2024 was not a stellar year for Ethereum, the second-largest cryptocurrency by market value, as it lagged behind Bitcoin and numerous other altcoins throughout the period. Yet, as 2025 commences, Ethereum is exhibiting signs of revival, having increased by more than 10% in just a few days. This swift uptick has sparked optimism among investors and analysts who anticipate strong performances for Ethereum this year.

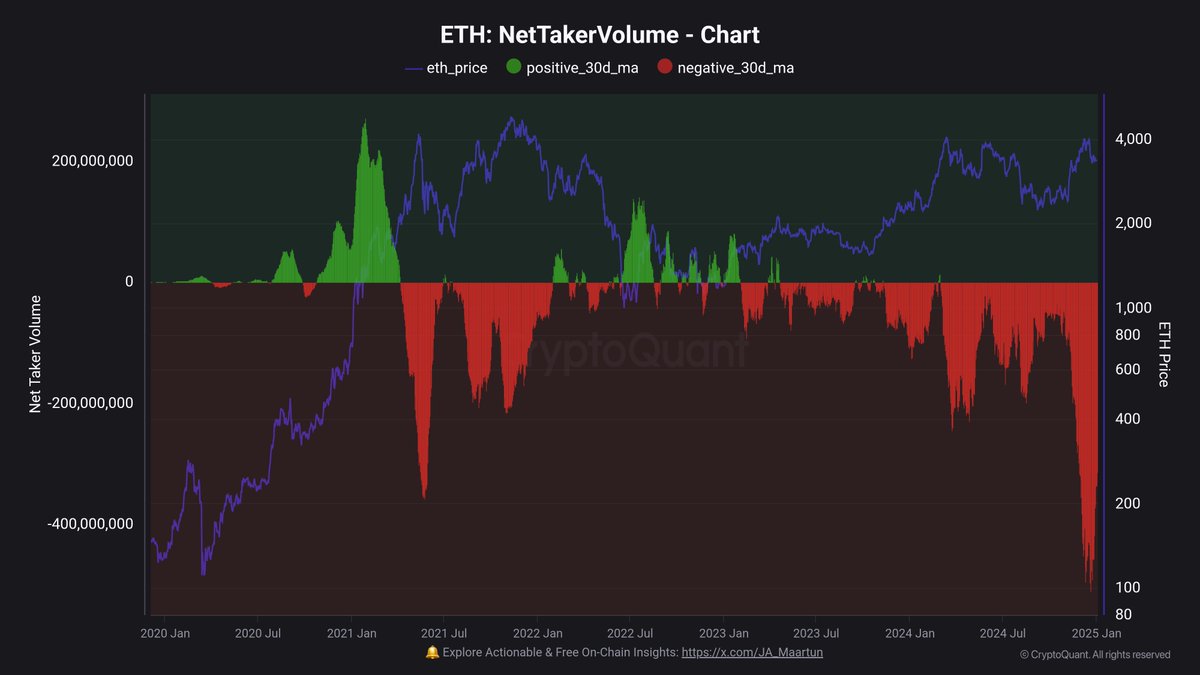

Recently, top analyst Maartunn provided revealing information about a growing tendency towards intense short-selling in the Ethereum market. As per Maartunn’s analysis, taker sellers have been controlling the market, surpassing taker buyers by approximately $350 million daily in terms of trading volume. This persistent short-selling could potentially account for Ethereum’s sluggish performance in 2024, as a substantial selling pressure may have stifled its price increase.

With a fresh start in the new year, there’s optimism that the downtrend in Ethereum might reverse, potentially allowing it to regain its status as a market frontrunner once more. As the leading altcoin tackles its hurdles, the next few weeks are crucial for revealing if this early surge signifies the start of a prolonged uptick. The investment community is keeping a close eye on Ethereum, hoping that a flip in these negative trends could pave the way for an outstanding 2025 for the network.

Ethereum Rising Amid Aggressive Shorting Trends

Ethereum is trying to break through its record high from 2024, but a definitive breakout has yet to materialize. The recent market activity hints at an upward trend, as Ethereum has made early gains in 2025. However, the road ahead is not straightforward due to persistent selling pressure that keeps pushing down on the leading altcoin.

As a researcher delving into the dynamic world of cryptocurrencies, I’ve been closely following the analysis by top industry expert Maartunn. Her latest findings, drawn from CryptoQuant, offer valuable insights into our current market landscape. It appears that Ethereum is undergoing significant shorting, with taker sellers leading the trading activity. Daily trade data indicates a staggering $350 million more in sell-side pressure compared to buy-side activity. This imbalance creates a tough situation for ETH as it struggles to break free from its current price range.

This trend, albeit temporarily reducing prices, won’t persist forever. Typically, market fluctuations anticipate such intense selling as a signal for a turnaround. As the momentum for selling wanes and buying interest strengthens, long-term investors are said to be taking notice of this period, preparing to profit from Ethereum’s currently low prices.

In the coming weeks, Ethereum’s progression through these changing conditions will be significant. If it manages to break free cleanly above last year’s peak, this could mark the beginning of a broader surge, rekindling interest and possibly halting the current shorting trend. At present, Ethereum stands at a critical crossroads.

