As a seasoned crypto investor with a few battle scars and some impressive wins under my belt, I always keep a keen eye on on-chain data, especially when it comes to Bitcoin long-term holders (LTHs). Their actions can often serve as a barometer for the market’s sentiment.

Recent on-chain activity indicates that long-term Bitcoin owners have been unloading some of their holdings, likely due to the substantial increase in profit they’ve earned following the price spike.

Bitcoin Long-Term Holders Have Been In Huge Profits Recently

In my recent analysis for CryptoQuant’s community platform X, I highlighted an interesting trend: Over the past month, long-term Bitcoin investors have been offloading a significant amount of their coins. These “long-term holders” (LTHs) are defined as individuals who have held onto their Bitcoins for over 155 days.

This group consists of the unyielding market participants who seldom cash out, irrespective if it’s a bull run or a bear market crash. Unlike the “momentum investors” (MI), who often adjust their strategies based on industry developments.

Therefore, it’s worth keeping an eye on when Large Time Holders (LTHs) choose to sell, as this could signal that the market has reached a point where even those known for holding onto their assets for extended periods are feeling the urge to let go of their previously accumulated cryptocurrency.

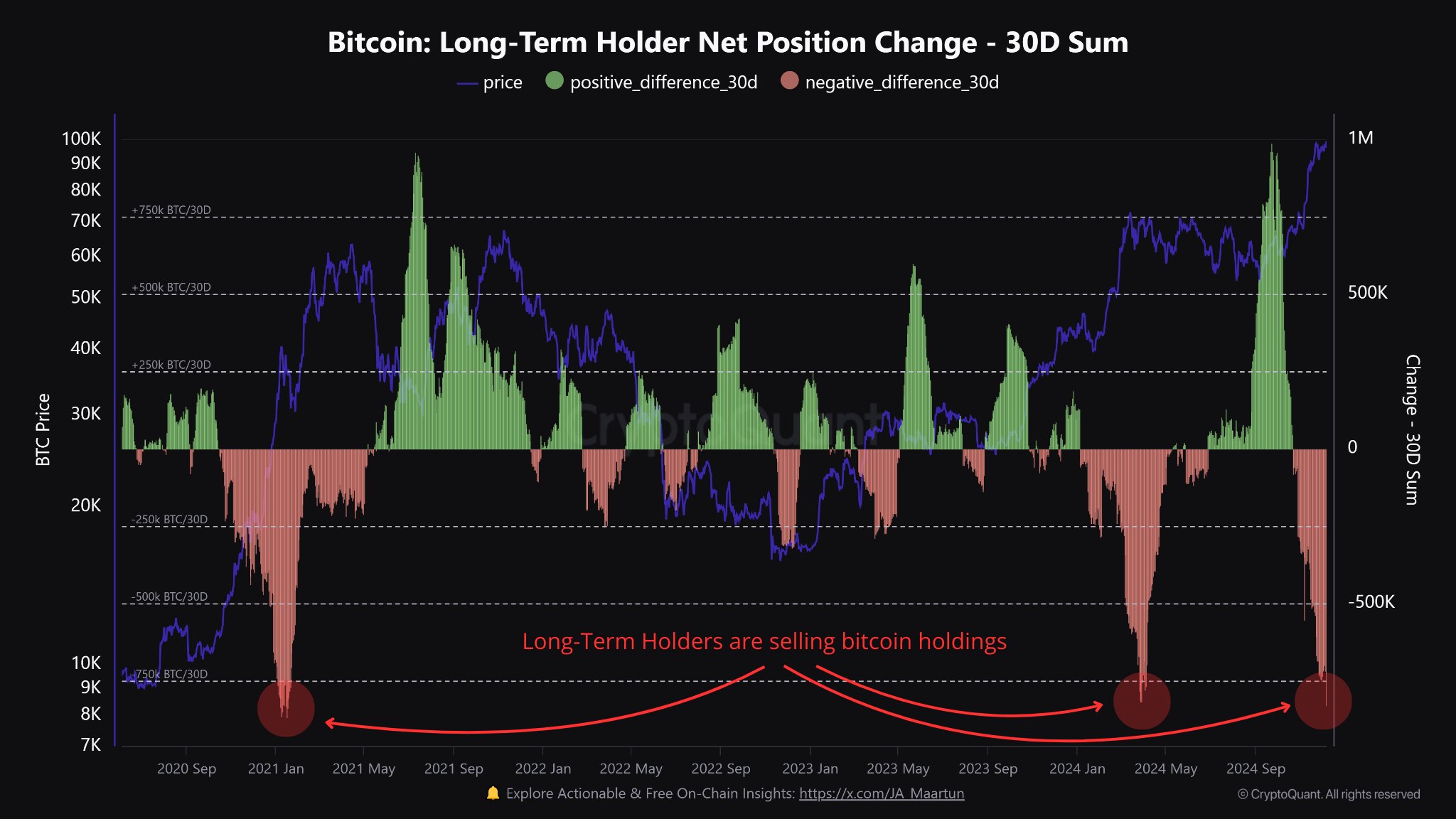

At present, Bitcoin is undergoing a similar situation, with its upward surge towards unprecedented peaks causing Long-Term Holders (LTHs) to cash out their accumulated gains. The graph below, provided by an analyst, illustrates the 30-day change in the LTH supply trend.

