As an analyst, I find myself reflecting on the market’s New Year recovery that soon transformed into a retreat at the start of this year. This shift occurred when Bitcoin (BTC) slipped from its recently strengthened $100,000 support and dipped into the $94,000 area. Despite this decline, I maintain a cautiously optimistic stance regarding BTC’s price trajectory moving forward.

Bitcoin Risks Crash To $74,000

On a recent Tuesday, Bitcoin dipped under $97,000, causing the market to experience its initial decline for the year. At the start of 2025, BTC was trading approximately at $92,000, but it saw a rise of about 6.5% over the subsequent days.

Following the weekend’s shift from resistance to support at $98,000, Bitcoin surged over $100,000 to reach its highest price level in several weeks. Yet, Bitcoin encountered difficulties in preserving this crucial support area, experiencing a 3% drop within an hour yesterday.

The price of cryptocurrency decreased by 2.5% over the past day, reaching a low of around $94,500 in the early hours of Wednesday. Since then, Bitcoin (BTC) has fluctuated between roughly $94,800 and $95,600, briefly touching the resistance level of $96,000.

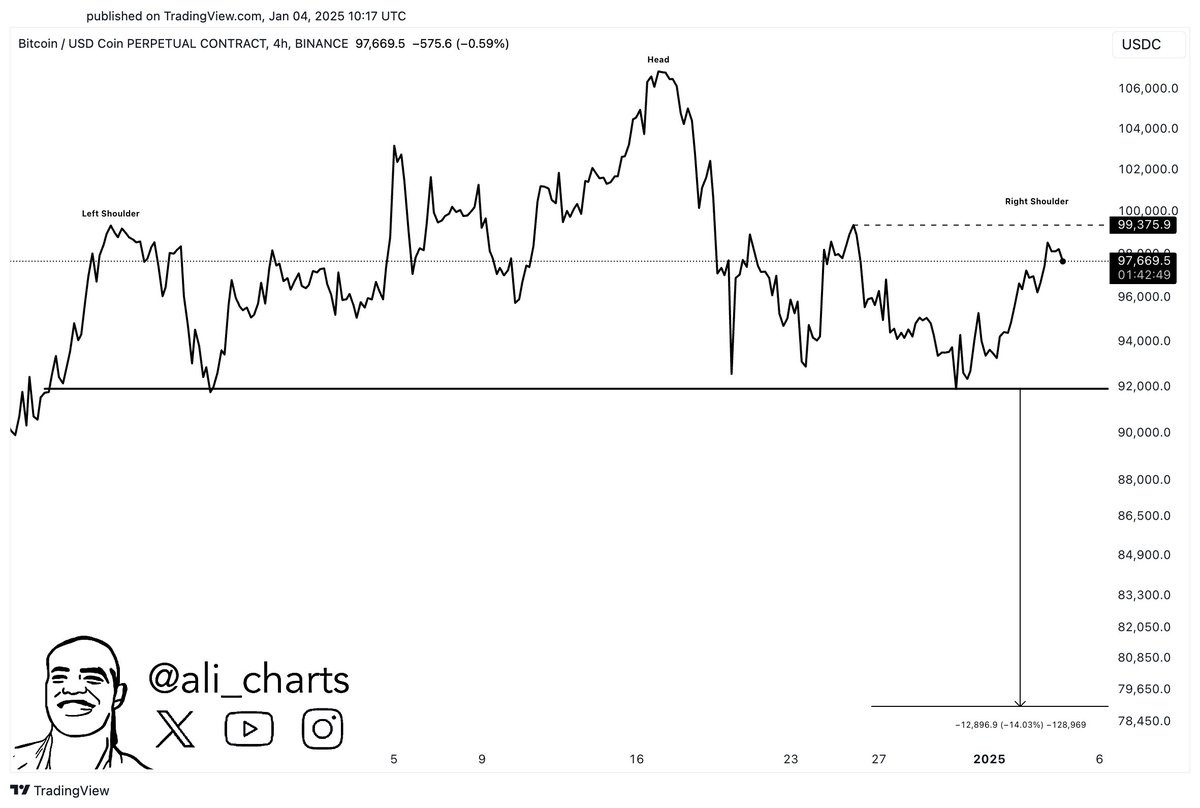

crypto expert Ali Martinez scrutinized Bitcoin’s latest market behavior. On Monday, he pointed out in his analysis that Bitcoin had broken through the upper arm of a ‘head and shoulders’ chart formation, which could potentially nullify the previous bearish prediction associated with this pattern.

But the opposite occurred, “wiping away those advancements,” causing Bitcoin to drop back beneath its right shoulder, renewing worries about a bearish trend. Martinez additionally noted that Bitcoin dipped below a crucial buying area ranging from $95,400 to $98,400, where approximately 1.77 million wallets hold over 1.53 million Bitcoins.

The analyst proposed that the price decrease might compel these owners to “dispose of some Bitcoin to limit potential losses.” Additionally, he pointed out that for Bitcoin, there’s not much resistance ahead, with only a modest barrier of 107,000 BTC between $104,700 and $105,770.

Despite the warning, the analyst cautioned that if the price of the cryptocurrency falls below $92,000, it could lead to difficulties. This decline might initiate a significant drop in value, as there is minimal support until $74,000.

Consequently, viewed from a broader standpoint, the present market situation seems to be reviving concerns about a possible drop in Bitcoin’s value,” he remarked.

BTC Price Set To Bounce Soon?

As a researcher, I find myself sharing a measured optimism towards Bitcoin from a technical standpoint. To put it simply, the TD Sequential indicator on the 4-hour Bitcoin chart indicates a possible buying opportunity, hinting at a potential price uptick if the value can maintain its position above the $93,500 support level.

Furthermore, he emphasized that the majority of traders on Binance seem to be optimistic about Bitcoin, with approximately 61.28% of active traders holding long positions, indicating they believe the price will rise.

Martinez further pointed out that a sum of $35 million would be released if the price of Bitcoin (BTC) rises to $98,600, indicating that market makers might attempt to capitalize on this increase. Additionally, there is another liquidation zone worth approximately $66 million above the price level of $103,300.

Nevertheless, the analyst underscored that Bitcoin needs to regain the $100,000 level to disprove the bearish perspective and aim for fresh record highs. In brief, Martinez predicted a short-term recovery up to $98,600, but warned that the broader market trends call for caution.

As of this writing, Bitcoin is trading at $94,500, a 3.3% retrace in the daily timeframe.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

2025-01-08 21:58