The data suggests that a Bitcoin predictor has recently developed a pattern which historically indicates a rise in the cryptocurrency’s value.

Bitcoin Coinbase Premium Index Has Crossed Above Its 14-Day SMA

On their latest update, CryptoQuant, a leading analytics firm in the cryptocurrency sector, has delved into a recent pattern that has emerged in the Bitcoin Coinbase Premium Index. This “Coinbase Premium Index” is a tool that measures the percentage gap between the price of Bitcoin quoted on Coinbase (in USD) and its price on Binance (expressed in USDT).

This tool helps compare the purchasing and selling trends between the user groups of the two leading cryptocurrency exchange giants, Coinbase and Binance. A positive value suggests that more users on Coinbase are buying or selling less aggressively compared to those on Binance. Conversely, a negative value indicates that Binance users may be driving Bitcoin’s price higher than their counterparts on Coinbase.

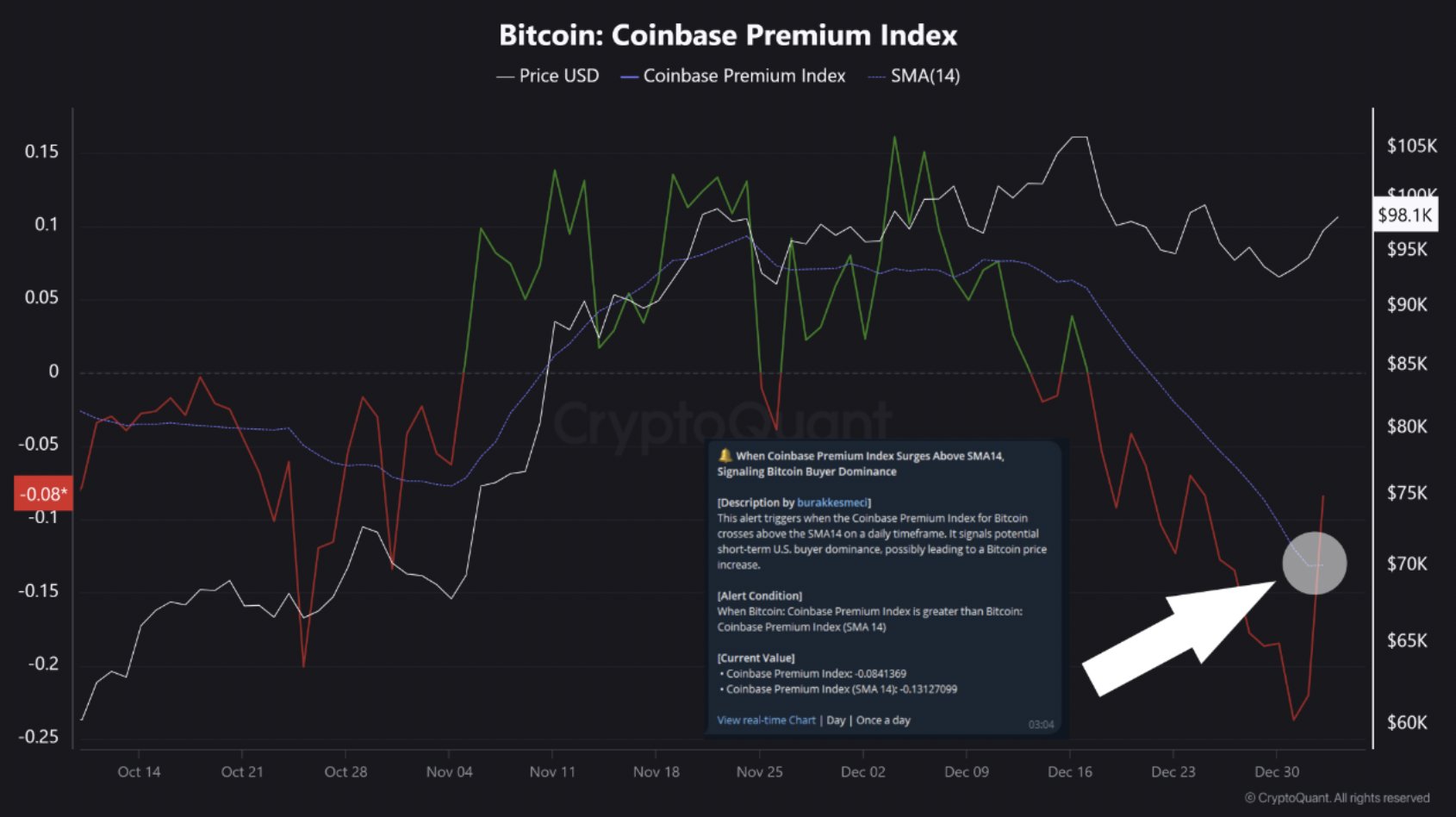

Here’s a chart provided by an analytics company, displaying the development of the Bitcoin Coinbase Premium Index and its 14-day simple moving average (SMA) for the recent past several months.

This chart shows how the price difference between Bitcoins on Coinbase and their global market value has changed, as well as a moving average of that difference, over the last few months, according to data from an analytics firm.

According to the graph, the Bitcoin Coinbase Premium Index fell below its 14-day moving average and turned red last month. This drop in the index was accompanied by a decrease in the price of Bitcoin, implying that Coinbase investors were selling rather than Binance users buying more.

This year, the behavior of Coinbase users, who are primarily based in the U.S., has significantly influenced Bitcoin’s price fluctuations. In many instances, the value of Bitcoin has closely followed the pattern set by the Coinbase Premium Index. Consequently, it’s no surprise that these investors were instrumental in triggering the recent market downturn as well.

According to the graph, users on the exchange have been selling throughout the new year. However, in the past few days, there’s been a change – the metric is now showing an increase. This surge has caused the value to climb back above the 14-day Simple Moving Average, which could suggest that market momentum might be coming back.

According to CryptoQuant’s analysis, the current trend in cryptocurrency is reminiscent of one we saw back in November. After a similar crossover event previously, this indicator moved into the positive zone, and Bitcoin surged from around $69,000 to an unprecedented high of $108,000.

As a researcher, I find myself curious about whether this recent development marks the beginning of increased buying from American traders. If history repeats itself, this could potentially be bullish for Bitcoin. So far, the signs have been promising; the asset has bounced back above the $100,000 mark following the crossover, indicating a recovery.

BTC Price

At the time of writing, Bitcoin is trading at around $100,900, up over 7% in the last week.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2025-01-08 06:04