As a seasoned crypto investor with over a decade of experience navigating the rollercoaster ride that is the digital asset market, I find myself both perplexed and intrigued by the current state of affairs. The Bitcoin price crash to $94,000 has indeed stalled the bullish momentum, but it’s important to remember that such corrections are par for the course in a bull cycle.

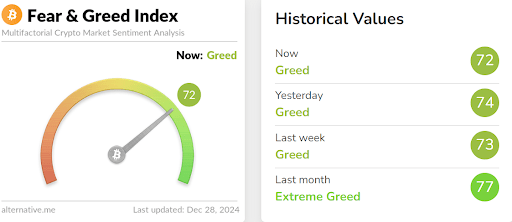

The market sentiment remains in ‘greed,’ which is a testament to the resilience and optimism of investors who view these declines as buying opportunities rather than reasons to panic. I’ve been through enough market cycles to know that the fear and greed index can be an effective barometer for gauging investor psychology, and at 72, it suggests we are far from the end of this bull run.

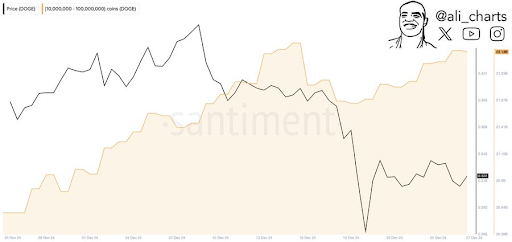

It’s also fascinating to see buying trends across various cryptocurrencies, such as Dogecoin whales scooping up over 90 million DOGE tokens in the past two days. This kind of activity is a clear indication that institutional money continues to flow into the market, and it’s not hard to imagine a broader recovery in the coming weeks.

As for Bitcoin, if it can hold above support levels around $92,000, technical indicators point to a rebound. I’ve seen Bitcoin rise from the ashes more times than I can count, and I wouldn’t be surprised if this were another instance of its resilience.

In closing, let me leave you with a little humor to lighten the mood: They say Bitcoin is like a rollercoaster, but I’d argue it’s more like a game of snakes and ladders – just when you think you’ve reached the end, you slide back down a few squares. Happy investing!

As a long-time observer of the cryptocurrency market, I have seen numerous ups and downs, yet I remain convinced that it maintains its resilience even during challenging times like the recent drop in Bitcoin price to $94,000. Despite the apparent negative implications suggested by the price action, this resilience is evident through the optimistic predictions from crypto analysts on social media and platforms like TradingView, which span various cryptocurrencies.

In my experience, the crypto market’s ability to bounce back quickly from significant setbacks underscores its robustness and potential for growth. While I understand the concerns of those who may view this drop as a sign of instability, I believe that the market’s inherent volatility should not deter us from recognizing the long-term potential it offers.

In conclusion, while it is essential to remain cautious in any investment decision, I maintain my optimism for the future of the cryptocurrency market and its capacity to recover and thrive amidst short-term challenges.

Despite the falling prices and widespread market optimism, the Cryptocurrency Market Fear and Greed Index remains biased towards greed, suggesting a potential short-term drop followed by a larger market rebound.

Bitcoin Price Crash Stalls Bullish Momentum

2024 saw a strong upward trend in the crypto market, as numerous cryptocurrencies hit record highs they hadn’t seen in years. This positive surge was primarily driven by Bitcoin, which surpassed its previous all-time high of $69,000 from 2021 and eventually climbed above the psychologically significant level of $100,000 on December 5 for the first time ever.

Since hitting the six-digit mark, Bitcoin’s price trend has primarily involved corrections rather than steady growth. Despite reaching an all-time high of $108,135 on December 17, the following twelve days have seen a series of drops in its value. In fact, within the last week alone, Bitcoin plummeted to around $92,600, triggering similar declines among other cryptocurrencies and effectively halting the bullish trend.

Many cryptocurrency traders have been taken aback by Bitcoin’s recent downturn, given its robust surge over the past few months. Analysts believe that this dip is due to some long-term investors cashing out their profits and a momentary decrease in trading momentum.

Crypto Market Sentiment Stays In Greed

As a researcher studying the cryptocurrency market, I’ve noticed that despite recent price drops, the HODLing trend indicates we’re still on course for an extended rally up until 2025. This optimistic outlook is echoed in the Fear and Greed Index, which persistently resides within the ‘greed’ zone, demonstrating investor confidence. This index is calculated based on several factors such as market volatility, trading volume, social media sentiment, Bitcoin dominance, Google search trends, and surveys. Each factor is meticulously weighed to assess the overall psychological mood of the market.

Currently, the Crypto Fear and Greed Index, as reported by alternative.me, stands at 72, indicating that we’re in the “Greed” zone. This implies that investors are generally optimistic across various market indicators, suggesting they view the recent downturn not as a cause for alarm but rather as an opportunity to buy.

The feeling of excessive desire for profit is evident in some purchasing patterns observed across significant cryptocurrencies. For instance, data from crypto analytics firm Santiment reveals that large Dogecoin investors (whales) have amassed over 90 million DOGE tokens within the last 48 hours. This trend has analysts hopeful about a potential market upswing in the upcoming weeks. Furthermore, technical signals suggest a recovery might be initiated by Bitcoin if it manages to stay above its support levels around $92,000.

Currently, at this point in time, Bitcoin is being exchanged for approximately $94,400. Since it peaked at $108,135 on December 17, its value has decreased by 12.8%. As per crypto analyst Ali Martinez’s analysis, these types of corrections, ranging between 20% and 30%, are actually beneficial occurrences for Bitcoin during each bull market cycle.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Brody Jenner Denies Getting Money From Kardashian Family

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

2024-12-29 00:40