As a seasoned researcher with over two decades of experience in analyzing market trends and investment patterns, I have witnessed the rise and fall of numerous cryptocurrencies. The growth story of Toncoin, or TON, has been nothing short of remarkable, especially considering its humble beginnings as a Telegram project back in 2017.

One of the prominent players in the crypto sphere is Toncoin (TON), boasting a market capitalization of approximately $13.87 billion. Originally developed by Telegram in 2017, TON is a Layer-1 blockchain network, also known as The Open Network. Over the past 24 hours, it has shown minimal volatility with a 0.1% change and a 24-hour trading volume of $292.33 million.

2024 saw significant expansion in Toncoin’s network and value. Yet, amidst the wider market adjustment following the correction and the challenge for Toncoin to rebuild bullish momentum after the detention and release of Telegram’s CEO Pavel Durov, Toncoin prices are currently anticipating a surge in demand.

Will the TON prices skyrocket in 2025 as the broader market recovers?

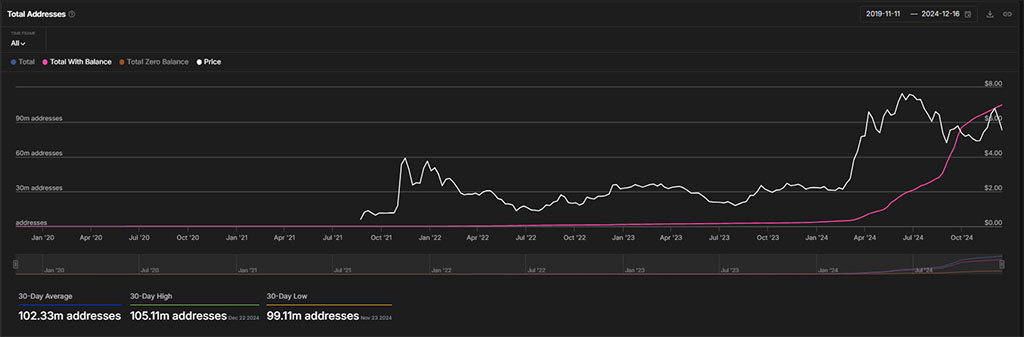

Success Story of TON with Total Addresses Crossing 100M

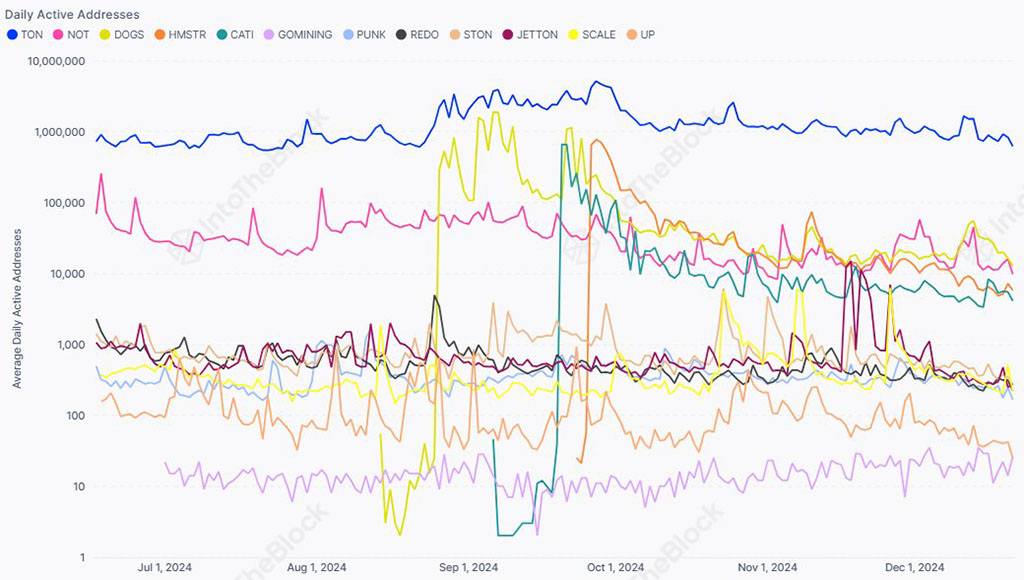

2024 saw a remarkable rise for Toncoin, as highlighted by IntoTheBlock on Twitter. This surge was largely due to the extensive use of mini-apps within Telegram, leading to over 5 million daily active users of the TON network by mid-year.

