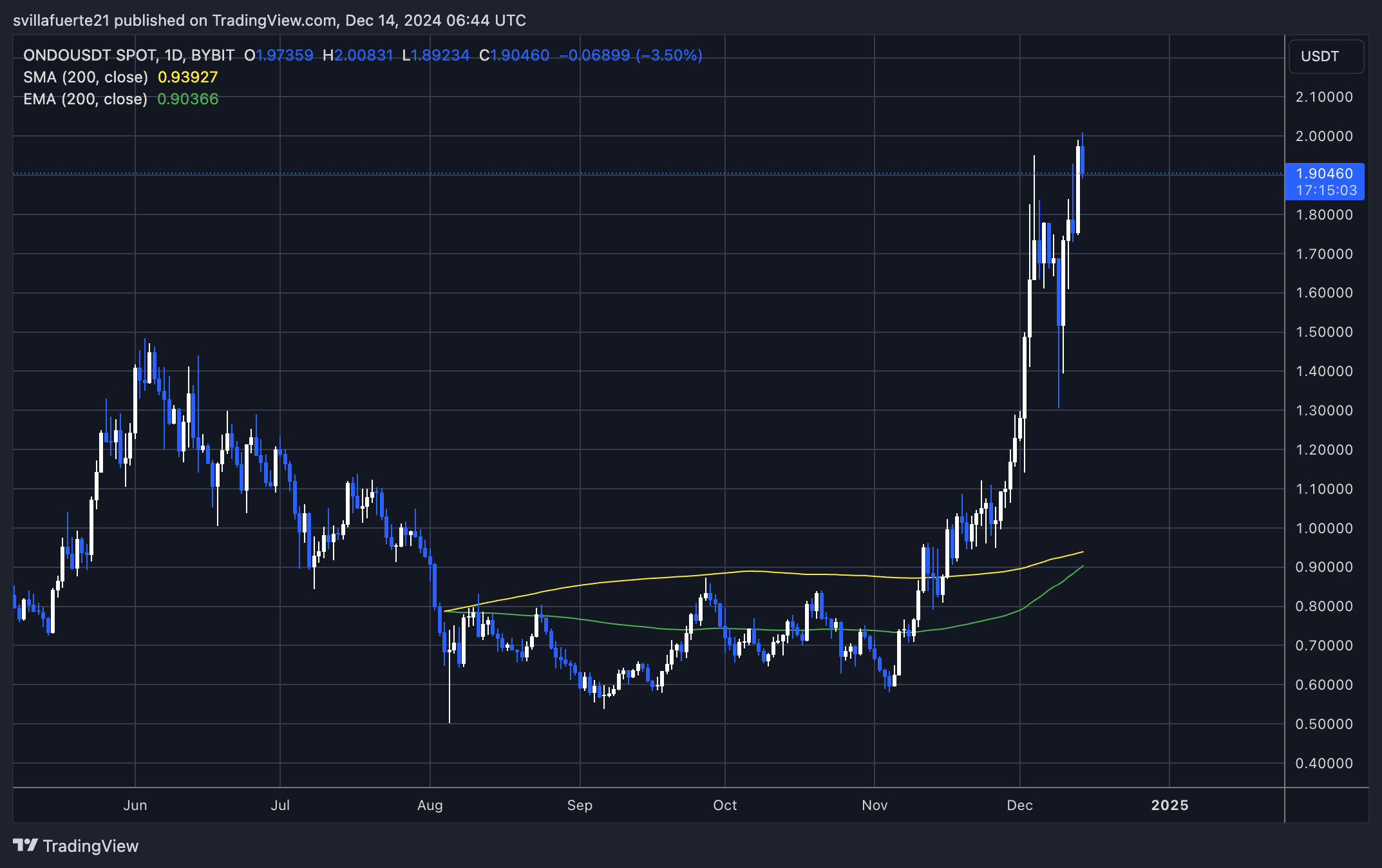

As a seasoned crypto investor with over a decade of experience navigating the volatile and ever-changing digital asset landscape, I find myself intrigued by Ondo Finance (ONDO). This project’s focus on tokenizing US Treasury Bonds is a game-changer, bridging traditional finance and decentralized finance in an innovative manner. The impressive growth of ONDO, up over 235% since November 5, has certainly caught my attention.

