As a seasoned crypto investor with roots deeply entrenched in the dynamic world of digital assets, I find myself intrigued by Metaplanet’s relentless Bitcoin accumulation. Having witnessed the ebb and flow of the market since its inception, I can confidently say that their strategic approach mirrors the tenacity of a seasoned samurai in feudal Japan – unyielding, calculated, and resolute.

Metaplanet, an investment firm based in Japan, is still on a roll with its Bitcoin (BTC) purchases. Today, they revealed they’ve bought 619.7 BTC worth approximately $61 million, which marks their biggest Bitcoin purchase yet.

Metaplanet Increases BTC Holdings To 1,762

It seems that the dip in the cryptocurrency market from its record highs doesn’t faze Metaplanet, as they’ve just made their largest Bitcoin purchase yet, acquiring 619.7 BTC for approximately $61 million, with an average price of roughly $96,000 per coin.

Metaplanet initiated its Bitcoin purchases back in May this year, acquiring 97.9 Bitcoins. Except for September, the company has consistently added BTC to its portfolio each month. It surpassed the 1,000 Bitcoin mark in November and with its latest purchase, now holds a total of 1,762 Bitcoins, which were obtained at an average price of approximately $75,600 per Bitcoin.

As a researcher, I’d like to highlight an interesting point: The recent $61 million acquisition we made is nearly twice the value of our largest previous acquisition back in November, which was approximately $30 million. Our persistent Bitcoin accumulation has led to us being dubbed “Asia’s MicroStrategy,” a title that references the US-based business intelligence firm recognized for its bold Bitcoin purchasing strategy.

It is worth highlighting that today’s BTC purchase comes a week after Metaplanet raised $60.6 million through two tranches of bond issuance for the purpose of “accelerating BTC purchases.” Metaplanet’s latest purchase also makes its BTC reserves the 12th-largest among publicly listed firms globally.

As stated in Metaplanet’s official announcement, their BTC Yield, a unique tool for evaluating the effectiveness of their Bitcoin buying approach, reached an impressive 310% from October 1st to December 23rd. The company highlighted that this strategy is intended to bring benefits to its shareholders, aiming to be “shareholder-friendly.

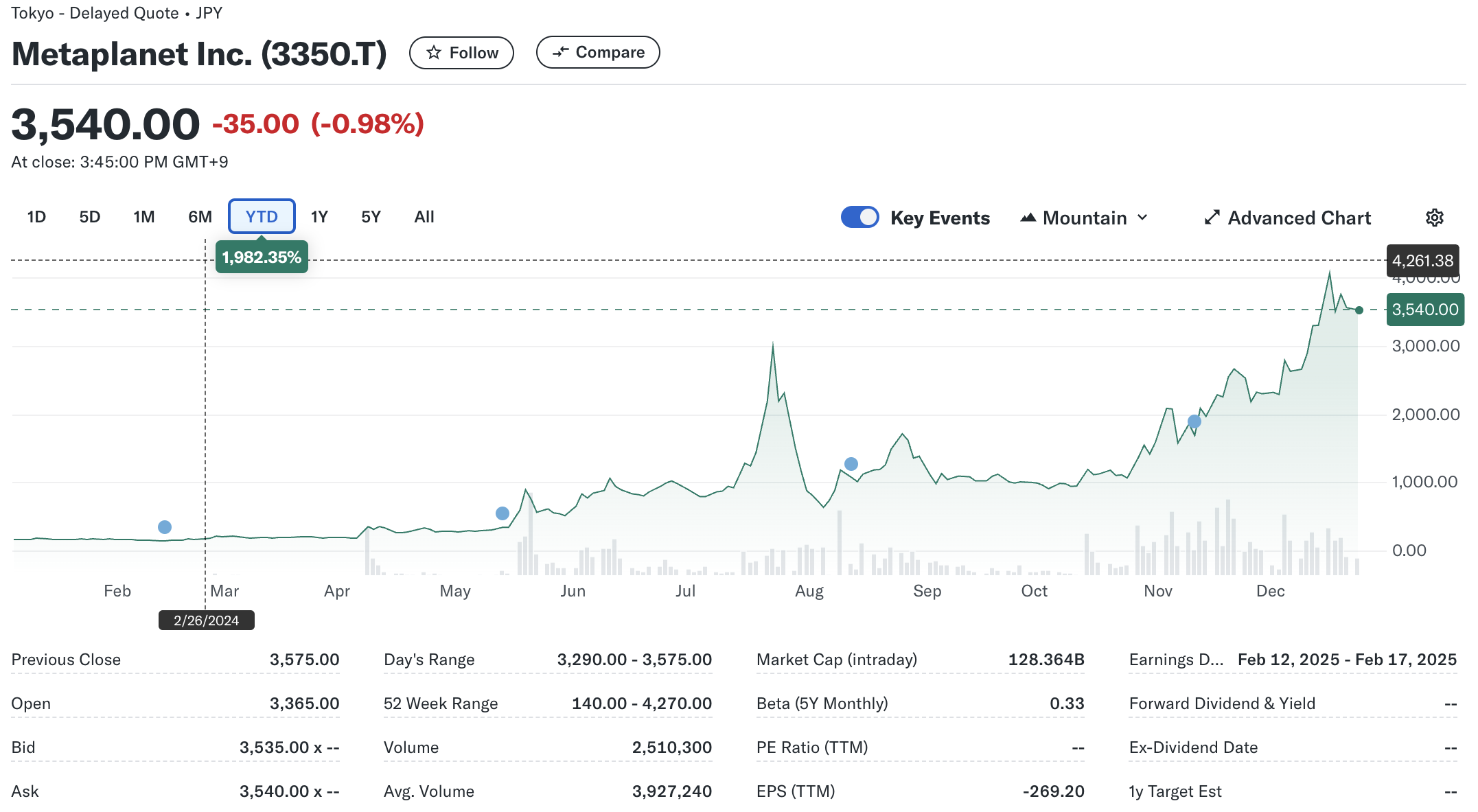

Although today’s large Bitcoin purchase was made, Metaplanet’s share price remained relatively unchanged, ending at $22.5, a decrease of 0.98% for the day. However, over the course of the year, the company’s stock has experienced an extraordinary increase of 1,982%, demonstrating the long-term advantages of its Bitcoin-focused approach.

Bitcoin Supply Crunch To Hasten Adoption?

The fact that Bitcoin’s total supply can never exceed 21 million coins gives it a strong standing as an asset resistant to inflation, serving as a reliable store of value. A recent study has shown that the amount of Bitcoin stored on cryptocurrency exchanges has reached record lows for several years. This suggests that holders are taking their Bitcoins off exchanges more frequently, thereby reducing the circulating supply and possibly causing prices to rise.

The limited supply of Bitcoins has ignited a clandestine competition among businesses and potentially governments. For example, a Bitcoin mining firm called Hut 8 recently bought 990 Bitcoins for $100 million, boosting its overall holdings to more than 10,000 Bitcoins. In a similar vein, MARA, another Bitcoin miner, procured 703 Bitcoins this month, now owning a total of 34,794 Bitcoins.

Discussions about the possibility of a U.S. strategic Bitcoin reserve are adding fuel to the belief that Bitcoin is facing a scarcity issue, which could accelerate its acceptance more quickly. At this moment, one Bitcoin is being traded for approximately $94,000, representing a decrease of 1.5% over the past day.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Best Japanese BL Dramas to Watch

- List of iOS 26 iPhones: Which iPhones Are Supported?

2024-12-24 02:10