Dogecoin, represented by DOGE and currently valued at $0.39, is among the top-performing meme coins. In the last 24 hours, it experienced a 2.26% increase, while its 7-day growth has escalated to an impressive 25.88%.

Additionally, it’s worth noting that Dogecoin holds approximately half of the entire meme coin market, with a total capitalization of around $57.82 billion. The combined market cap for all meme coins amounts to $115.81 billion, and the daily trading volume is approximately $9.96 billion.

DOGE Price Analysis

On the 4-hour timeframe, the Dogecoin price pattern suggests a strong push beyond a nearby resistance line, indicating a bullish move. This surge in price action rebounded from the significant support area around $0.30 following a reversal triggered by retail investors’ influence.

The cost of Dogecoin has almost touched $0.40, which represents an impressive jump during the last seven days. Yet, despite repeated attempts, the uptrend hasn’t been able to push past the $0.40 barrier, causing the price action to level off instead.

As the Dogecoin price seems to be rebounding within its current range, guided by the 20-Exponential Moving Average (EMA), it suggests an impending breakout spike. The robust uptrend observed over the past week has led to a ‘golden cross’ between the 50 and 200 EMA lines, indicating a bullish trend shift.

Additionally, the 100 and 200 moving averages are about to cross over each other in a positive manner for Dogecoin. This crossing action is typically interpreted as a buy signal.

The 4-hour Relative Strength Index (RSI) line holds a delicate balance. It’s been moving away from the overbought zone and has started to level off, indicating potential for growth. Yet, this sideways movement also suggests a decrease in momentum.

Nevertheless, the technical indicators are still maintaining a positive outlook for Dogecoin.

Dogecoin Derivatives and Whale Activity

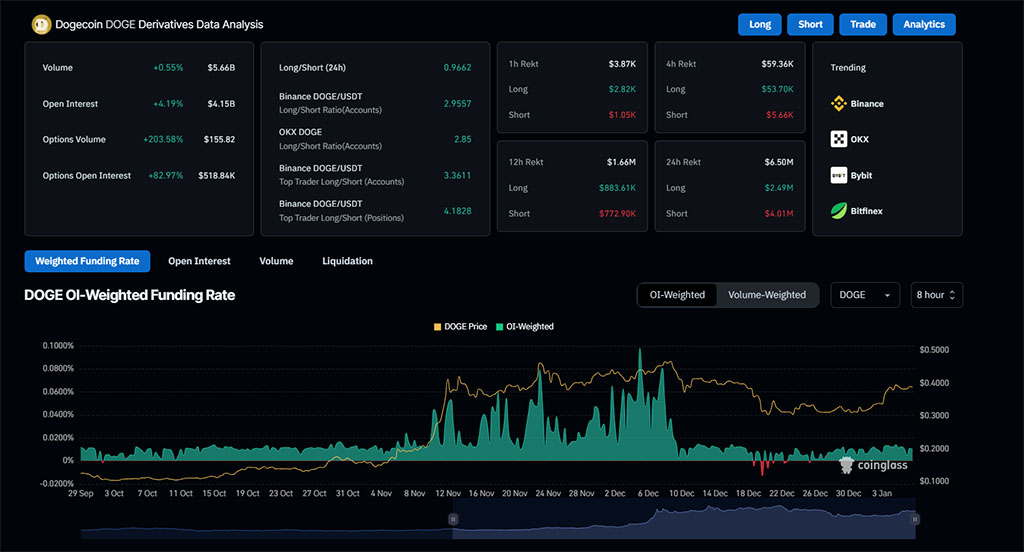

In the midst of a thriving cryptocurrency market and optimistic investor attitudes, an examination of Dogecoin derivative data indicates encouraging results. Over the last day, the Dogecoin open interest has increased by 4.19%, surpassing the $4 billion threshold.

Right now, the figure stands at a staggering $4.15 billion, and the options volume has surged an astounding 200% to hit $155 million. Additionally, the ratio between long and short positions over the last 24 hours is trending toward a bullish stance, approaching the critical level of 1.

As we speak, the Long-to-Short Ratio is at 0.9662. Simultaneously, the funding rate for Dogecoin has climbed to 0.0099%. Given this positive funding rate and a substantial increase in open interest, investors are showing great optimism regarding the future price direction of Dogecoin.

Over the last 24 hours, whales have shown strong optimism towards Dogecoin, with a notable purchase of approximately 140 million Dogecoins, equating to around $55.43 million at the current time. This substantial investment stands out particularly as Bitcoin surpasses $100,000.

Therefore, given the positive figures and Fibonacci benchmarks, a surge beyond the $0.40 threshold may test significant resistance points at approximately $0.4693 and $0.54779.

What if Dogecoin Loses $0.37772?

With Bitcoin hovering slightly above $100,000, Dogecoin is getting close to its temporary high point. As the price of Dogecoin finds it challenging to exceed $0.40, the TD Sequential Indicator signals a sell opportunity. This makes it more likely for a small price adjustment before the continued upward trend continues.

If the price closes below the $0.37772 resistance, it will undermine any bullish prospects, possibly leading to a return towards the 200-EMA around the 50% Fibonacci level, which is approximately $0.3532.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2025-01-07 13:55