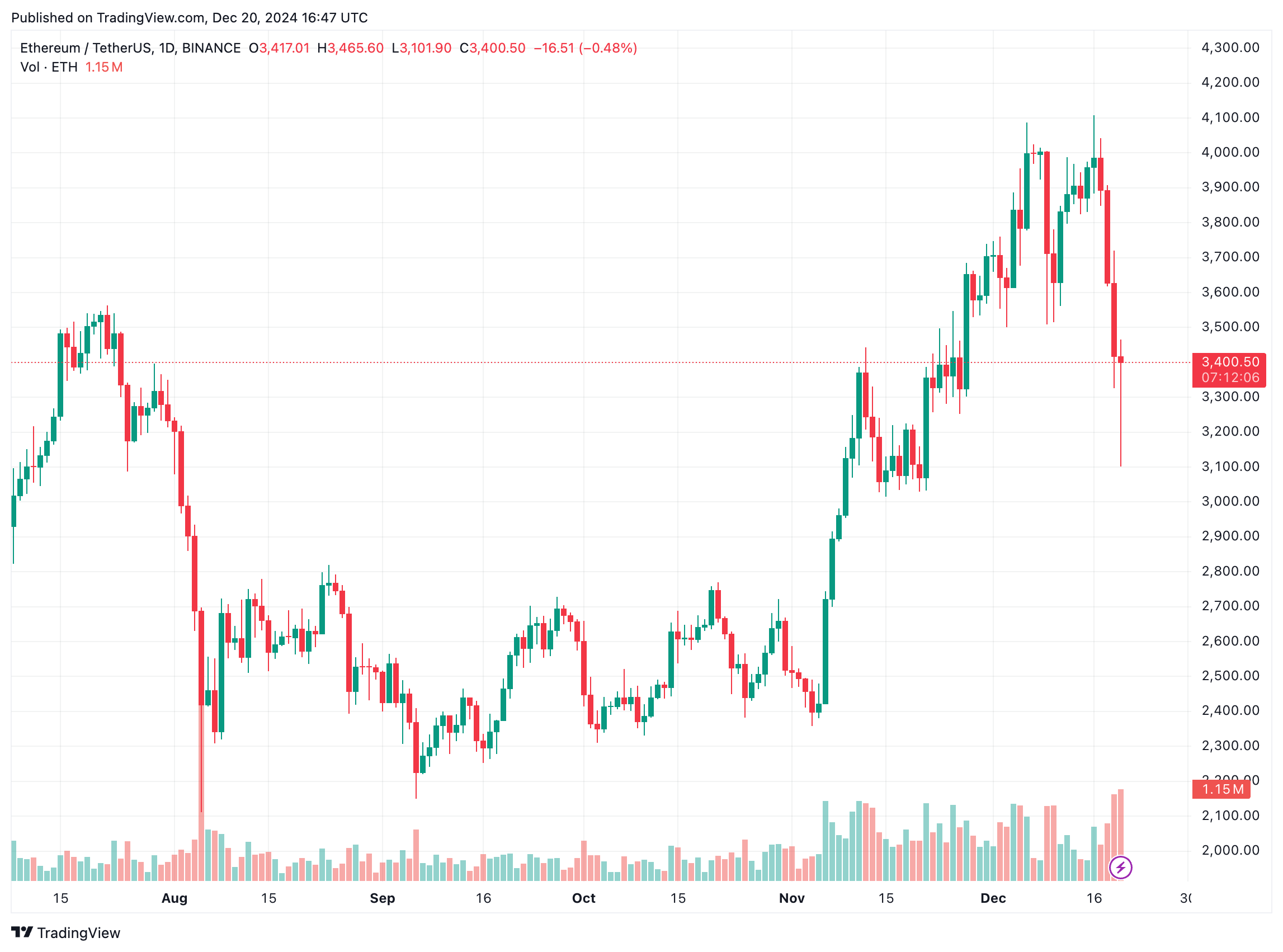

As a seasoned crypto investor with over a decade of experience in this dynamic market, I find myself intrigued by Ethereum‘s recent performance. The repeated rejection at the $4,000 resistance level and the current trading at $3,400 is a familiar dance we’ve seen before.

As a result of yesterday’s slump in the crypto market, Ethereum (ETH) has failed to break through the crucial $4,000 barrier for the third time since March 2024, with each attempt being unsuccessful. Currently, Ethereum is trading at approximately $3,400, representing a decrease of 6.7% over the past day.

What’s Behind Ethereum’s Underwhelming Price Performance?

As an analyst, I’ve observed a notable 47% year-to-date (YTD) growth in Ethereum (ETH), but its performance pales in comparison to other prominent cryptocurrencies such as Bitcoin (BTC), Solana (SOL), and XRP. These digital assets have seen substantially higher returns during the same period. The reasons for Ethereum’s sluggish price growth seem to be multifaceted.

One contributing factor is Ethereum’s comparatively weaker brand recognition versus Bitcoin. This was highlighted by the lackluster response to the launch of spot ETH exchange-traded funds (ETFs) in August. The introduction of these ETFs failed to generate any meaningful price movement for ETH.

Data further reveals a significant disparity in investor interest between the two assets. The total net assets held in U.S. spot ETH ETFs currently amount to $11.98 billion. In contrast, spot BTC ETFs hold $109.66 billion – nearly ten times as much.

Moreover, yesterday experienced approximately $60 million in withdrawals from Ethereum spot ETFs, which represents the largest one-day withdrawal since November 19. Crypto analyst Ali Martinez noted that public sentiment regarding Ethereum has reached its lowest point in a year. Yet, considering past trends, this potentially suggests a bullish opportunity for Ethereum.

It seems that futures traders have grown pessimistic towards ETH, as the cost of holding future positions has dropped below its value for the first time since November 6. This market decline initiated Ethereum’s most significant liquidation event since December 9, with a staggering $299 million being sold off in just one day. These major liquidations frequently result in sequential sell-offs and increased price instability.

As a crypto investor, I’ve noticed a pattern that often raises concerns – the Ethereum Foundation seems to have a habit of selling ETH around local price highs. Recently, in a post on X, Lookonchain pointed out that the Ethereum Foundation offloaded 100 ETH on December 17. Since then, the value of ETH has dropped by roughly 17%.

There’s growing doubt concerning the way Ethereum distributes its supply. A study by Binance Research has pointed out that Ethereum’s substantial emission rate challenges the idea of it being a “deflationary currency,” which asserts that Ethereum operates as a scarce asset.

Is Ethereum Set For A Bounce?

Experienced cryptocurrency expert Trader_XO shared yesterday that they purchased Ethereum (ETH) at approximately $3,200. They also forecasted a period of around several weeks for price stabilization, suggesting that ETH may experience further growth soon.

Currently, the cryptocurrency analyst known as CryptoShadowOff has spotted a possible rising triangle pattern on Ethereum’s monthly price chart. Based on their assessment, Ethereum might experience a decline to around $2,800 before attempting to reach another record high price level.

According to analyst CryptoBullet1, the current state of Ether (ETH) on a 4-hour chart is unusually oversold, akin to August 5th. This could potentially signal an upcoming price increase. At the moment, ETH is being traded at approximately $3,400, representing a 6% decrease over the past day.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-12-21 12:40