As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous market cycles and trends that have shaped the investment landscape. Having closely followed Bitcoin since its inception, I find Fred Thiel’s advice to retail investors intriguing, considering my personal journey through various asset classes throughout my career.

Thiel’s long-term approach resonates with me, as I often advocate for a patient, disciplined investing strategy that focuses on fundamentals and the potential for compounded returns over time. The historical performance of Bitcoin, with its consistent appreciation and rare annual losses, lends credence to Thiel’s argument about its growth potential.

However, it is essential to remember that every investment carries risk, and Bitcoin remains no exception. As a prudent investor, I would encourage readers to carefully consider their risk tolerance and financial goals before making any investment decisions.

One can’t help but draw parallels between the early days of other emerging asset classes and the current state of Bitcoin – it’s exciting, volatile, and filled with potential. But as they say, “the early bird catches the worm,” so maybe now is the time to consider adding a little Bitcoin to your portfolio and forgetting about it for a while, just like Thiel suggests.

Lastly, I’d like to leave you with a joke that encapsulates the spirit of investing in Bitcoin: “Why did the Bitcoin cross the road? To get to the other blockchain!

During a conversation with FOX Business, the CEO of Bitcoin (BTC) mining company MARA Holdings, Fred Thiel, proposed that small-scale investors considering investing in the forefront digital currency might find it beneficial to adopt an “invest and let be” approach.

