As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles, but none quite as fascinating as the current Bitcoin (BTC) phenomenon. Having closely followed the evolution of digital assets since their inception, I find myself captivated by the rapid growth of Bitcoin Exchange-Traded Funds (ETFs).

This year, the Bitcoin market has experienced a significant rebound, largely fueled by the growing interest in Bitcoin Exchange-Traded Funds (ETFs). In the initial part of the year, BTC peaked at an unprecedented price of $73,000, igniting a bullish momentum that persists even now. The recent high for BTC has been $104,000.

Over the past month, particularly since Donald Trump’s presidency, there has been a significant surge in crypto influence. This is largely due to Trump positioning himself as the pioneer for cryptocurrency within the U.S., envisioning America as the leading global hub for cryptocurrencies.

The positive stance that Trump has towards digital assets is sparking greater enthusiasm among investors, leading to increased demand from providers of Bitcoin ETFs like BlackRock and Fidelity. It’s worth noting that the top 12 Bitcoin ETFs now hold the largest amounts of Bitcoin, collectively valued at more than $100 billion.

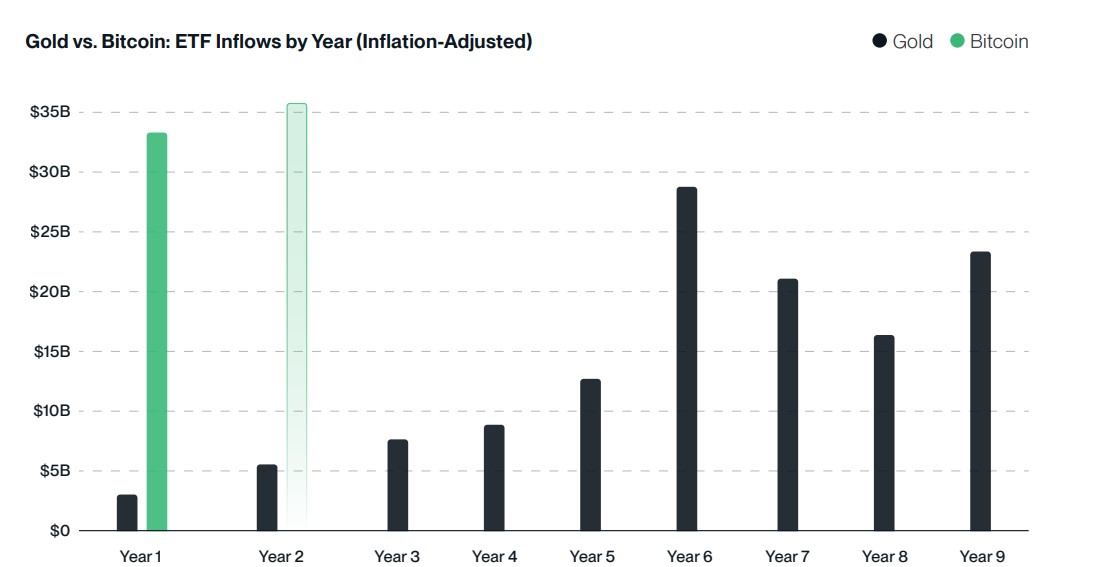

This graph shows one of the most profitable ETF debuts ever, as the 12 Bitcoin ETFs currently hold close to 1.1 million Bitcoins combined – which is roughly 5% of all Bitcoins in existence.

Bitcoin ETFs Expected To Surpass 2024 Inflows

According to a recent analysis by cryptocurrency asset manager Bitwise, there are three main reasons to expect significant expansion for Bitcoin ETFs through 2025. Firstly, it’s crucial to understand that the initial year of an ETF’s operation usually sees the slowest growth.

Comparisons of historical data reveal that gold-based Exchange Traded Funds (ETFs) launched in 2004 experienced a substantial rise in investments over subsequent years. For example, these ETFs initially attracted $2.6 billion during their inaugural year, followed by an increase to $5.5 billion in the second year and further growth in subsequent years.

The company proposes that should U.S. 12-point Bitcoin ETFs mirror their current trend, inflows in 2025 might surpass the amounts experienced in the year 2024.

A significant element that could foster growth is the expected involvement of large financial institutions, including firms like Morgan Stanley, Merrill Lynch, Bank of America, and Wells Fargo. These institutions have not yet fully utilized their wealth management resources to advocate for the approval of Bitcoin Exchange-Traded Funds (ETFs).

With a more supportive regulatory climate under the Trump administration, these financial institutions are anticipated to offer Bitcoin ETFs to their customers. This could channel vast sums of money, possibly amounting to trillions, into the cryptocurrency market.

Investors ‘Laddering Up’

In summary, it’s been observed by Bitwise that a common strategy among investors is referred to as “laddering up.” This approach typically starts with modest Bitcoin investments but gradually escalates into larger investments as time progresses.

In simple terms, the asset manager predicts that numerous investors who got into the Bitcoin ETF market in 2024 are likely to increase their investments in 2025.

As a researcher, I’m noticing an intriguing statement from the firm that “3% is the new 1%” in relation to Bitcoin. This suggests to me a growing acknowledgment of Bitcoin as a legitimate asset class. They seem to predict that this perception could lead investors to significantly boost the proportion of their investment portfolios allocated to cryptocurrencies, with some potentially dedicating as much as 3%.

Currently, Bitcoin (BTC) is holding steady above $100,900 after experiencing a 7% drop to $91,000 at the beginning of the month. In the last day, its market’s leading cryptocurrency has shown an almost 4% price increase.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-12-12 12:40