As a seasoned analyst with over two decades of experience in traditional finance and the crypto market, I’ve seen my fair share of market swings and investor behavior. The recent Ethereum market movements have caught my attention, not just because of the price fluctuations, but also due to the underlying network activity.

The surge in staking activity, despite the temporary price dip, suggests a growing confidence in Ethereum’s long-term worth. This is a trend I’ve seen before in other successful technologies and industries – early adopters often see the potential beyond short-term volatility.

The influx of ETF investments, particularly from institutional players like BlackRock, further underscores this confidence. It seems that despite the price action, traditional financial markets are increasingly embracing digital assets. This is reminiscent of the dot-com era, where skeptics doubted the potential of internet companies, only to see them become industry titans.

However, it’s important for investors not to get too carried away by short-term price fluctuations. The crypto market remains volatile, and broader macroeconomic uncertainties can impact prices. But as I always say, “The market is like a drunken sailor, but it eventually finds its way.”

In the end, let’s not forget that Ethereum is more than just a price on a chart. Its network activity and use cases are still strong, and its leadership in NFTs and DeFi is undisputed. So, while we might see some ups and downs, I believe Ethereum will continue to sail through these waters and reach its destination.

And as for the joke, here it is: Why don’t we ever let our investments go to bed hungry? Because a well-fed portfolio always performs better in the morning!

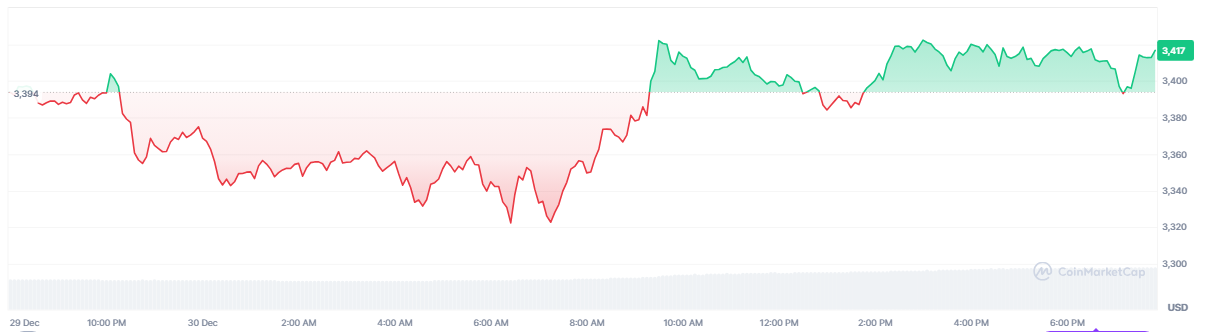

Lately, fluctuations in the Ethereum market have brought to light a noteworthy difference between price and network usage. Engagement in staking continues to escalate, even as the value of ETH dipped to around $3,400—a 16% decrease from its highest point in December.

As an analyst, I’ve observed a significant increase in the amount of ETH being staked by investors, surpassing our initial expectations. Despite some temporary price volatility causing uncertainty among certain individuals about Ethereum’s short-term potential, this surge in staking indicates a growing belief in the long-term value of this cryptocurrency.

