As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset market, I find myself optimistic about the recent surge in Bitcoin‘s price. Having weathered numerous market cycles and witnessed the meteoric rise and fall of various coins, I can confidently say that this latest increase above $106,000 is not just another false dawn.

The cost of Bitcoin surged past its previous resistance level at around $106,000, reaching a brand-new record high of over $108,000. However, it’s now experiencing a pullback from these gains.

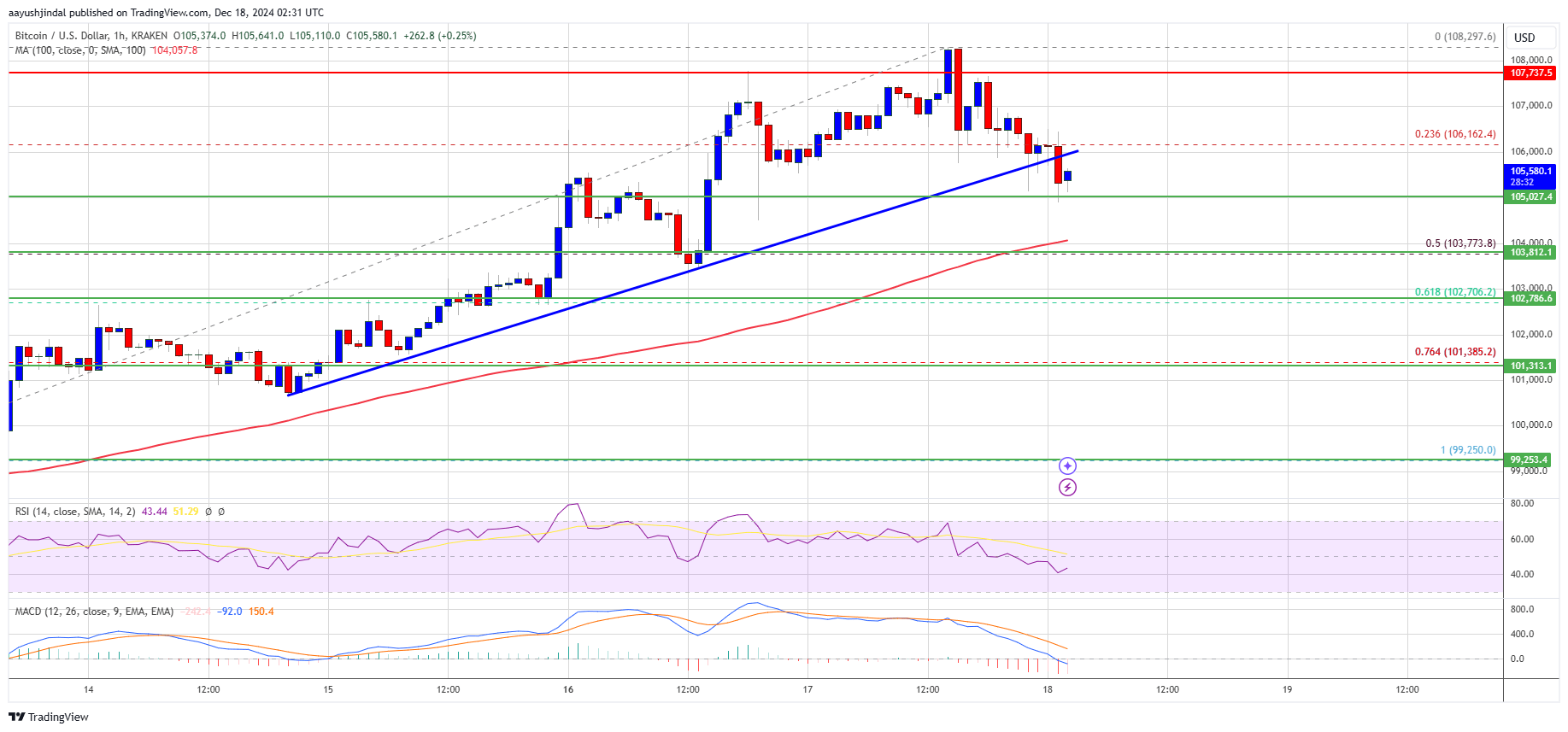

- Bitcoin started a fresh surge above the $106,000 zone.

- The price is trading above $105,000 and the 100 hourly Simple moving average.

- There was a break below a key bullish trend line with support at $106,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start a fresh increase if it stays above the $103,750 support zone.

Bitcoin Price Remains In Uptrend

As an analyst, I observed that the Bitcoin price established a foundation and commenced a significant surge beyond the $103,500 threshold. Subsequently, there was a notable upward movement surpassing both the $104,000 and $105,000 price levels.

The cost surpassed the $106,000 mark and reached an unprecedented peak at $108,297. However, it’s currently correcting a portion of its gains. A slight dip occurred below the 23.6% Fibonacci retracement level from the price drop between the $99,250 low to the high of $108,297.

On the hourly Bitcoin-to-USD chart, there was a drop below a significant bullish trendline, which previously offered support at approximately $106,000. At present, the Bitcoin price is trading slightly above $105,000 and is now hovering above the 100 hourly moving average.

On the upside, the price could face resistance near the $106,200 level. The first key resistance is near the $107,750 level. A clear move above the $107,750 resistance might send the price higher. The next key resistance could be $108,250. A close above the $108,250 resistance might send the price further higher.

In this particular scenario, there’s a possibility that the price might escalate, potentially challenging the $112,000 resistance point. If it continues to climb further, it could push the price towards the $115,000 mark.

More Downsides In BTC?

If Bitcoin doesn’t manage to break through the $106,200 barrier, it might keep falling instead. The nearest support level if it does fall can be found around $105,000.

The first major support is near the $103,750 level or the 50% Fib retracement level of the recent wave from the $99,250 swing low to the $108,297 high. The next support is now near the $102,200 zone. Any more losses might send the price toward the $100,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $105,000, followed by $103,750.

Major Resistance Levels – $106,200, and $108,250.

Read More

- The Beauty Cast Adds Rebecca Hall to Ryan Murphy’s FX Series

- IMX PREDICTION. IMX cryptocurrency

- Skeleton Crew Episode 4 Ending Explained: What Happens to Neel?

- How Much Did Taylor Swift’s Eras Tour Contribute to the US Economy?

- What Happened to Richard Perry? ‘You’re So Vain’ Music Producer Passes Away

- Old Guy Trailer Sets Release Date for Christoph Waltz Action Comedy

- The Handmaid’s Tale Season 6 Features ‘A Lot’ of Deaths

- Why Is ‘Vexbolts Mass Unfollowing’ Trending on TikTok & What Did He Do?

- Bill Skarsgård Talks Reprising Pennywise Role for It: Welcome to Derry: ‘It’s Pretty Hardcore’

- Black Ops 6 needs to add this key feature to curb-stomp cheating

2024-12-18 05:46