In the dynamic world of cryptocurrencies, Ondo Finance (ONDO) has made a notable impact, drawing considerable interest due to its dedication to real-world asset (RWA) tokenization. Specifically, Ondo focuses on digitalizing US Treasury Bonds using blockchain technology, thereby serving as a pioneer in merging traditional banking with decentralized finance. This groundbreaking strategy has propelled the growth of ONDO, the project’s own token, which has experienced an impressive increase of more than 235% since November 5.

The pace hasn’t let up with ONDO consistently reaching new peaks, as it has seen a strong surge since late December that has grabbed the attention of both investors and analysts. However, even though this trend is bullish, there are signs suggesting that market volatility could be on the horizon. Recent findings from Santiment reveal an upward trend in ONDO exchange inflows, which typically signals upcoming significant price shifts.

With Ondo Finance gaining attention, its strategy of tokenizing U.S. Treasury Bonds mirrors the increasing tale of uniting conventional finance with blockchain systems. This blend of practicality and novelty positions Ondo as an intriguing venture in this market trend. As the price trend maintains strength, the increasing volume of trades on exchanges hints at a significant phase approaching for ONDO. Now, investors are keenly watching the token for indications of its imminent major shift.

ONDO Testing Price Discovery

The native token of Ondo Finance, ONDO, has been on an impressive surge since early December, surpassing its prior record high of $1.48 and reaching as high as $2 in recent hours. This upward trajectory reflects increasing investor enthusiasm, although the current peak could indicate that market volatility may re-emerge soon.

According to crypto analyst Ali Martinez’s latest findings, the inflows to the ONDO exchange have been consistently rising. In the past, such increases in ONDO exchange inflows have often preceded substantial price fluctuations, be they upwards or downwards. This trend suggests that traders and investors should be cautious, as it could indicate a period of high volatility ahead.

Martinez underscored the need for careful observation of these inflows. Based on his assessment, a surge in inflows often signals increased activity, as existing holders might be gearing up to sell or fresh buyers could be entering the market, hoping for more profits. He advised us to stay alert, hinting that ONDO’s price may either plummet sharply or continue its upward trend into unknown heights.

Over these coming days, I find myself eagerly watching ONDO’s progress as it navigates through price discovery. If the token manages to maintain its upward trajectory beyond crucial support points, there’s a strong possibility that we could witness further growth, bolstering ONDO’s status as a leading performer in this market phase. Nonetheless, I must emphasize the importance of staying alert, as heightened exchange inflows hint towards impending significant price fluctuations.

Technical Analysis: Levels To Watch

Presently, ONDO is being exchanged at $1.90, having failed earlier today to surpass the $2 mark. It momentarily reached this significant psychological barrier before pulling back, suggesting a possible area of resistance. Nonetheless, even with this temporary setback, ONDO continues to shine among market performers, demonstrating remarkable strength as it consistently outperforms many other assets.

Lately, this dip might signal an opportunity for a significant uptrend, given that the token has shown strong bullish trends in recent weeks. If it can maintain its position above the crucial $1.83 resistance level, it could lead to another surge, possibly surpassing the $2 threshold and initiating a new phase of price exploration. But remember, traders need to exercise caution as volatility seems to be escalating, with increased trading activity suggesting heightened market involvement.

In the coming days, the direction of the price, which is close to its recent peaks, will be influenced significantly. Maintaining the $1.83 level is vital for investors hoping to continue the upward trend. If this support is lost, it could trigger more downward adjustments. Given its impressive performance and growing market attention, Ondo Finance continues to be a significant player worth monitoring in the current dynamic market scenario.

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- How to get all Archon Shards – Warframe

- Nagarjuna Akkineni on his first meeting with Lokesh Kanagaraj for Coolie: ‘I made him come back 6-7 times’

- Is Average Joe Canceled or Renewed for Season 2?

- What’s the Latest on Drew Leaving General Hospital? Exit Rumors Explained

- What Alter should you create first – The Alters

2024-12-14 22:34