Ethereum currently lags behind Bitcoin, but it might catch up in 2025 due to a promising 17% yield opportunity which could boost institutional interest. As of now, its price is $3639, with a 24-hour volatility of 0.7%, and a market cap of $438.29 billion. The total volume in the last 24 hours was $16.42 billion. Meanwhile, Bitcoin’s price stands at $98,868, with a 24-hour volatility of 1.2%, and a market cap of $1.96 trillion. Its total volume in the last 24 hours was $26.30 billion.

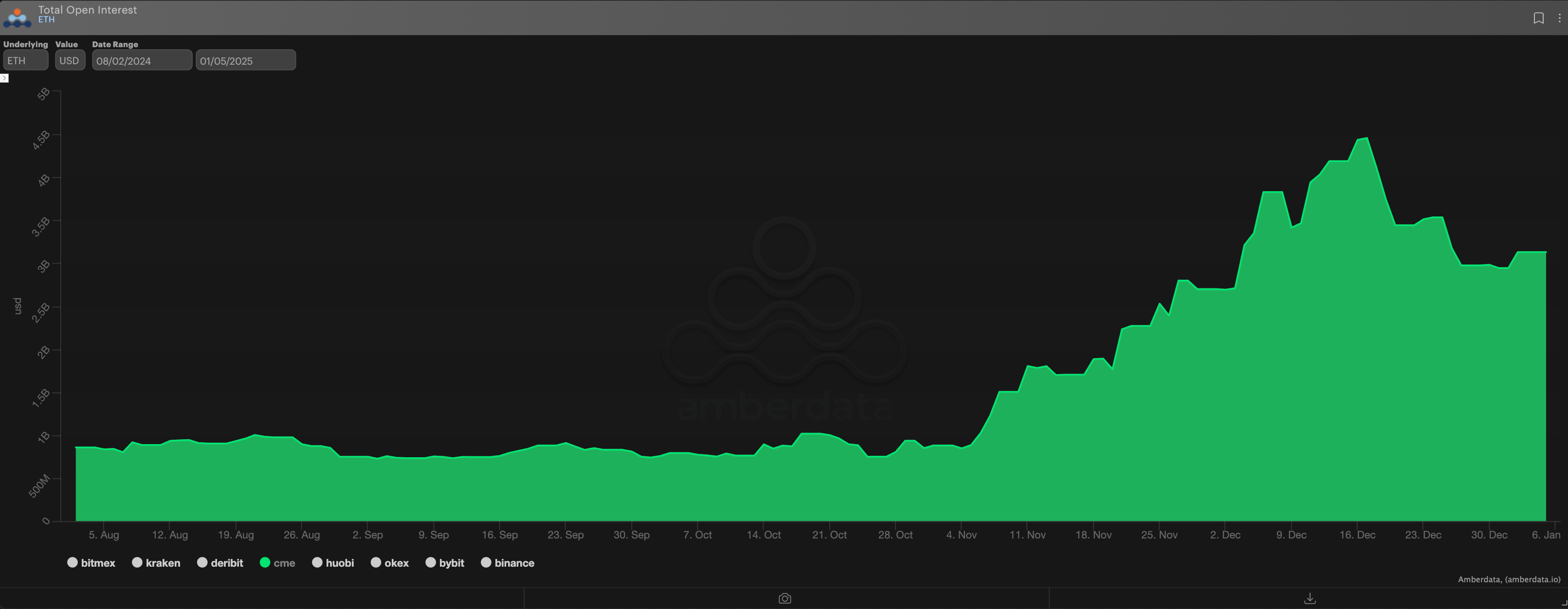

Recently, Greg Magadini, who is the head of derivatives at Amberdata, highlighted an increase in open interest for Ethereum CME Futures as evidence of renewed institutional investment in the Ethereum smart contract platform.

It seems that there is now a growing concentration of Open Interest (OI) within the Ethereum futures contracts offered by the Chicago Mercantile Exchange (CME), possibly indicating that American financial institutions have started taking notice of Ether (ETH) at last, as suggested by Magadini in their statement.

After the U.S. election in November, optimistic anticipation for the ETH CME Futures market and the DeFi sector grew under the new Trump administration. During this timeframe, the total Open Interest (OI) increased significantly from $1.5 billion to more than $4.5 billion.

Ethereum’s 17% Yield Opportunity

From my perspective as an analyst, Magadini’s point emphasizes that the introduction of Ethereum (ETH) exchange-traded funds (ETFs) enabling staking could be a highly optimistic trigger for increased institutional interest in ETH, potentially driving up its price.

Magadini pointed out an intriguing aspect: the possibility of an ETH Exchange Traded Fund (ETF) that distributes staking rewards to its investors. Such a product could create an engaging trading opportunity.