Thiel Cites Positive Historical Performance Of Bitcoin

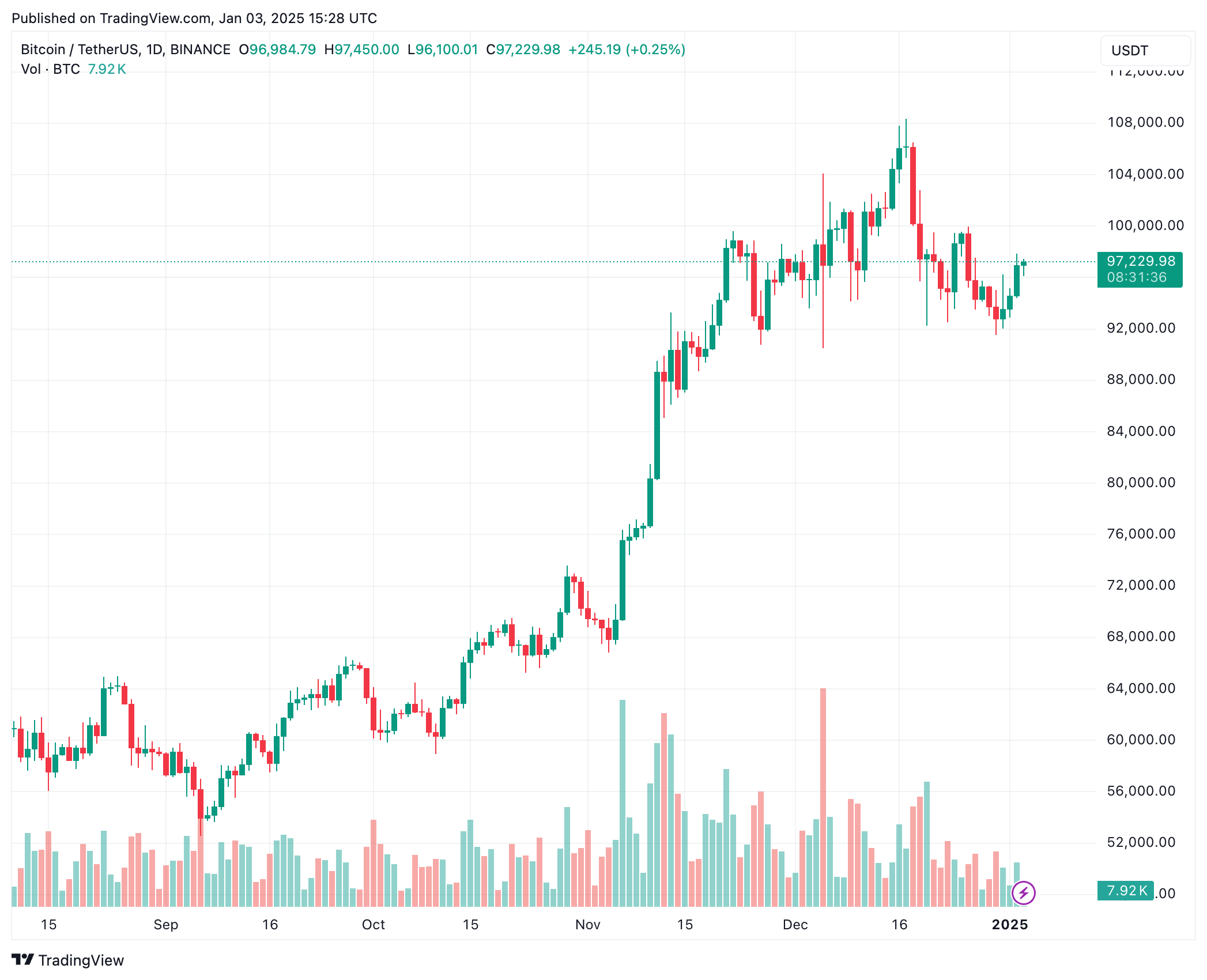

Bitcoin’s trading remains within approximately $90,000 after a recent dip from its peak of $108,135. As crypto analysts monitor Bitcoin’s price changes closely, significant Bitcoin investors seem unphased by temporary price shifts.

“Based on Bitcoin’s past performance, it would be wise for individual investors to invest for the long haul. In its entire 14-year existence, Bitcoin has closed the year below its starting price only three times, one of those instances being during the peak of the COVID-19 pandemic.

Based on my personal experience and observations, I strongly advise my children to invest a small amount into Bitcoin each month and let it grow over time. This strategy has proven effective for many individuals, including myself, who have reaped significant rewards after several years.

Thiel underscores Bitcoin’s steady increase, noting it typically rises between 29% and 50% each year. Yet, Bitcoin is considered a high-risk investment, so cautious investors might hesitate until the asset class becomes more widely accepted or receives endorsement from a significant global economy.

To illustrate, if the United States were to set up a strategic Bitcoin deposit, it could strengthen Bitcoin’s standing as a valuable asset and possibly trigger a chain reaction, with other countries considering similar moves. Thiel suggested that such a move could act as a significant catalyst, pushing Bitcoin’s value to record highs by 2025.

As a crypto investor myself, I find it interesting to note that Peter Thiel has identified a few key factors that might contribute to Bitcoin’s growth this year. These include increasing institutional involvement through Bitcoin ETFs and a favorable regulatory environment for digital assets under the Trump administration.

As a crypto investor, I’m finding myself in agreement with Thiel’s advice to hold Bitcoin, even if it was primarily intended for retail investors. Interestingly, recent data from a poll conducted by MicroStrategy CEO Michael Saylor reveals that a substantial majority (over 75%) of the 65,164 respondents are planning to amass more Bitcoin by the end of 2025 compared to their current holdings.

2024 has seen a surge of optimism among individual investors, fueled by favorable events like the approval of ETFs, the Bitcoin halving, and Donald Trump’s re-election in November.

More Companies Adding BTC To Balance Sheet

The use of Bitcoin by corporations is increasing at a steady pace. Notably, MARA Holdings has already incorporated Bitcoin into their financial assets, and competitor Hut 8 has significantly increased its own Bitcoin holdings to over 10,000 units.

In the year 2024, companies like Metaplanet from Japan and Rumble based in Canada decided to align with the Bitcoin trend. Furthermore, Bitcoin Exchange-Traded Funds (ETFs) have amassed more than a million Bitcoins within just a year of their debut.

As a seasoned investor with over two decades of experience in global financial markets, I have seen countless trends come and go. While I am always open to new investment opportunities, I remain cautious about Bitcoin, especially when it comes to the idea of establishing a strategic reserve for Japan’s government.

My skepticism stems from my personal experiences with volatile investments and the potential risks they pose. In the past, I have seen promising technologies and assets skyrocket in value only to crash just as quickly, leaving investors with significant losses. Bitcoin is no exception, as its price has fluctuated wildly since its inception.

That being said, I understand the allure of investing in Bitcoin, given its potential for high returns. However, I believe that any investment decision, especially one made by a government, should be based on thorough analysis and careful consideration of the risks involved. In the case of Japan’s Prime Minister expressing caution about establishing a strategic reserve, I agree with his sentiment.

At press time, Bitcoin is trading at $97,229, up 0.7% in the past 24 hours. While this may seem like a promising sign, I would urge investors and governments alike to approach Bitcoin with caution and do their due diligence before making any investment decisions.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

2025-01-04 11:47