As a seasoned researcher with years of experience in the cryptocurrency market, I can confidently say that the recent surge of Bitcoin above $95,000 and the bullish momentum of Chainlink (LINK) has caught my attention. The 10.35% increase over the past 24 hours for LINK is particularly noteworthy, especially considering its current market cap of $13.97 billion.

From a technical analysis perspective, the bullish engulfing candle on the daily chart, coupled with the reclaiming of the broken 50-day EMA line, suggests that LINK could be gearing up for a potential rally towards its previous rejection zone near the $30 psychological mark. However, it’s important to remember that the dynamic average lines at $21.11, $18.36, and $16.20 serve as critical support levels.

Moreover, the bullish projections from analysts like Michaël van de Poppe further reinforce my belief in LINK’s potential upside. If Chainlink manages to surpass the critical resistance at 0.0004480 BTC, we could witness a trend switch for LINK, leading to a higher high and higher low formation.

However, as they say, “the market can stay irrational longer than you can remain solvent,” so I would advise caution and careful risk management when investing in the volatile world of cryptocurrencies. After all, even though we’re talking about digital money here, it doesn’t mean that laughter is always guaranteed! In fact, it might just be the best medicine for those nerve-wracking market swings!

When Bitcoin surpasses $95,000, it signals a recovery phase for the cryptocurrency market. Meanwhile, Chainlink appears poised to soar, taking advantage of the surge in buying activity and initiating an upward trend, potentially leading to a bullish run.

At present, Chainlink maintains its position as the 13th largest digital currency, boasting a market capitalization of approximately $14 billion. In the last day alone, it has experienced a growth of around 10.35%, currently being traded at values above $22.

Chainlink Reversal Targets $30

In the day-to-day price graph, the LINK displays a bullish engulfing candle, which contradicts the dip observed on December 30 and 31. This reversal was followed by a significant 8.61% jump on January 1, further supporting the ongoing bullish trend, as there was also a 1.52% increase in price throughout the day.

Presently, LINK is being transacted at a market value of $22.02 and has regained its 50-day Moving Average line. The recent drop may represent an opportunity for a retest of the broken head-and-shoulder configuration. However, if LINK manages to close the day above the breached neckline at $22, it will negate the bearish trend associated with this pattern.

If the situation arises, the recovery run might find itself testing the prior resistance region close to the significant level of $30 again. Conversely, the dynamic average lines situated at $21.11, $18.36, and $16.20 could potentially serve as vital support points in this context.

Furthermore, the $20 psychological mark has highlighted itself as a high-demand zone.

Analyst Reveals Massive Upside in Chainlink

During this continuing restoration phase, renowned cryptocurrency analyst Michael van de Poppe has expressed optimistic forecasts regarding Chainlink. Although the LINK/BTC weekly chart shows recurring up and down patterns, the current uptrend is seeking to establish a fresh upward trendline.

At the moment, the value of LINK is being rejected at prices just under 0.00022 BTC, indicating a temporary drop in its price.

Request 02 – $LINK

The uptrend has begun.

Currently, it’s attempting to find a new lower price point before potentially rising again, but the value of Chainlink relative to Bitcoin remains significantly undervalued at the moment.

I expect a lot of upside to come for LINK in 2025.

— Michaël van de Poppe (@CryptoMichNL) December 30, 2024

According to Michael van de Poppe’s price chart, there appears to be a significant upward potential for Chainlink, with a key resistance level marked at approximately 0.0004480 BTC.

Should Chainlink overcome this significant barrier, it could trigger a shift in its trend direction. This is expected to lead to the formation of successive higher highs and higher lows, indicating an upward momentum.

LINK Holdings Grow by $5 Billion in 2024

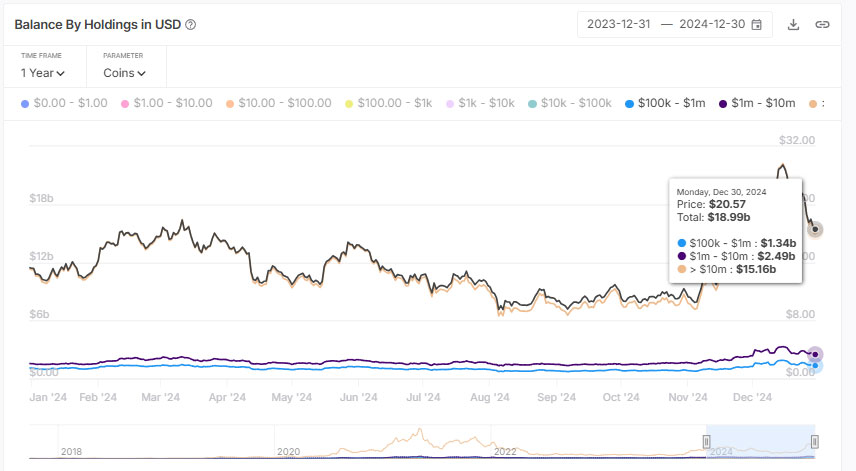

As a long-term investor who has been following Chainlink since its early days, I must say that the growth of this token over the past year has been nothing short of impressive. In my personal investment journey, I have seen many cryptocurrencies come and go, but Chainlink’s consistent performance and strong community support have set it apart from the rest. The significant increase in bullish confidence among its holders is evident in the surge of the total balance by holdings, which has grown from $15.2 billion to a staggering $20.57 billion, with a 52-week high peak at $29.43 billion. This growth not only speaks volumes about the project’s potential but also reflects the faith that investors have in its future success. As we move forward, I am excited to see what Chainlink will achieve and how it will continue to revolutionize the blockchain industry.

The increase in whale confidence towards Chainlink is evident as the balance of holdings between $100,000 and $1 million has grown from $1.08 billion to $1.34 billion, reaching a 52-week high of $1.36 billion.

Initially, investments totaling over $10 million were valued at approximately $11.32 billion. Over time, these holdings have increased and are now worth around $15.16 billion. Given a positive outlook for 2024, the upward trend in Chainlink’s value is likely to persist.

chainlink (LINK) demonstrates robust positive momentum, suggesting it could challenge higher prices, as financial experts anticipate considerable growth prospects for the coin by 2025.

Read More

- Odin Valhalla Rising Codes (April 2025)

- King God Castle Unit Tier List (November 2024)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- POPCAT PREDICTION. POPCAT cryptocurrency

- Vesper’s Host guide – Destiny 2

- Sarah’s Shocking Hospital Emergency—What Really Happened on Days of Our Lives?

- Cape Fear Cast: Patrick Wilson Eyed to Star in Apple TV+ Show

- Pet Simulator 99 VIP Private Server Links And How To Use Them

- Incarnon weapon tier list – Warframe

- Pokémon and Crocs Release “Charizard vs. Blastoise” Versus Clog

2025-01-02 12:08