According to the graph, there’s been a significant decrease in long-term Bitcoin holdings over the last month, hinting that those who ‘HODL’ may be becoming more active.

Approximately 827,783 Bitcoin have been moved by the long-term holders within this timeframe. While not every transaction implies selling, it’s quite possible that they are looking to sell when large holders decide to transfer their coins.

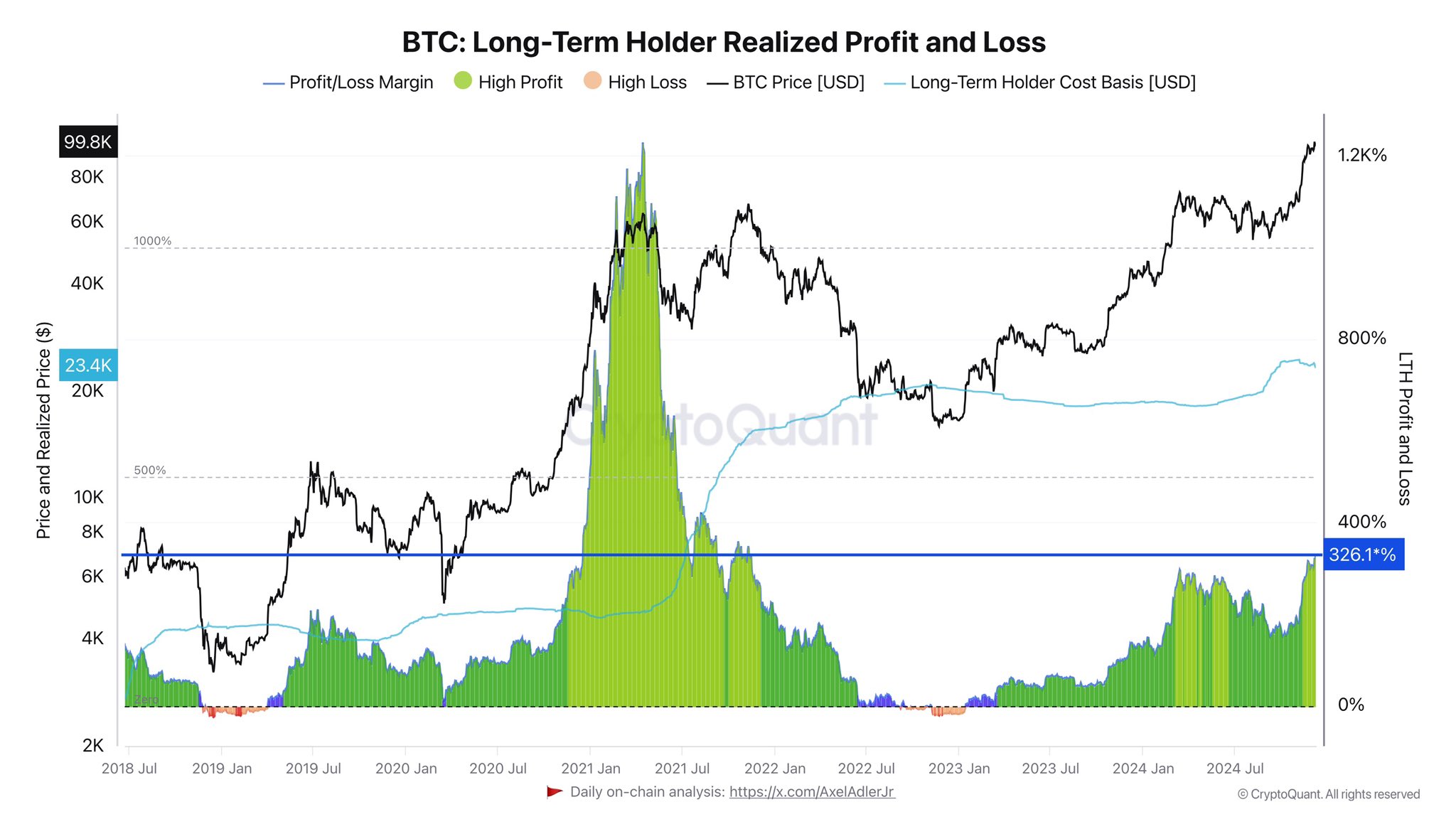

It’s clear why there was a selloff by the LTH group as their impressive average profits, amounting to 326%, come into view. This observation was made by CryptoQuant author Axel Adler Jr in a recent post.

According to the graph, although the earnings of Long-Term Bitcoin holders are substantial, they’re significantly lower compared to the profit margins experienced during the 2021 bull market surge.

This, of course, doesn’t mean that the current rally also has as much room left to go, as it’s very possible that this cycle would simply net these diamond hands fewer gains than last time.

Despite Large Token Holders (LTHs) investing substantial sums lately, Bitcoin’s price movement has been relatively minimal, suggesting a steady influx of new demand that is balancing out the selling pressure. But, it’s uncertain how long this equilibrium can persist.

BTC Price

Earlier this month, Bitcoin temporarily broke free from its period of steady price movement, but it seems the cryptocurrency has returned to this range and is currently being traded at approximately $98,200.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-12-10 08:46