As a seasoned crypto investor with over two decades of experience navigating the ever-evolving digital asset landscape, I find myself intrigued by the latest move of World Liberty Financial (WLFI). Having witnessed numerous projects rise and fall, I must admit that the strategic acquisitions made by WLFI have caught my attention.

The newly established World Liberty Financial (WLFI), led by incoming US President Donald Trump, is stirring curiosity within the cryptocurrency sector. WLFI has been delving into significant initiatives related to decentralized finance. Rapidly amassing digital assets has caught the attention of both skeptics and supporters in the crypto community.

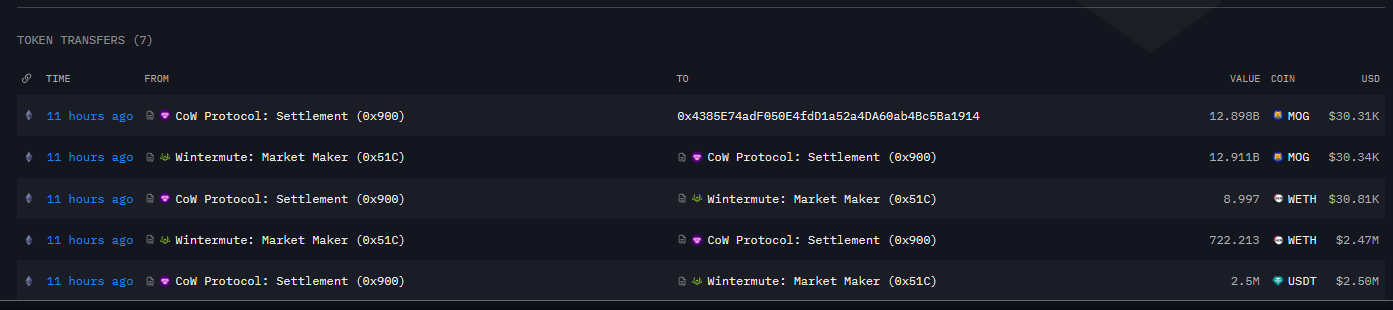

Trump, WLFI Add 722 Ether To Its Inventory

In the recent market dip, WLFI seized the opportunity to purchase around 722 Ether for roughly $2.5 million. This strategic buy-in has boosted their Ethereum holdings to over 15,598 tokens, currently valued at about $53 million. This significant acquisition signals WLFI’s intent to establish a dominant position in the Decentralized Finance (DeFi) sector.

The primary aim of this project is to make cryptocurrency loans accessible to all, thereby contesting established financial institutions. This idea is truly captivating. Investors seeking options beyond traditional finance, particularly amid today’s uncertain banking landscape, are finding a strong connection with this concept.

As reported by Arkham, the Trump family’s cryptocurrency initiative, World Liberty, acquired 722.213 Ether (ETH) for around 2.5 million USD Coin (USDC) using Cow Protocol on December 20, at 6:54 UTC+8. Currently, this project owns a total of approximately 15,595 Ether, which is worth roughly $53.61 million.

— Wu Blockchain (@WuBlockchain) December 20, 2024

Diversifying To Other Coins

It appears WLFI isn’t just about swift Ethereum purchases; it seems they’re also investing heavily in other popular cryptocurrencies such as Aave (AAVE) and Chainlink (LINK). These strategic moves suggest an intention to create a varied investment portfolio, aligning with what Trump referred to as a “financial revolution.

“The participation of Justin Sun, the founder of TRON, who has pledged $30 million as a major investor and consultant, is arguably the most impactful event in the initiative’s history. His involvement brings substantial cryptocurrency know-how to WLFI, while Donald Trump’s renowned brand captures attention from both individual and institutional investors.

Questions Linger

In my line of work, I’ve encountered some discussions that question the alliance, centered around concerns about potential conflicts of interest and the possibility of individuals exploiting the project for political favors.

Currently, the spotlight is on WLFI as it continuously improves its products and broadens its financial resources. For those who prefer alternatives to conventional banking, WLFI presents an opportunity to question established finance norms. However, the question remains as to how WLFI will distinguish itself in a DeFi market that’s becoming increasingly congested.

The substantial monetary backing from the Sun, coupled with Trump’s widely recognized leadership, has undeniably fueled a significant surge in the cryptocurrency market. However, WLFI’s ultimate victory will hinge on its ability to meet high expectations amidst legal obstacles and volatile market conditions.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

2024-12-20 21:40