As a seasoned researcher with over two decades of market analysis under my belt, I find myself cautiously bearish on Dogecoin (DOGE) at this juncture. The recent price surge and subsequent correction have left me with a sense of déjà vu – it seems like we’ve been here before, only to see the memecoin plummet once again.

Over the last two days, Dogecoin (DOGE) has exhibited noticeable weakness following a significant price increase, resulting in a drop of more than 21% during Monday and Tuesday. After an impressive surge starting from October 10, where DOGE prices skyrocketed by over 360%, the coin peaked at $0.4834 on December 8, reaching its highest point since May 2021. However, a considerable bearish trend has taken hold since then.

How Low Can Dogecoin Price Go?

As a researcher delving into the dynamic world of cryptocurrencies, I find myself intrigued by the current position of Dogecoin (DOGE). According to crypto analyst Kevin (@Kev_Capital_TA), who recently provided his insights using a daily DOGE/USD chart, it appears that we are at a pivotal point for this digital asset.

Dogecoin is experiencing a significant downturn. Many people believed Doge would break through, but as a lead analyst for Doge, I identified it was instead reaching its highest levels of resistance – the macro golden pocket on a linear chart. I had warned that this wasn’t a time to get too excited, and a substantial correction was likely imminent. Thank you for heeding my advice.

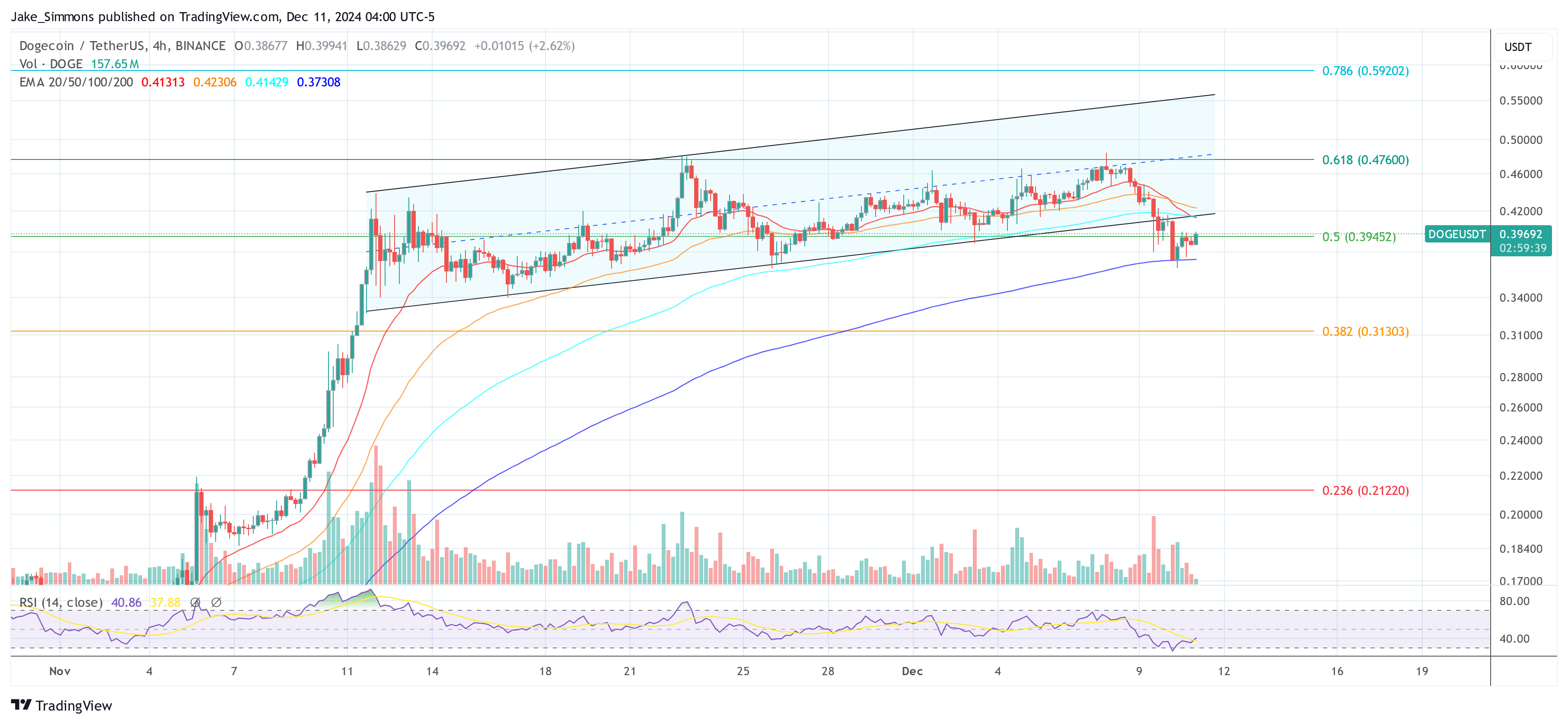

Previously, Kevin emphasized the “golden pocket” – an important area demarcated by significant Fibonacci retracement levels (specifically, the .703 and .786) within the $0.47 to $0.60 range – as a crucial barrier. For Dogecoin (DOGE) to potentially reach new record highs, this barrier needed to be broken convincingly. However, the recent price drop implies that this barrier has remained strong.

As the bearish view strengthens, Dogecoin’s price has dipped below a trend line that had been supporting its growth over the past month. This break in the trend line suggests a change in market conditions. When a chart breaks below such a line, it often signals that the momentum that was pushing the asset upwards is weakening. Traders might view this as a sign to cash out, sell long positions, or explore short position opportunities.

A technical marker suggesting a pessimistic perspective is the Relative Strength Index (RSI), observed on the daily graph. Lately, the RSI has been decreasing instead of rising, despite Dogecoin (DOGE) recording new peak values.

In simpler terms, when the price goes up while indicators suggesting momentum are going down (a situation called bearish divergence), it often signals a possible reversal in trend. The recent drop below the previous uptrend line in the price chart, along with the Relative Strength Index (RSI) line breaking its own upward trajectory, seems to indicate that the momentum has possibly changed direction and is moving downwards.

According to Kevin’s analysis, there’s a possibility that Dogecoin (DOGE) might decrease and reach between $0.29 and $0.26.

Glancing more closely at the Fibonacci retracement lines on the daily chart offers a guide to potential support points. Right now, the 0.5 Fib retracement point around $0.39 seems crucial. If this level is effectively defended, it could potentially halt the downward trend and even initiate a rebound that surpasses the breached trend line.

If the price line finishes daily below the 0.5 Fibonacci level, it might lead to more significant pullbacks. In this case, Dogecoin (DOGE) may aim for the 0.382 Fib at approximately $0.31 and potentially even the 0.236 Fib at $0.21 as potential future support points if the selling pressure increases. On the 4-hour charts, the 200 Exponential Moving Average (EMA) is currently crucial to maintain as a floor of support.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Who Is Stephen Miller’s Wife? Katie’s Job & Relationship History

- Green County secret bunker location – DayZ

- The Righteous Gemstones Season 4: What Happens Kelvin & Keefe in the Finale?

2024-12-11 13:34