The data from the blockchain indicates that fewer than 1% of all Bitcoin owners have yet to realize a profit as the value of the cryptocurrency surpasses $100,000 per coin.

Very Few Bitcoin Addresses Are Sitting Underwater At Current Price

On their latest update at X, the market analysis platform IntoTheBlock delves into the distribution of profits and losses among Bitcoin users following the recent recovery phase of the digital currency.

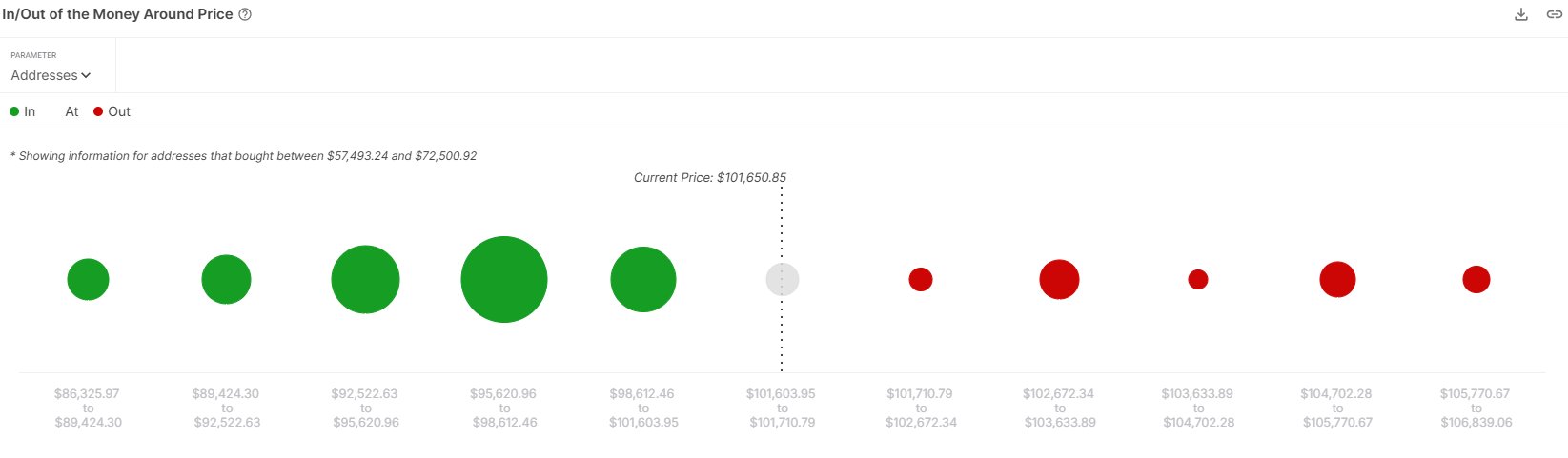

At present, Bitcoin’s price is approaching its all-time high, which means there might not be too many investors who are still in a losing position. Here’s a chart provided by an analytics firm that indicates the price ranges within which these remaining investors bought their coins.

As a researcher, I’ve plotted the Bitcoin (BTC) data, and the size of each dot represents the quantity of BTC that was last bought within the given price range. Notably, I observe that the dots are relatively small in size for levels above the current market price, indicating minimal recent purchases at those prices.

Approximately 380,000 bitcoin addresses have a cost basis associated with them, which might seem substantial, but considering the massive size of the Bitcoin community, it represents fewer than 1% of its total users.

In on-chain analysis, it’s crucial to consider cost basis levels because investors tend to act when their investment’s potential gain or loss is about to change from a loss to a gain, or vice versa.

Individuals who had previously incurred losses before the retest (meaning the retest happens at a lower price than before) may react by selling, as they might worry that the price could decrease further, offering them a possible short-term chance to recover their investment.

If the current test level is significant for a large number of Bitcoin investors as their purchase point, then this selling could noticeably impact Bitcoin’s price. At the moment, however, the potential price levels ahead seem rather slim with few addresses, suggesting they might not provide much resistance against panicked sellers.

Even though advancing through these stages might not automatically equate to an easy stroll for the coin, it’s important to note that when the scale tips heavily in favor of market profits, another factor may emerge as a substantial threat: the temptation to sell with the goal of realizing profits.

As the imbalance in the market grows larger, it becomes increasingly likely that a widespread sell-off will occur. Given that most Bitcoin investors currently hold profits, it’s inevitable that some of them will choose to cash out their investments. The question now is whether demand will be robust enough to counteract this selling pressure or not.

BTC Price

At the time of writing, Bitcoin is trading around $97,900, up 3% over the past week.

Read More

2025-01-08 10:37