Over the last four days, there’s been a resurgence of optimistic trends in the cryptocurrency market, with Bitcoin taking the lead in price increases. This bullish movement has sparked predictions of potential profits for various alternative coins, and technical indicators hint that an altcoin rally could be imminent.

Crypto expert Kevin (@Kev_Capital_TA) has highlighted an important event: a daily ‘death cross’ forming in Bitcoin’s dominance. If this unusual occurrence is indicative, it might signal changes in cryptocurrency investment patterns over the next few months, potentially impacting both Bitcoin and the broader altcoin market.

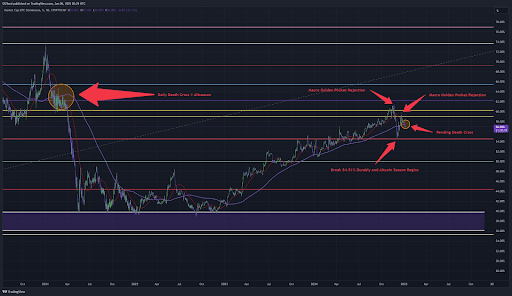

Bitcoin Dominance Chart Forms Daily Death Cross

Based on an examination of the Bitcoin dominance graph using technical analysis, it appears that the primary cryptocurrency is on the verge of creating what’s known as a ‘death cross’. This occurs when a short-term average line moves beneath a long-term average line in a daily candlestick format, which typically suggests a downward trend. In simpler terms, this pattern might indicate that Bitcoin could experience a drop in value. Conversely, a decrease in Bitcoin’s dominance chart reflects an increase in the importance of alternative cryptocurrencies within the overall market.

In this specific situation, a daily death cross is appearing for the first time in four years on Bitcoin’s dominance chart, as per Kevin’s assessment. Notably, technical analysis suggests that Bitcoin’s dominance has encountered two instances of macro golden pocket rejections over the past three months, which is an unusual occurrence. If a death cross eventually materializes, it could be an indication of a shift in market dynamics, given this pattern’s historical significance.

What Does This Mean For Cryptocurrencies?

In simpler terms, Kevin’s findings show an analogous situation in history where a daily death cross on a high level (macro high) was followed by an ‘altcoin season.’ Four years ago, something similar transpired on the Bitcoin market chart, which led to a change in the market trend favoring altcoins over Bitcoin. At that time, Bitcoin’s share of the total market cap was approximately 63%. Subsequently, during the altcoin season, Bitcoin’s share fell below 40% by April 2021.

Based on the present situation, there’s a possibility of a similar pattern emerging. If the “death cross” results in a prolonged decrease in Bitcoin’s market dominance, it might trigger an upward trend in the altcoin market.

Despite Bitcoin’s current dominance, its reign may be challenged by rising stars such as XRP, Dogecoin, and Solana. At the moment, Bitcoin is valued at around $99,750 and controls about 55.8% of the market. Yet, the recent price surges in these cryptocurrencies could potentially shake up this dominance. Meanwhile, Ethereum, the leading altcoin, has yet to show significant gains like those seen in other coins during this cycle.

From this viewpoint, crypto expert TechDev suggests we’re approaching an altcoin rally period, or “altseason.” His analysis is based on the six-month candlestick pattern of the Bitcoin dominance chart. He notes that the current candlestick could signal a surge in altcoins. Historically, similar patterns have occurred in 2017 and 2021, where altcoins experienced significant growth. TechDev explains that during these cycles, Bitcoin’s dominance decreases following the creation of a new six-month candlestick after it surpassed its previous cycle’s all-time high.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2025-01-06 13:34