10x Research’s latest study indicates that the Federal Reserve’s position on potential interest rate reductions poses the greatest challenge to Bitcoin‘s ongoing price surge.

Bitcoin’s Trump-Fuelled Rally At Risk Ahead Of FOMC Meeting

Ever since the pro-cryptocurrency Republican Donald Trump won the presidential election in November, Bitcoin has experienced a significant surge, increasing by about 47%. Initially priced at approximately $67,500 on November 4, its value now stands around $99,700 as of January 6.

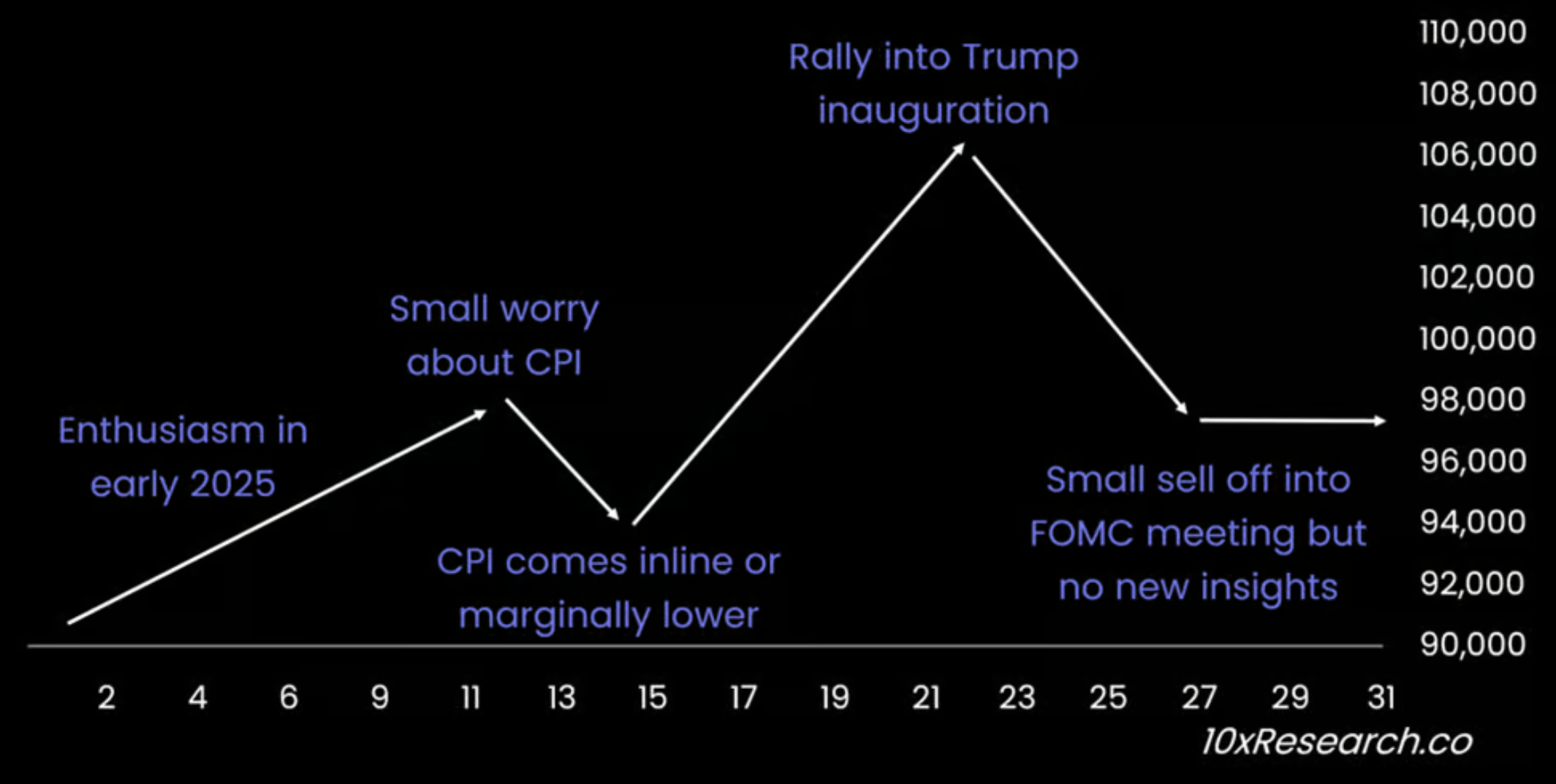

10x Research’s Markus Thielen predicts that while there could be more growth during the period known as the “Trump rally” before the inauguration on January 20th, this momentum may slow down prior to the Federal Open Market Committee (FOMC) meeting scheduled for later in January.

According to Thielen’s forecast, Bitcoin (BTC) is expected to have a promising beginning in January, followed by a minor downturn around the time of the Consumer Price Index (CPI) inflation data release on January 15. If the CPI report turns out to be beneficial, it could spark optimism and possibly initiate another surge before Donald Trump’s inauguration. However, Thielen advises that the bullish trend might weaken leading up to the Federal Open Market Committee (FOMC) meeting scheduled for January 29.