Price Testing Crucial Levels

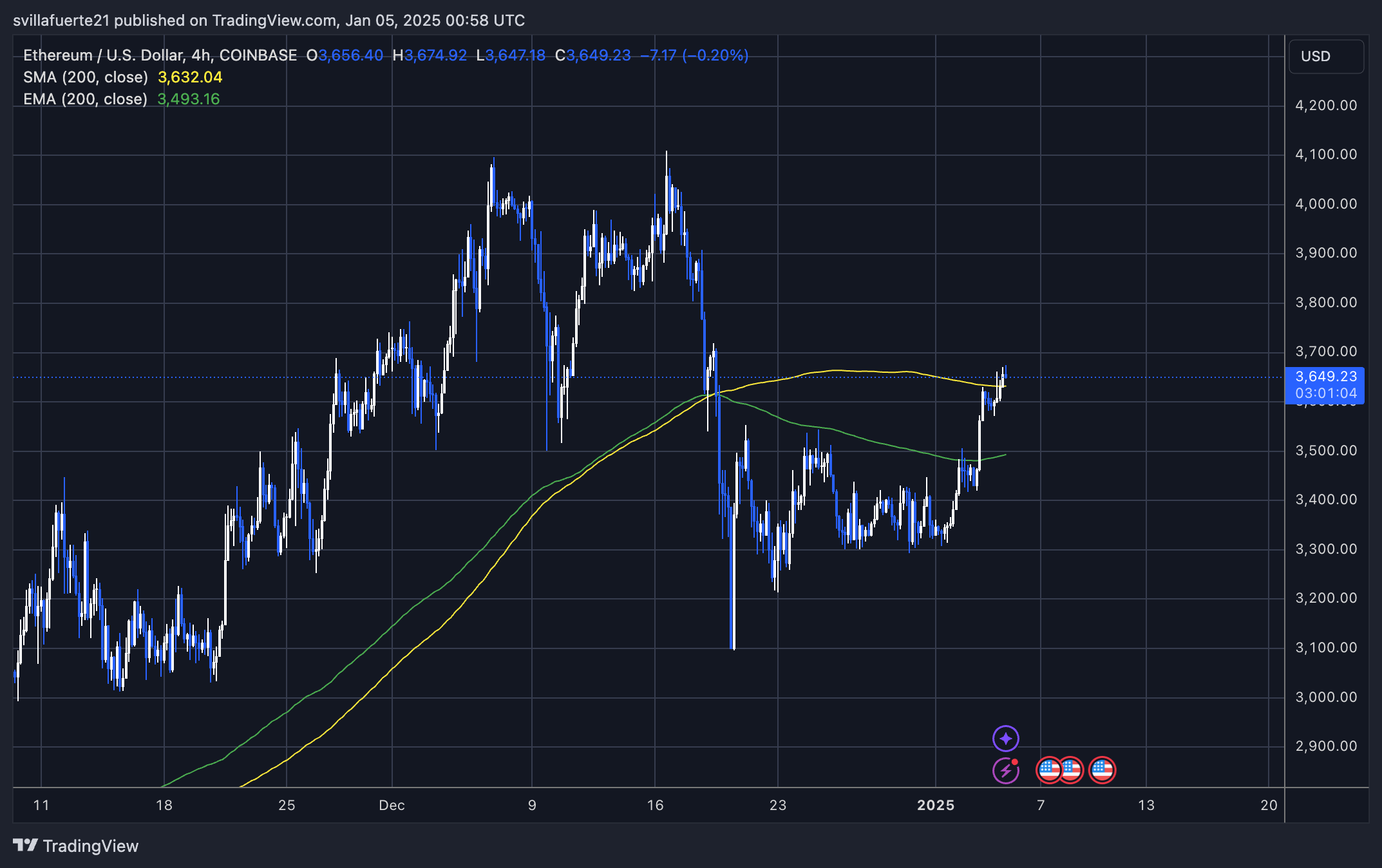

2025 has seen Ethereum make a strong debut, currently trading at $3,650. In recent times, it has surpassed the 4-hour 200 Exponential Moving Average (EMA) with notable power, which is a technical marker often considered a crucial boundary for long-term movements. At present, Ethereum is testing the 200 Moving Average (MA) on the same timeframe. If this level is reclaimed and maintained as support, it could signify the continuation of a bullish trend.

Closing Ethereum significantly above its 200-day moving average each day could reinforce its bullish trend, potentially triggering a significant surge that might push it past last year’s peaks. This development could rekindle market optimism and draw more buyers, causing Ethereum to reach new heights in the short term.

Nevertheless, it’s important to note that while optimism prevails, there are potential risks involved. If Ethereum is unable to maintain the 200 Moving Average as a support level, there could be a resurgence of selling pressure in the market. This might drive ETH prices back towards lower regions, undoing recent advances and prolonging its struggle to rebuild positive momentum.

Read More

- Ana build, powers, and items – Overwatch 2 Stadium

- The Last of Us Season 2 Episode 2 Release Date, Time, Where to Watch

- Who Is Christy Carlson Romano’s Husband? Brendan Rooney’s Job & Kids

- Why Is Ellie Angry With Joel in The Last of Us Season 2?

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- Paradise Season 2 Already Has a Release Date Update

- Who Is Kid Omni-Man in Invincible Season 3? Oliver Grayson’s Powers Explained

- The Hunger Games: Sunrise on the Reaping Cast Finds Young Haymitch & More

- Arjun Sarja’s younger daughter Anjana gets engaged to long-term boyfriend; drops dreamy PICS from ceremony at Lake Como

- Jr NTR and Prashanth Neel’s upcoming project tentatively titled NTRNEEL’s shoot set to begin on Feb 20? REPORT

2025-01-05 15:40