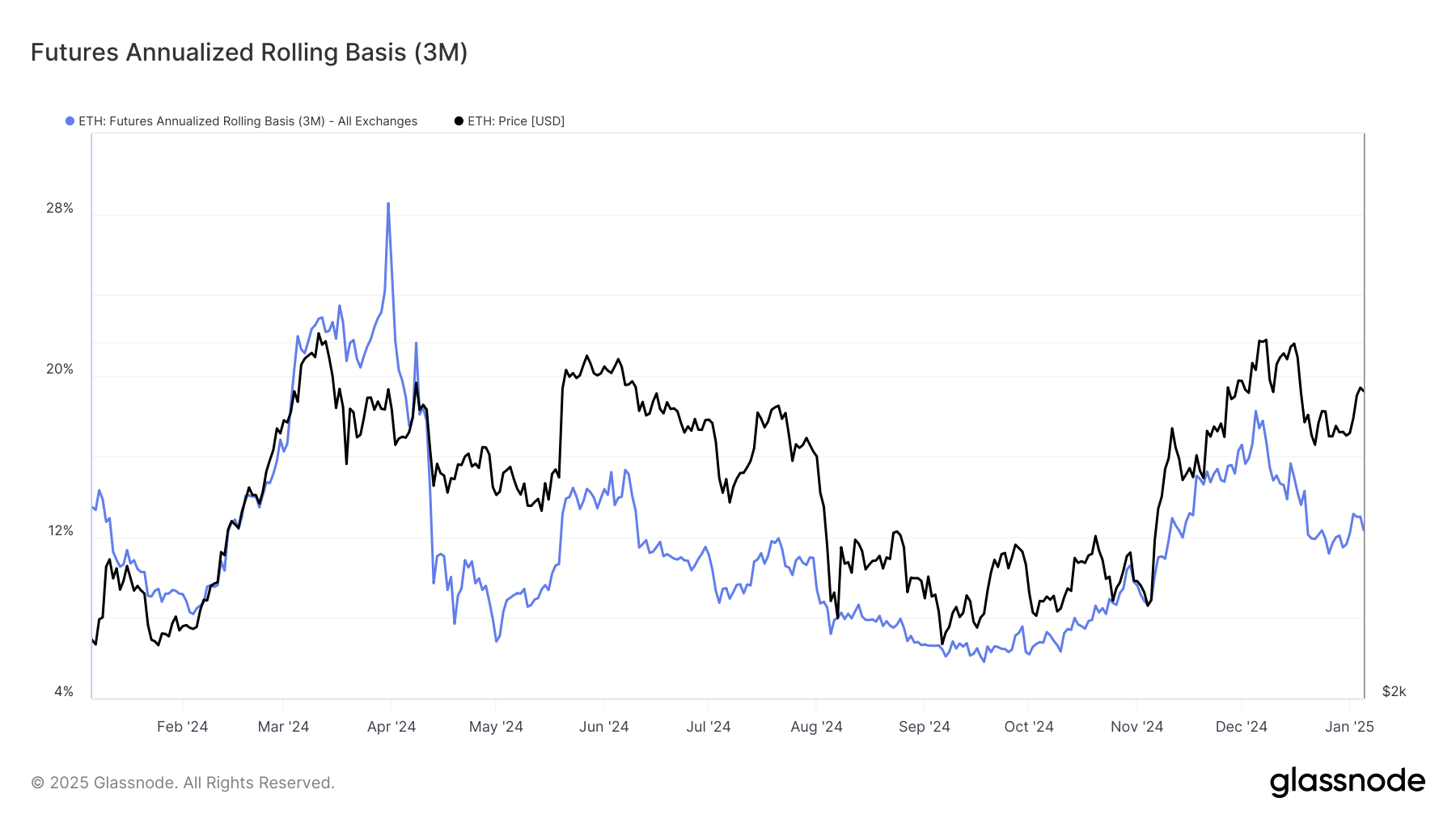

Presently, holding and staking Ether (ETH) by assigning your tokens to validators for network security generates approximately a 3.5% yearly return. Additionally, investors can gain an additional 14.5% annualized yield from ETH’s basis trade, which serves as interest on CME Futures contracts.

For those not familiar, ‘ETH’s basis trade’ is a strategy where traders purchase ETH spot ETF and sell CME Futures contracts at the same time. This technique could have provided an annualized return of up to 18% in early December, but currently stands at around 13%.

Together, the combined yield from ETH basis and staking incentives might appeal to institutional investors, as suggested by Magadini.

Investors might enjoy a combined yield of approximately 17%, which includes a +14% annual percentage yield (APY) from trading and a 3.5% yield from Proof of Stake (PoS). If regulations allow, staking rewards could be distributed, potentially offering lucrative income opportunities in the year 2025.

If that’s the case, the interest in ETH might significantly increase, potentially pushing its worth upwards. Currently, it stands at approximately $3,600, while options traders on Deribit are looking towards $5,000 and even $6,000 as potential end-March targets for its value.

To put it simply, ETH has historically performed exceptionally well during the first half of the year. According to CoinGlass data, the first and second quarters typically yielded an average return of 83% and 66%, respectively. If this seasonal pattern persists, we might see remarkable growth from ETH in the upcoming months.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2025-01-06 13:24