As a seasoned researcher with a penchant for deciphering market trends, I find myself intrigued by the recent surge of AAVE and other DeFi tokens. While the past week has been an impressive run for Aave, my experience tells me that the crypto market can often be as unpredictable as a game of cat and mouse.

Over the previous week, the cryptocurrency market has generally shown optimistic trends. Notably, the Decentralized Finance (DeFi) sector and its associated tokens have stood out significantly during this seven-day period. For example, the price of Aave has noticeably surged following a relatively subdued performance in the extraordinarily bullish month known as “Moonvember.

As a researcher, I’ve been closely monitoring the price movements of AAVE, and based on data from CoinGecko, it’s clear that the token has experienced a significant surge over the past week, climbing more than 26%. Yet, recent on-chain indicators hint at potential challenges that may disrupt AAVE’s upward trend in the short term, possibly causing a minor setback.

Is AAVE Price Going To Witness A Correction?

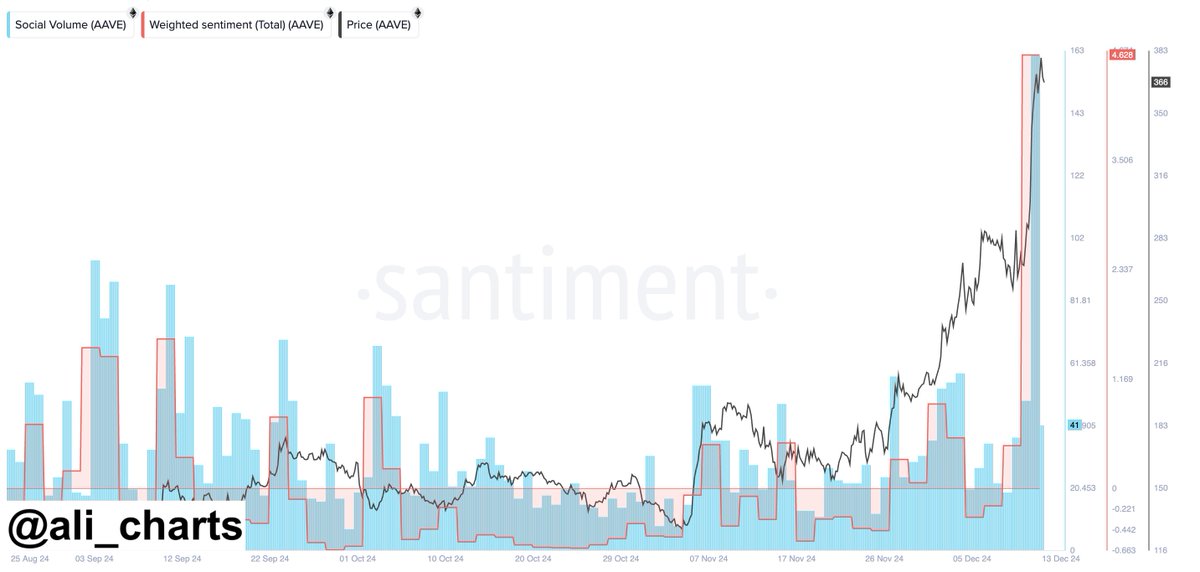

In a recent post on the X platform, prominent crypto analyst Ali Martinez revealed that the investor sentiment around the Aave token has become increasingly positive following its latest price upswing. This on-chain observation is based on the Social Volume and Weighted Sentiment metrics.

As a crypto investor, I’ve learned that the Social Volume metric is all about counting how many times my chosen digital currency pops up in conversations across popular social media outlets over the past day. Essentially, it gives me a sense of how much buzz there is about a particular cryptocurrency on the internet.

In simpler terms, the weighted sentiment is calculated by multiplying the sentiment score with the social volume. Noticeably, a substantial change occurs in this value when social volume is high and the average sentiment, whether it’s positive or negative, shows a particular trend.

According to Santiment’s data analysis, there has been a substantial increase in social activity and optimistic sentiment regarding the price fluctuations of AAVE in recent days. As illustrated in the following chart, this rising optimism mirrors the upward trend in the Aave price over the last week.

As suggested by Martinez, there could be a short-term adjustment in Aave’s price due to the current excitement among cryptocurrency enthusiasts about the DeFi token’s performance. This prediction is based on the pattern observed in historical data, which indicates that crypto prices tend to move in the opposite direction of public enthusiasm.

current market trends indicate that the value of Aave may be entering a period of stabilization, as it couldn’t maintain its position above the $380 level on Friday. Presently, each Aave token is worth approximately $365, representing a minor 0.4% growth over the past day.

DeFi Coins Back At It?

In this current market uptrend, meme coins have been grabbing most of the limelight, rightfully so. Yet, it seems that influential DeFi (Decentralized Finance) coins are now stepping up and making their presence felt, vying for attention.

Over the last seven days, numerous high-valued DeFi tokens, aside from AAVE, have experienced growth in their market worth. As per information from IntoTheBlock, the market cap of the DeFi token sector almost doubled, reaching a staggering $20 billion during this period.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-12-14 15:04