Leading digital currency Bitcoin (BTC) surpassed the $102,000 mark again, reaching a staggering valuation of $2 trillion. Currently, Bitcoin is trading at an impressive $102,435.34 after a 4.25% price increase in the past 24 hours. Notably, this is the first time since December 18th that BTC has exceeded the $102,000 threshold.

Over the last 24 hours, a massive $131.71 million worth of Bitcoin short positions were closed, contrasted by only $67 million in long positions. Within the past 12 hours, an even more significant amount of $129.26 million was liquidated, with $38.13 million from long positions and a staggering $91.13 million from short positions.

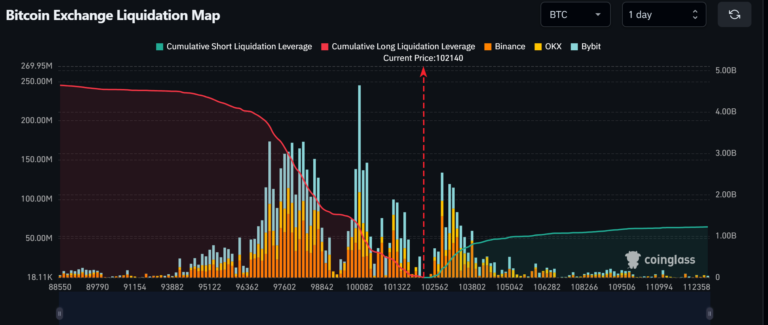

Additionally, the Bitcoin exchange liquidation heat map presented below demonstrates that should Bitcoin surpass $106K, approximately $1.01 billion in BTC short positions could be eliminated, potentially boosting the price even further. Conversely, if Bitcoin falls below $100K, a significant $1.35 billion in BTC long positions might be liquidated. If the cryptocurrency dips to $96,000, an enormous $4.10 billion in short positions could vanish.

Bitcoin exchange liquidation – Source: Coinglass

Diving Deeper Into Bitcoin Price Rally

In a recent post (originally from Twitter), Bitcoin analyst Vivek stated that the amount of Bitcoin held on exchanges has reached an unprecedented minimum. This suggests that users are moving their funds to secure options such as hardware wallets, intending to hold onto their coins for extended periods. Vivek forecasts a potential “supply shortage” for Bitcoin, which could propel the cryptocurrency towards another record high and a bullish trend.

#Bitcoin balance on exchanges hits an all time low.

Supply shock incoming 🚀

— Vivek⚡️ (@Vivek4real_) January 6, 2025

From my perspective as a crypto investor, based on CoinMarketCap’s data, the current record high for Bitcoin is $108K, set about 20 days ago. If the bullish sentiment following President Trump’s inauguration day persists and US spot Bitcoin exchange-traded funds keep attracting investments, there’s a possibility that Bitcoin could reach another all-time high before January 20th.

Bitcoin Price Analysis

The graph displays the Relative Strength Index (RSI) for Bitcoin, indicating a value of 62.6, signifying that the bulls have predominantly controlled Bitcoin’s price fluctuations. Additionally, the slope of the line implies that further price increases are plausible, as Bitcoin’s potential to reach $110K becomes more likely.

Bitcoin price – Source: TradingView

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2025-01-06 21:06