As a seasoned analyst with over two decades of experience in the cryptocurrency market, I have seen my fair share of bull and bear markets. But the current surge in Ethereum (ETH) is reminiscent of the early days of Bitcoin, when every coin seemed poised for the moon.

Ethereum’s price soared by 4.26% last night, forming a bullish engulfing candle and completing a morning star pattern. The current trading price of ETH stands at $3,398, pushing against the 50-day Exponential Moving Average (EMA) line while bouncing off from the 100-day EMA. In the last 24 hours, the market cap has increased to a staggering $409.01 billion, with a trading volume of $30.76 billion.

Preparing for a potential reversal, the hourly chart hints at an upcoming breakout that could provide a suitable entry point for those engaging in price action trading.

Ethereum Price Analysis

On the one-hour price graph, the Ethereum’s price movement exhibits a trendline of resistance that has been built following the recent correction. This forms a triangle pattern along with yesterday’s upward trend, hinting at an imminent breakout surge from this triangle formation.

Additionally, the movement of ETH resembles an Adam and Eve chart configuration, characterized by a V-shaped recovery followed by a rounding bottom reversal. Notably, the neckline of this pattern aligns with the 38.20% Fibonacci level, which is approximately $3,477.

Therefore, the upward surge beyond the triangle formation signifies the completion of the temporary downtrend, enhancing the likelihood of a successful breakout in the bullish pattern. Based on Fibonacci projections, this uptrend could potentially propel the price to approximately $4,000 by the year-end 2024, marking a significant psychological milestone.

Institutions Support Ethereum Reversal Chances

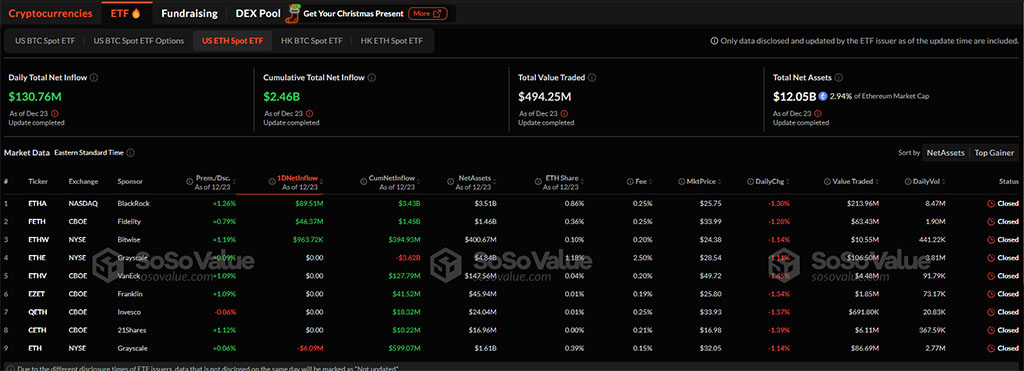

As a researcher, I’ve noticed an intriguing shift in the cryptocurrency market, particularly with Ethereum. Despite U.S. Bitcoin ETFs experiencing a significant outflow of approximately $226 million, institutional interest in Ethereum appears to be reviving. This was evident on December 23, as daily net inflows reached an impressive $130.76 million, pushing the total net assets over the $12 billion mark.

Approximately 2.94% of Ethereum’s total market value is accounted for by it, and its total inflow accumulates to roughly $2.46 billion.

In the forefront among bullish investors, BlackRock bought approximately $89.51 million in Ethereum (ETH), with Fidelity not far behind, investing around $46.37 million. Bitwise acquired a total of $963,720 worth of ETH, and Grayscale was the only ETF showing outflow, amounting to $6.09 million.

On-chain Insights Signal Buy ETH

With increasing institutional interest in Ethereum driven by evolving technological understandings, the expansion of its network suggests a promising bullish trend. A recent tweet from Cryptoquant highlights several positive indicators for Ethereum, signaling a potentially optimistic future.

As a crypto investor, I’m seeing indications that suggest a strong bullish stance for Ethereum. From my analysis as a technical on-chain specialist at Cryptoquant, it appears that market participants are eager to not only hold onto but also amplify their involvement with this asset.