At present, the count of addresses in the network surpassed 100 million, reaching a total of approximately 104.67 million. Concurrently, there are around 773,640 active addresses, with an additional 198,720 addresses becoming active.

27,690 zero-balance addresses stay constant. Over the short term, the number of daily active addresses is still decreasing, though a spike in September saw up to 3.8 million daily active addresses.

HODLers Addresses Nears 3M

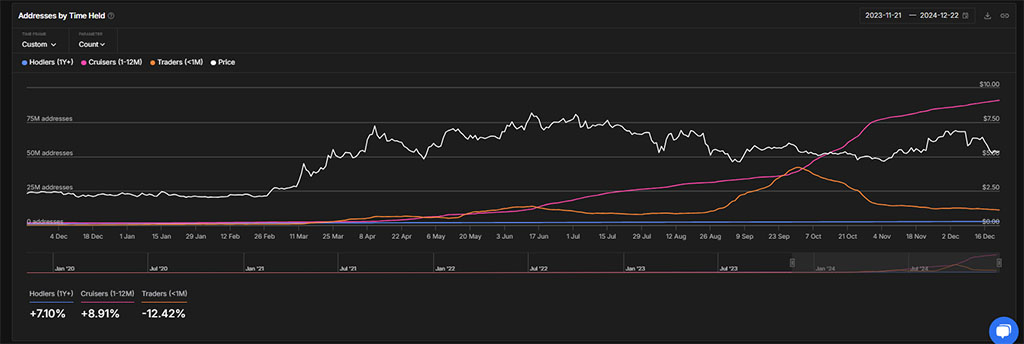

Building on the positive trend, it’s been noted that the number of cryptocurrency addresses has experienced an upward trajectory similar to a parabola over the past year. Starting from January 1, 2024, the number of long-term holders (HODLers), defined as those holding for more than one year, was approximately 1.38 million. Meanwhile, addresses that have held between one month and one year stood at around 1.74 million, and those with holdings less than a month totaled approximately 478,700.

As the year draws to a close, I’ve noticed an astonishing surge in the total number of addresses associated with our platform, reaching approximately 105.02 million. Interestingly, among these, I found that around 2.9 million addresses have been holding TON for over a year.

The massive surge in HODLers and cruisers reflects the growing confidence of investors in Toncoin.

Toncoin TVL Down at $646M

At present, the combined worth secured across the Toncoin network amounts to approximately $646.78 million. However, this figure represents a substantial drop compared to the peak Total Value Locked (TVL) of $1.145 billion that was reached on July 20, 2024.

Nevertheless, the stablecoin market cap over the network stands at $1.218 billion, with the 24-hour volume at $19.19 billion. The key numbers over the network are extremely positive and are recovering compared to the TVL dip to $554.5 million on September 4.

In the coming years as both the broader cryptocurrency market recovers and more people adopt the Toncoin network, it’s expected that the DeFi statistics for Toncoin will improve significantly in 2025. To provide some context, the Full Diluted Valuation (FDV) of Toncoin currently stands at approximately $27.857 billion.

Toncoin Price Ready for Bullish 2025?

Right now, Toncoin is being exchanged at approximately $5.4390, representing a decrease of 15.82% over the past week. This decline continues a two-week trend of bearish activity for Toncoin, which followed a 5.83% drop in the week prior.

Toncoin has experienced an incredible rise of 1,296% since reaching its all-time low of $0.3906 on September 20, 2021. Yet, the current market adjustment presents a reduction of approximately 33.78% compared to its peak at $8.24, which was hit on June 15, 2024.

On the weekly graph, a reversal trend that began as an evening star pattern has reached a test of the 50-week Exponential Moving Average (EMA) line. Additionally, the trend of TON in the weekly chart suggests a forming rising wedge pattern with a nearby resistance level.

As an analyst, I’m observing that the current uptrend, or the ‘reversal rally’, is currently probing the dynamic average line. This rally seems poised to confront the 200 Exponential Moving Average (EMA) at the earlier support level of $4.45. However, the recent price rejections in local candles indicate underlying support, which could potentially increase the likelihood of a short-term reversal.

Based on the pattern of recent price movements using Fibonacci ratios, the downward shift that started around the $7.00 mark (approximately the 38.20% level) is gathering strength. Yet, if the buyers manage to seize control again, a surge could occur, potentially overcoming the current resistance at around $8.62 – a level that corresponds to the 61.80% Fibonacci ratio.

On the flip side, the 200 EMA line at $4.27 remains crucial support, followed by $3.73.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Best Japanese BL Dramas to Watch

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

2024-12-23 17:19