As a seasoned crypto researcher with over a decade of experience navigating market volatility and whale activity, I find myself intrigued by the latest developments in Ethereum (ETH). The recent 5% drop might seem daunting to some, but it’s moments like these that often present valuable opportunities for those who dare to swim against the tide.

Amidst a broader crypto market slump due to the Fed’s anticipated tightening policies in 2025, the price of Ethereum has fallen by over 5% today. Yet, significant Ethereum investors, often referred to as ‘whales,’ are viewing this situation as a prime opportunity and are purchasing at these lower prices.

In the wake of the latest decline in ETH prices, a significant Ethereum investor, believed to be connected with Longling Capital, has shrewdly purchased 6,000 ETH. Renowned for its keen market sense, this whale has repeatedly profited from Ethereum price fluctuations, amassing a total earnings of $83 million so far, as reported by LookonChain.

In addition, information from Arkham Intelligence indicates that starting on May 8, 2023, a prominent investor (referred to as a “whale”) acquired approximately 75,400 ETH valued at around $180.4 million, with an average purchase price of about $2,392 per ETH. During this same timeframe, the whale also sold 50,800 ETH for roughly $172.8 million, with an average selling price of approximately $3,401 per ETH. This trading behavior suggests that the whale is skilled at purchasing assets at a lower price and then selling them at a higher one.

Source: LookonChain

In light of heightened Ethereum transactions by large investors (whales), there’s growing interest among investors about whether the ETH price will rebound yet again. Although it dropped today, market experts maintain a positive outlook for ETH.

For more than two years now, the trading relationship between ETH and BTC has been moving downward persistently. Since September 2022, this ratio has stayed within a channel that follows a parallel pattern. Despite this prolonged bearish trend, technical signs point toward a possible turnaround in the near future, as suggested by well-known analyst Venturefounder.

The analyst pointed out that certain chart patterns, such as a double bottom or an inverse head-and-shoulders formation, could potentially trigger a change in direction (a shift). In the past, Ethereum’s prolonged bear market relative to Bitcoin occurred between February 2018 and December 2019, which lasted close to two years. During this period, Ethereum required a double-bottom pattern to regain its upward momentum against Bitcoin.

Source: Venturefounder

ETH Price Recovery to $4,000 Soon?

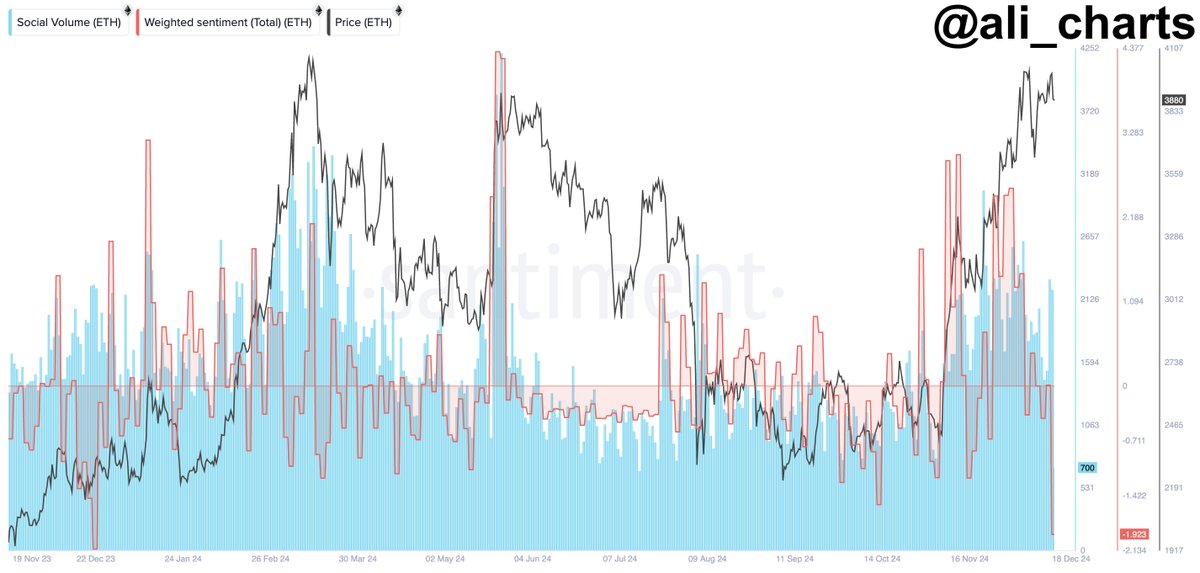

As a crypto investor, I’ve noticed that other on-chain signs suggest a recovery in Ethereum’s price is imminent. Crypto analyst Ali Martinez mentioned that the social sentiment surrounding Ethereum has reached its most pessimistic levels since December 18, 2023. Interestingly, these negative sentiments have often led to substantial price surges in the past.

Source: Ali charts

Martinez pointed out that during the last sentiment low point in December 2023, Ethereum showed a significant jump of approximately 30%. If Ethereum recovers by around 30% from its current support level at $3,500, it could trigger a swift increase towards $4,500 and potentially reach a new record high.

Source: IncomeSharks

According to Market Analyst IncomeSharks, Ethereum ($ETH) continues to maintain a bullish stance, as the Supertrend indicator hasn’t been breached even amidst recent market turbulence. The analyst underscored that Ethereum is currently showing signs of strength, and potential investors should exercise caution if betting against it (bearish traders).

Read More

- STETH/CAD

- AR Rahman to earn a staggering Rs. 8 crores for Ram Charan’s upcoming sports drama RC16!

- When Will Captain America 4 Get Its Digital & Streaming Release Date?

- Luna’s Paternity Bombshell Rocks The Bold and Beautiful

- The Batman 2’s Andy Serkis Gives Update on the Delayed Sequel

- Bigil OTT release on Valentine’s Day: Where to watch Thalapathy Vijay and Nayanthara’s sports action drama online

- Apple reveals more affordable iPhone 16e starting at $599

- Apple Cider Vinegar: The Shocking Truth About Milla, Lucy & Justin

- Thalapathy Vijay’s Jana Nayagan: Is the movie an attack on any political leader or party? H Vinoth clarifies

- Where Was Sweet Magnolias Season 4 Filmed? All Locations Revealed

2024-12-19 14:54