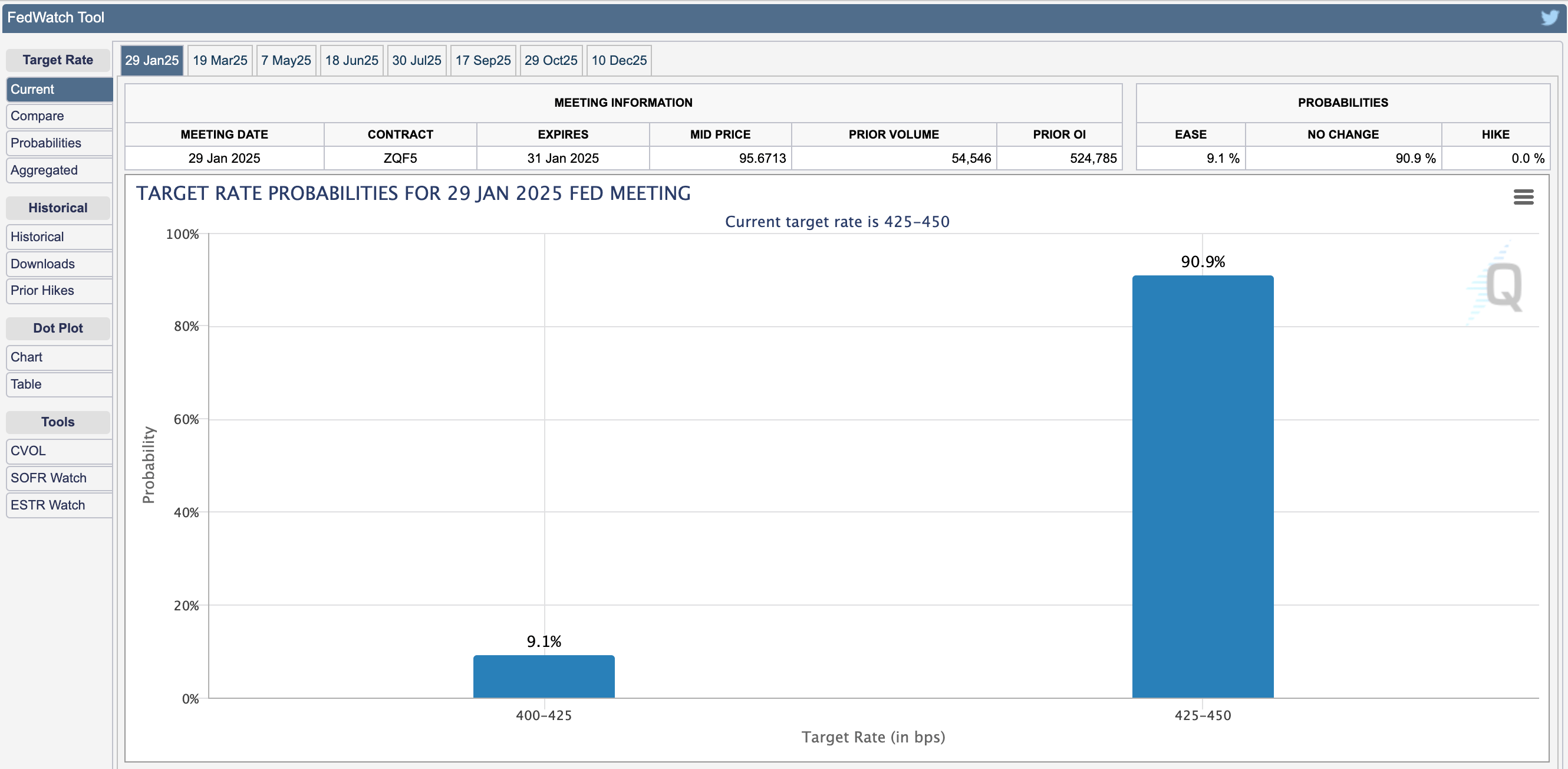

According to the most recent data from CME Group’s FedWatch tool, it appears that the Federal Open Market Committee (FOMC) is expected to keep interest rates steady following their upcoming meeting. The current prediction suggests a high probability of approximately 91% for interest rates to stay between 4.25% and 4.50%.

The fall in Bitcoin’s price by around 15%, or down to $92,900, following the December 18 FOMC meeting, highlights the considerable impact of the Federal Reserve. This drop occurred after the Fed announced that it would only make two rate cuts in 2025 instead of five, echoing Thielen’s belief that the Fed’s actions pose the “main risk” to Bitcoin’s ongoing bullish trend. In his words, Thielen asserted:

1. The decline in Bitcoin’s price following the FOMC meeting indicates the Federal Reserve’s significant influence.

2. This 15% drop occurred after the Fed announced that it would only make two rate cuts in 2025 instead of five, which supports Thielen’s view that the Fed’s decisions are a crucial risk factor for Bitcoin’s current bullish trend.

3. Thielen stated that the Fed’s actions pose the “primary risk” to Bitcoin’s ongoing bullish trajectory.

As a crypto investor, I’m optimistic about decreased inflation rates this year. However, I understand that it might take some patience before the Federal Reserve officially acknowledges and reacts to this change.

Additionally, Thielen pointed out that the level of institutional involvement plays a significant role in shaping Bitcoin’s immediate market fluctuations. Factors such as the pace of stablecoin creation and the flow of investments into crypto ETFs can signal growing institutional interest.

Institutional Interest In Bitcoin Continues To Rise

Despite substantial withdrawals from US Bitcoin Spot ETFs towards the end of December, a recent influx of funds has fueled optimism regarding growing institutional involvement in Bitcoin. As per SoSoValue’s data, spot Bitcoin ETFs experienced approximately $908 million in fresh investments on January 3.

Additionally, notable Bitcoin mining companies like MARA and Hut 8 are increasing their Bitcoins in storage. Furthermore, tech companies including the Canadian video-sharing platform Rumble have announced a strategic plan to allocate $20 million towards Bitcoin reserves.

According to a different forecast released by cryptocurrency platform Bitfinex, Bitcoin might soar as high as $200,000 around mid-2025, even though it experiences some temporary price drops. Currently, Bitcoin’s value is at $101,555 and has increased by 3.7% within the past day.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2025-01-07 09:04