Investor Confidence Indicated By ETF Inflows

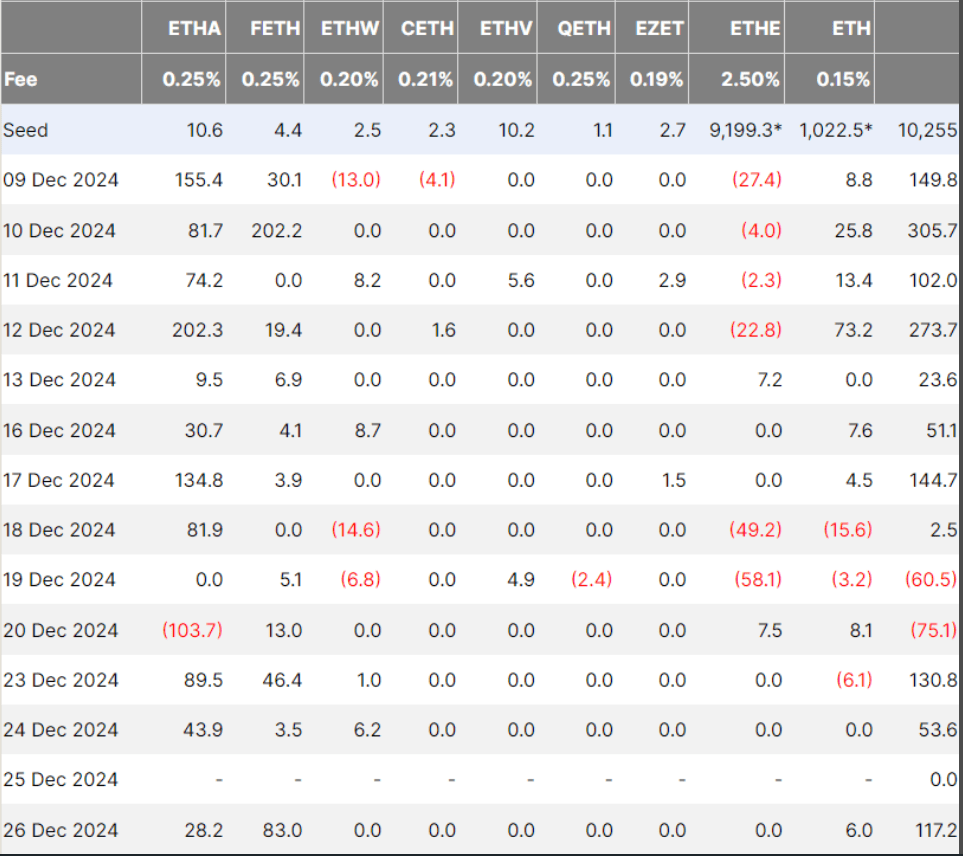

A notable advancement is the rise of Exchange-Traded Funds (ETFs) specifically focused on Ethereum. In just the last 25 days, a total of $2.68 billion has been accumulated, and ETF investments were made on 23 out of those days.

On December 27th, the combined value of all ETFs surpassed $12 billion due to approximately $48 million in daily investments, according to SoSoValue’s data. The BlackRock-offered Ethereum ETF has attracted the bulk of these investments, highlighting institutional demand for ETH despite a recent drop in its price.

The growing preference for Ethereum spot ETF indicates that it mirrors the broader cryptocurrency market, where ETFs are increasingly becoming a favored option among both institutional and individual investors.

Alternatively, the increasing flow of Bitcoin ETFs lately indicates that conventional financial markets are gradually embracing digital currencies.

Price Action And Broader Market Dynamics

Instead of Ethereum’s price decrease pointing to one story, it could be interpreted differently. The fall in Ether’s value might stem from investors cashing out after the recent surge, combined with the overall economic uncertainty, given the unpredictable nature of the cryptocurrency market.

The cautious approach of traders has become more pronounced due to the increasing regulatory demands and worries about potential increases in interest rates.

Or, Traders are adopting a more careful stance as a result of growing regulatory pressures and concerns over possible interest rate hikes.

Even though it’s experiencing a downturn, certain experts view this period as one of consolidation instead of something to be concerned about. They point out that the robust growth in Ethereum’s staking and ETF investments indicate a strong sense of long-term faith in the market.

Broader Perspective

As a seasoned cryptocurrency investor and enthusiast with several years of experience under my belt, I have witnessed Ethereum’s remarkable growth over time. The latest advancements in its ecosystem are particularly noteworthy, as they are taking place amidst an optimistic atmosphere.

Recent enhancements such as the transition to proof-of-stake and ongoing scalability improvements have piqued my interest. These developments underscore Ethereum’s commitment to innovation and progress, making it a leader in the world of non-fungible tokens (NFTs) and decentralized finance (DeFi).

Personally, I find these advancements exciting because they reflect the maturity and evolution of the Ethereum network. As someone who has been following its journey since its early days, I believe that these improvements position Ethereum to maintain its leadership in the rapidly evolving crypto space.

In my opinion, Ethereum’s continued success is a testament to its strong community, talented developers, and forward-thinking vision. I am eager to see what the future holds for this groundbreaking blockchain platform and how it will continue to shape the world of cryptocurrency.

As a crypto investor, I recognize the significance of maintaining a strategic, long-term perspective while staying nimble enough to adapt to short-term market swings. The dynamic landscape of cryptocurrency investing is evident in the increasing adoption of ETFs and staking options. Despite the fluctuations in Ethereum’s price, its underlying network and use cases continue to demonstrate strength.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-12-30 23:10