backing for Bitcoin has noticeably dropped off. On January 8th specifically, there was a total outflow of approximately $582.90 from 12 US-based Bitcoin ETFs, with 8 of them experiencing withdrawals, while 4 maintained a neutral position without any inflow or outflow.

As a researcher analyzing the latest trends in cryptocurrency investments, I’ve noticed some significant outflows in prominent investment firms. Specifically, Fidelity’s FBTC saw a substantial departure of approximately $258.69 million from its Bitcoin holdings. Following closely behind, ARK and 21Shares recorded an outflow of roughly $148.30 million each. Notably, BlackRock also sold around $124.05 million worth of Bitcoin, contributing to this trend.

With a significant withdrawal, the three-day run of investments into Bitcoin ETFs has ended, resulting in a sizable outflow. This event also represents the second largest outflow ever recorded for Bitcoin spot ETFs, surpassed only by an outflow of approximately $680 million on December 19.

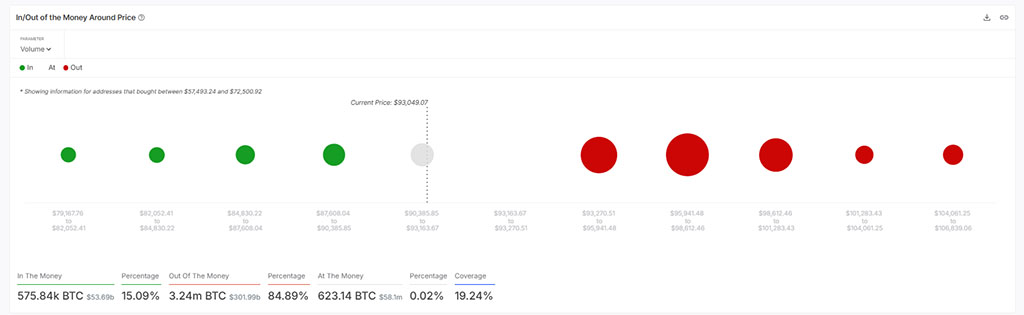

On-chain Reveal Crucial Support above $90k

With Bitcoin’s price continuing to plummet, key regions offering potential support can be identified by looking at areas both in-the-money and out-of-the-money. Notably, a significant portion (84.89%) of Bitcoins are currently out of the money within the range spanning from $79,000 to $104,000.

As a researcher examining Bitcoin market dynamics, I can share that the immediate price support level hovers around $93,163. This range encompasses values between $90,385, and it collectively represents a trading volume of approximately 222,200 Bitcoins.

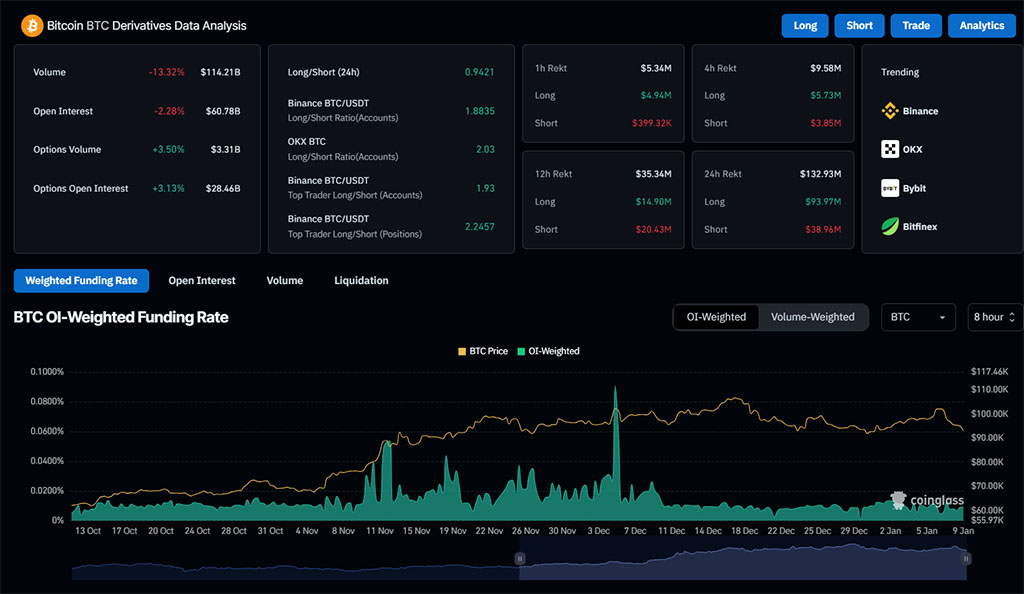

Bitcoin Open Interest Down to $60B as Liquidations Spike

In recent days, there’s been a rise in negative feelings about cryptocurrencies. Specifically, the total value of open Bitcoin contracts has dropped to approximately $60.74 billion, which represents a decrease of 2.23% over the last day.

Moreover, the long-to-short ratio is now at 0.9436%, while the funding rate stays at $0.0090. The last 24 hours have seen a significant sell-off in the crypto market, leading to liquidations amounting to approximately $480 million.

From this event, bulls have suffered a loss of approximately $341 million. The largest single sale, amounting to $15.30 million, took place on the OKEx exchange in the BTC-USDT trading pair. In Bitcoin specifically, the past 24 hours saw a liquidation of around $134 million, with about $92.38 million being bearish liquidations.

Whales Secure Their BTC in a Crashing Market

In spite of the significant downturn in the cryptocurrency market, some dedicated investors, known as “diamond hands,” are still moving their Bitcoin off exchanges. Over the last seven days, a total of approximately 22,000 Bitcoins have been withdrawn from these platforms.

The value of this stands at approximately 2.1 billion dollars. Despite the downward trend in global exchange reserves, they have not successfully created artificial demand for bitcoin within the market. As the price of BTC drops, the decreasing exchange reserves could serve as a catalyst for bullish movement once the market recovers its stability.

The current value is around 2.1 billion dollars. The falling trend in the amount of money held by countries (exchange reserves) hasn’t caused more people to buy bitcoin, but when the market settles down, less bitcoins in circulation could make the price go up again.

Read More

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Gold Rate Forecast

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- How to get all Archon Shards – Warframe

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- What’s the Latest on Drew Leaving General Hospital? Exit Rumors Explained

- Nagarjuna Akkineni on his first meeting with Lokesh Kanagaraj for Coolie: ‘I made him come back 6-7 times’

2025-01-09 13:51