As a seasoned crypto investor with a knack for spotting promising opportunities amidst market turmoil, I find myself intrigued by the resilience of Dogecoin (DOGE) in these challenging times. The chart analysis provided by CRG (@MacroCRG) has caught my attention, as it suggests that DOGE might be gearing up for a significant upward move.

Yesterday, December 9th, the cryptocurrency market experienced its biggest margin call (leverage flush out) since April 2021, as previously reported. Amidst this market correction, Dogecoin (DOGE) is exhibiting remarkable strength among the alternative coins. As per a recent post by crypto analyst CRG (@MacroCRG) on platform X, he suggests that the price of DOGE demonstrates “remarkable” resilience in comparison to the overall altcoin market.

Here’s Why Dogecoin Looks ‘Incredible’

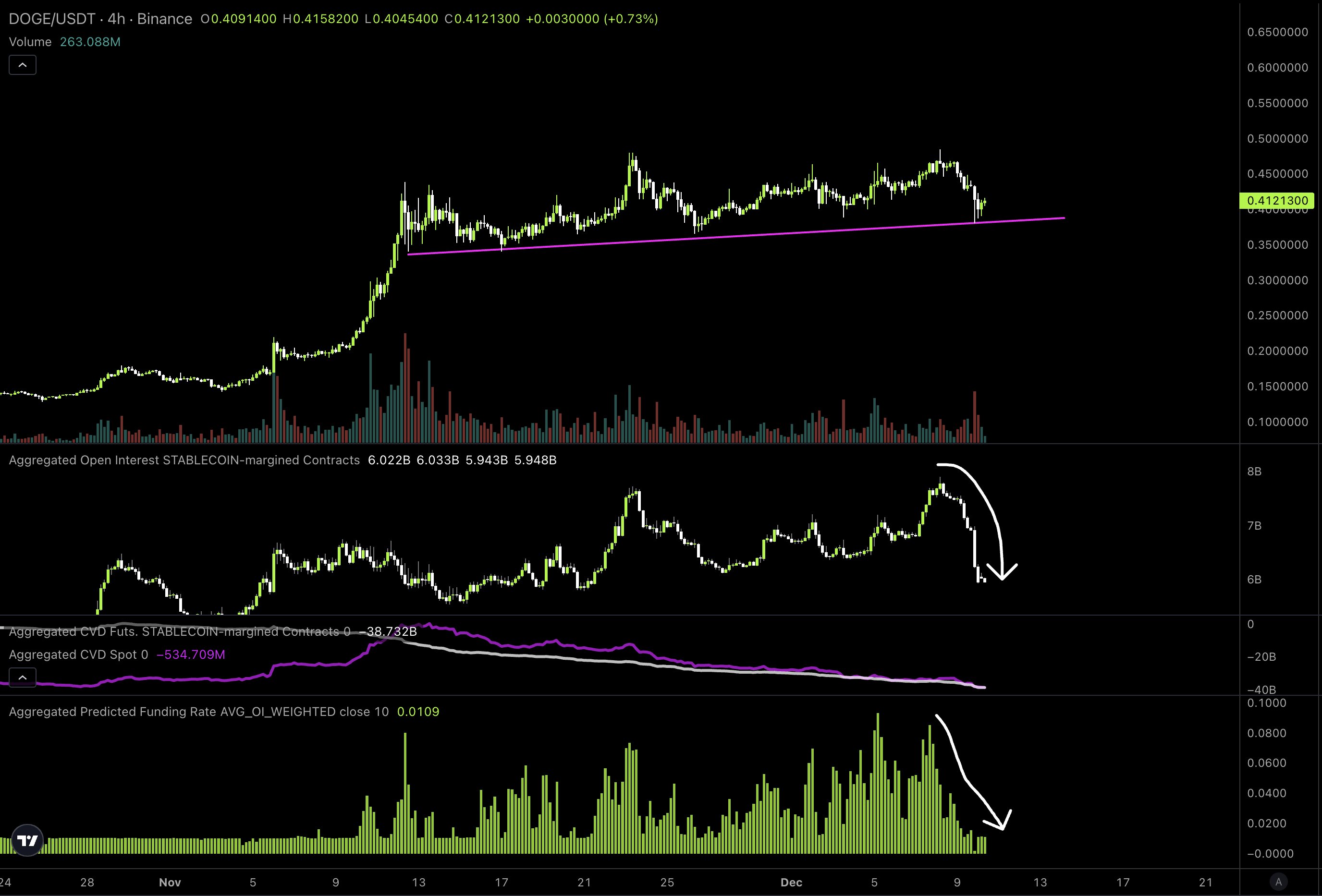

In the midst of the market’s decline, Dogecoin remarkably held onto its crucial support point. CRG posted this chart and remarked, “Dogecoin looks impressive indeed! The entire market panicked, but it barely reacted and didn’t disrupt its structure. Now all funding has been reset, and a significant amount of open interest has been eliminated. I believe it won’t be long before we see Dogecoin trending strongly again in my opinion.

The graph offers numerous key findings that bolster his positive perspective on DOGE. Initially, Dogecoin has consistently followed an essential upward trajectory in the 4-hour chart (DOGE/USDT). This trendline has functioned as a dynamic support level, with the Dogecoin price touching but not dropping below it on three different instances since mid-November.

Every time the Dogecoin price touched this upward trend line, it prompted a surge in value, implying substantial buyer enthusiasm at these points. The fact that the price aligns with this uptrend line is significant because it signifies not just support but also increasing investor confidence. Each time the price drops to this line and subsequently rebounds, it suggests a growing conviction among investors.

As a researcher, I’ve noticed an interesting pattern: The resistance appears around the $0.47 mark. This level has been challenged numerous times, and each attempt to surpass it has encountered resistance. The consistent failure to break through this resistance level might imply a consolidation period, which could potentially set the stage for a more powerful upward move if market sentiment improves.

To clarify, the graph indicates a significant decrease in the number of open stablecoin-backed contract positions. As reported by Coinglass, the maximum liquidation of $86.29 million in Dogecoin (DOGE) long contracts occurred on December 9, marking the highest since the 2021 bull run.

As a seasoned investor with over two decades of experience, I have witnessed countless market cycles and have learned to read between the lines when it comes to open interest and speculative positions. When I see a significant decrease in open interest, I can’t help but see it as a ‘washout’ of weaker hands exiting the market and reducing excess leverage. This cleansing process is often a sign that a more sustainable upward move may be on the horizon. It’s like pruning a tree – removing the dead branches allows for new growth to flourish. In my experience, this could be another hint that the market is preparing for a healthier and more resilient phase of growth.

One important detail depicted on the graph is the decrease in funding rates, a key factor because it lowers the expense for keeping long positions open. Reduced funding rates could stimulate additional purchasing, particularly among investors who had been hesitant due to high costs related to managing leveraged positions in the past.

CRG’s analysis additionally notes a trend regarding the Cumulative Volume Delta (CVD) in both future and current markets. The CVD for futures has dipped below that of the spot market, potentially suggesting that traders in futures are adopting more pessimistic stances or liquidating their existing positions at a faster pace than traders in the spot market. This disparity implies that the less speculative spot market remains optimistic, while acting as a shield against the bearish tendencies in the futures markets.

At press time, DOGE traded at $0.40.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best Heavy Tanks in World of Tanks Blitz (2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Gold Rate Forecast

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

2024-12-10 23:10