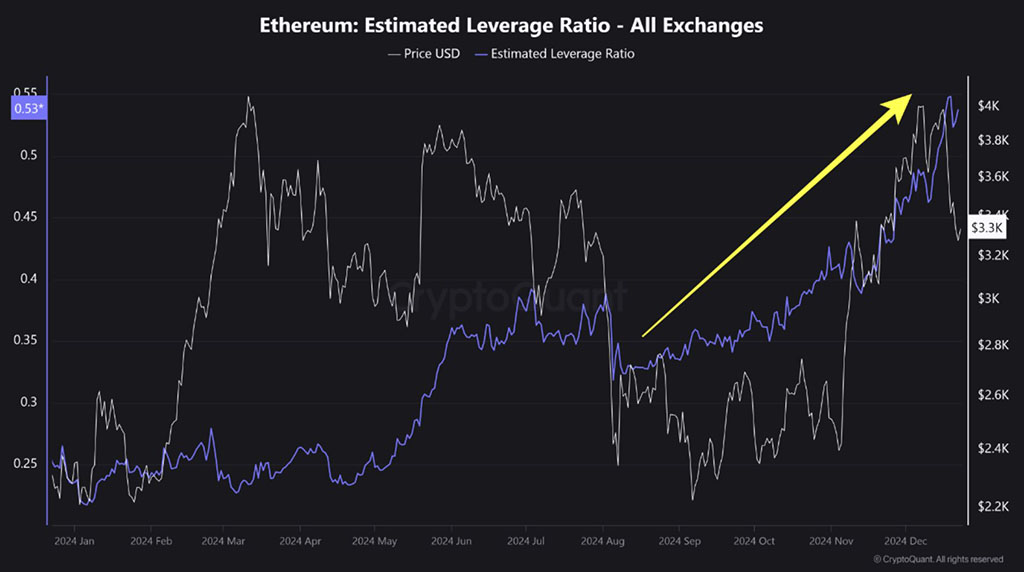

The highlighted metrics include Ethereum’s estimated leverage ratio, which has increased significantly over the past few months, rising from 0.35 in August to nearly 0.5 in December. This highlights the increase in leverage trading in the derivatives market across all Ethereum exchanges.

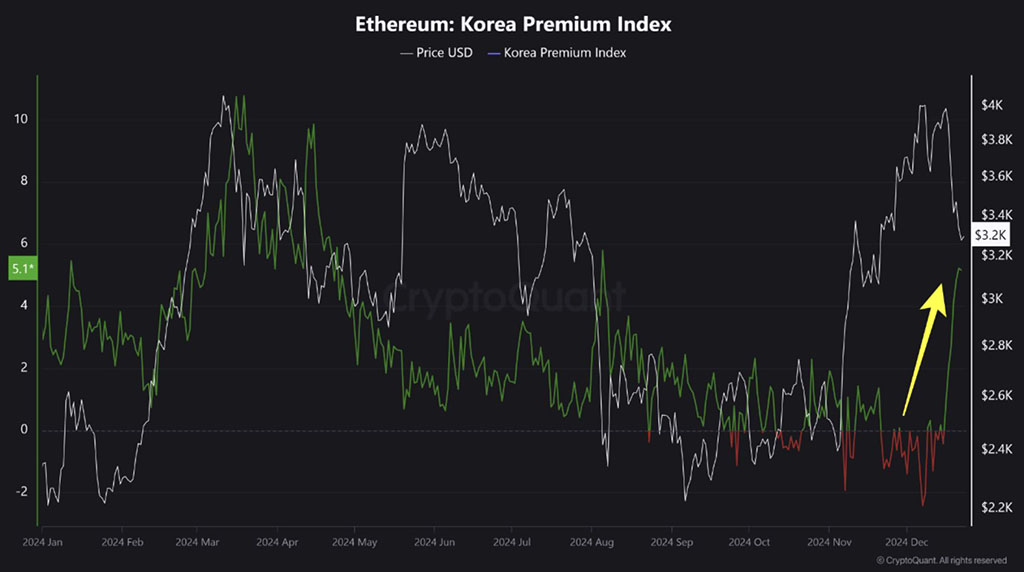

To expand, the total Ethereum holdings across all symbols now stand at approximately 3.6 million, marking an increase from below 3 million in late October. Generally, the funding rates continue to be favorable, while the Korean premium index has significantly surged in December.

In late December, the price of the premium soared from a low of -2 up to 5.1, reaching its maximum level. This is the highest point the Korean Premium Index for Ethereum has been since September.

Consequently, it is anticipated that the increasing institutional desire for Ethereum and the surging interest from South Korea will likely drive up the prices of the major alternative cryptocurrencies.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-12-24 13:13