As a researcher with a keen interest in blockchain technology and its applications, I find the recent growth trends of various networks, particularly Coinbase’s Base, quite intriguing. Having closely followed the crypto market since its early days, it’s fascinating to witness how quickly the landscape is evolving.

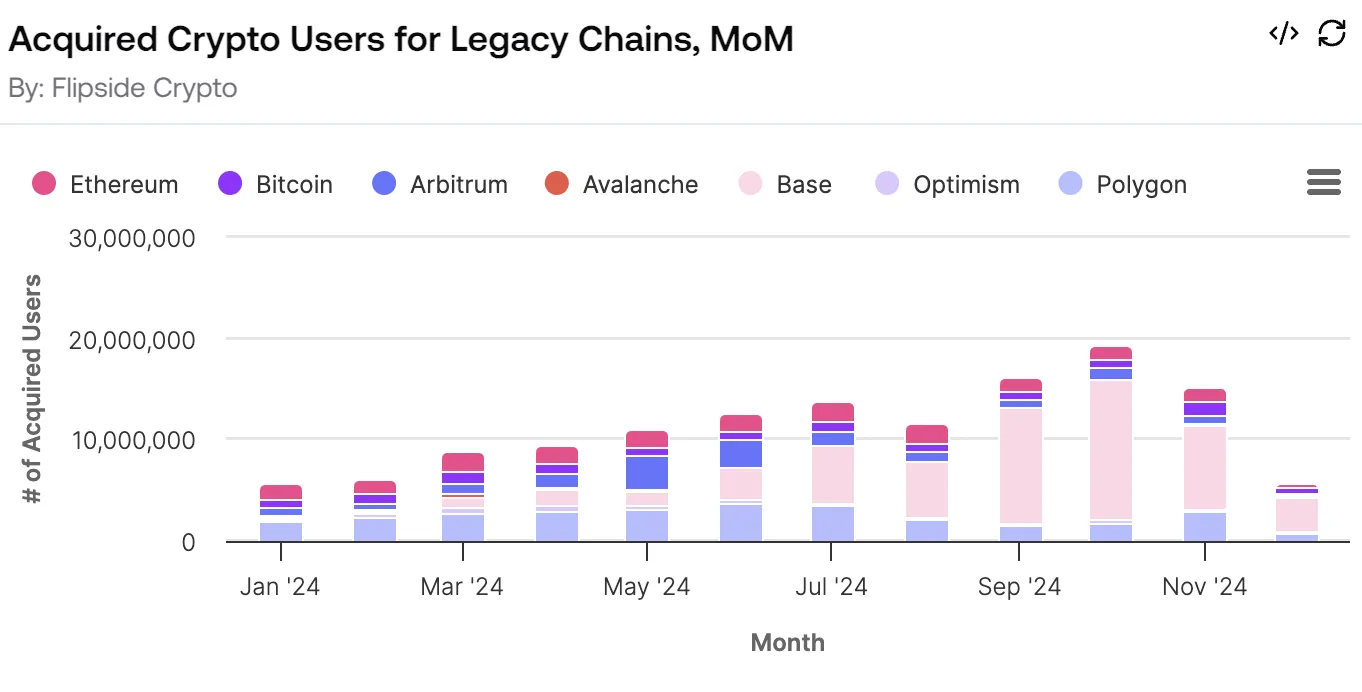

According to Flipsight’s recent findings, Coinbase’s Layer-2 blockchain network, Base, experienced extraordinary growth in user base throughout 2024, averaging approximately 1.56 million new users per month. Remarkably, it surpassed industry titans like Ethereum in this regard. In just the month of October, the Base network attracted an impressive 13.7 million new users, making it the fastest-expanding blockchain network.

While Ethereum’s network has remained strong and continues to lead in user acquisition, the emergence of Base and Polygon networks has caused a disruption, particularly due to increased engagement that expanded their respective user bases, not just through DeFi activities but also other sectors. On the contrary, despite Bitcoin‘s price surpassing $100,000, its blockchain has struggled in terms of network growth and onboarding new users.

Here’s How Coinbase’s Base Outpaced Ethereum

15.1 million active users with more than 100 transactions each have flocked to the Base platform, outperforming both Ethereum and Polygon in this regard. This significant milestone highlights the strong user interaction on Base and establishes it as a leading choice among platforms. On the other hand, Polygon has excelled by expanding its endeavors, consistently preserving high transaction rates across gaming and non-financial fields.

Examining the market for decentralized exchanges (DEX), it’s clear that Uniswap, the largest platform built on Ethereum, has solidified its dominance, accounting for approximately 91.3% of user activity on Base. Meanwhile, Trader Joe remains in charge within the Avalanche ecosystem, boosted by innovative features like Auto-Pools and multi-chain functionalities.

This progression underscores the increasing dominance of Decentralized Exchange (DEX) activities by major competitors. Meanwhile, emerging platforms grapple with finding a balance between fostering novelty and ensuring user loyalty.

Emerging blockchain networks such as Aleo have exhibited impressive growth potential, yet faced challenges in sustaining user interaction. Conversely, Base stands out as an example of boosting user engagement by implementing thoughtful features and forming strategic alliances.

Institutional Confidence Surges amid Macro Development

2024 saw a significant boost in institutional acceptance of digital assets due to regulatory clarity, as stated in the Flipside report. Particularly noteworthy was the EU’s Markets in Crypto-assets Regulation (MiCA), which increased confidence among institutions, resulting in the launch of ETFs and broader adoption. This trend, in turn, fostered consistent user growth across various blockchain networks.

With the continuous development of the cryptocurrency sector, innovative concepts like GameFi and artificial intelligence (AI) integration may speed up its growth. These advancements could help resolve challenges related to scalability and data handling, thereby opening doors for increased user interaction and engagement. According to Flipside’s analysis, these developments show promise.

Beyond the impressive statistics of increasing user numbers, there’s a more complex issue to address: constructing environments where users engage in a significant and enduring way, not just for brief moments of speculation. In essence, most blockchain platforms are yet to fully tap into the potential of transforming casual users into valuable contributors.

2024 marked a significant period of development for the cryptocurrency sector as established platforms clashed with newcomers. Yet, to foster expansion in 2025, it’s crucial to strike a balance between fostering innovation, maintaining user interest, and adapting to regulatory changes.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-12-20 17:30