As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous price movements and trends across various asset classes. Having closely followed Ethereum since its inception, I must say that the recent surge in active addresses is indeed a promising sign for the altcoin’s future.

Following its spike above $4,000 on December 6, Ethereum (ETH) has entered a period of stability without any substantial price changes over the last day. As discussions about Ethereum’s potential future price trend intensify, CryptoQuant analyst Burak Kesmeci has provided insights indicating a prolonged upward price trend for Ethereum.

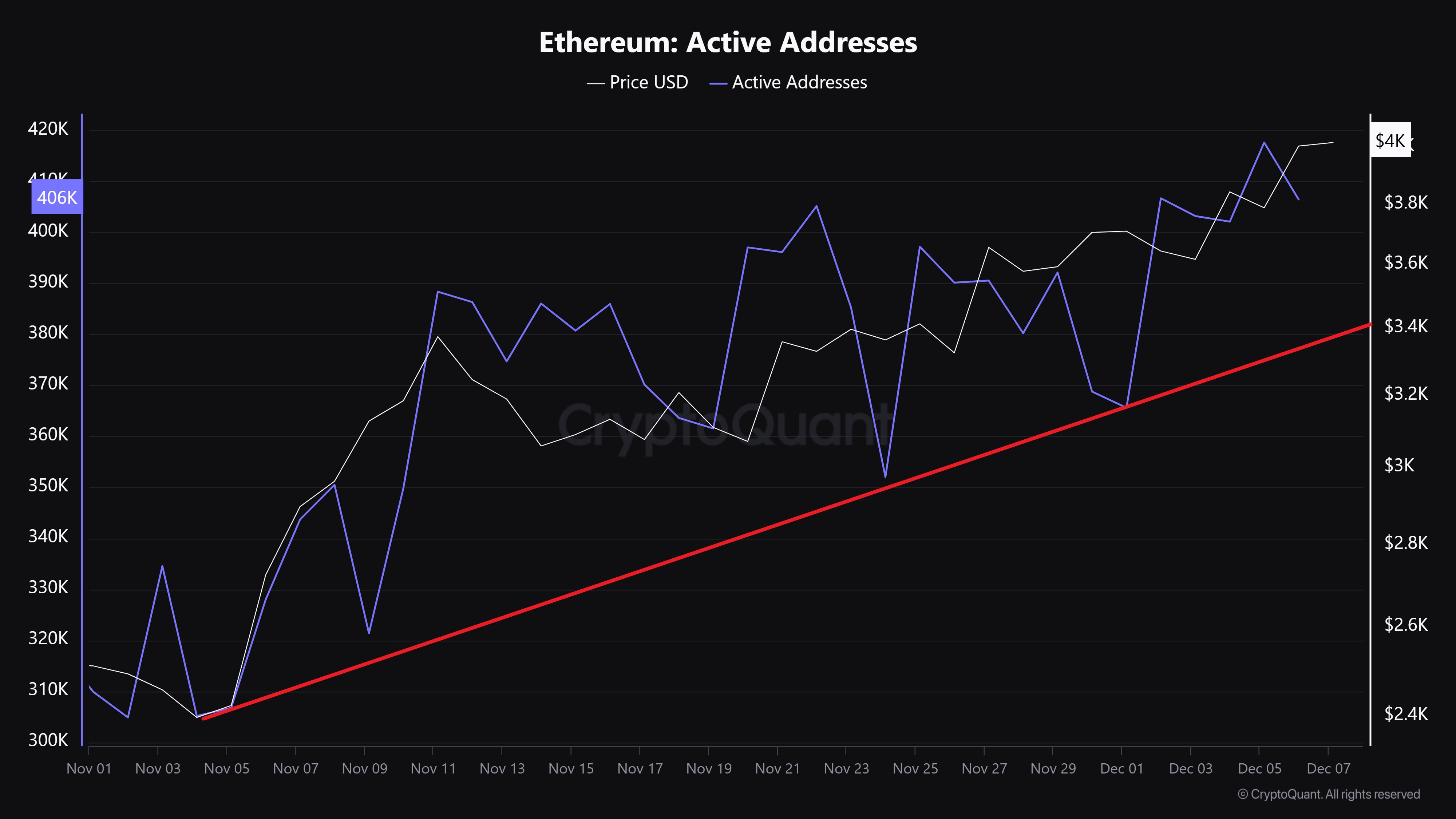

US Election Results Drive Ethereum Active Addresses To 417,000

After the U.S. elections held on November 3rd, Ethereum, along with several other digital currencies, has seen substantial price surges predominantly due to the election of Donald Trump, a candidate supportive of cryptocurrencies, as the U.S. President-elect.

Burak Kesmeci claims that the outcomes of the U.S. elections have significantly decreased uncertainty in the crypto market and stimulated investment, as demonstrated by the increase in value for numerous tokens. Notably, Ethereum, often referred to as the “Pioneer of altcoins”, has experienced a 70% price surge since November 5, peaking at $4,077 locally.

In line with any market surge, there’s ongoing debate about whether Ethereum can sustain its present rising price trend. Contributing to this discussion, Kesmeci interprets a shift in the number of active addresses as a positive sign, suggesting an optimistic outlook for the asset.

According to a CryptoQuant analyst’s analysis, there was a notable surge in active addresses on Ethereum’s network during its recent price rise. These active addresses jumped by approximately 36.26% from around 306,000 on November 5th, up to the current figure of 417,000. This growth suggests that Ethereum’s price increase was fueled not just by market speculation but also a significant increase in organic demand and investor/user interest in the blockchain.

To summarize, Burak Kesmeci asserts that the increase in active Ethereum addresses supports the current price spike, describing it as both “healthy” and “sustainable.” Furthermore, this trend is considered a positive sign suggesting that ETH may be poised for a prolonged period of price escalation.

ETH Price Overview

Based on information from CoinMarketCap, Ethereum is currently trading at $4,006. This represents a minor decrease of 0.54% over the past 24 hours. However, for long-term investors, Ethereum continues to yield a profit, with increases of 7.36% and 39.31% in the last seven and 30 days respectively.

If Ethereum continues its upward trend after consolidation, it may encounter a substantial barrier near $4,100. Overcoming this level could pave the way for potential progress towards $4,900, which is close to its all-time high of $4,891.

Beyond the surge in daily transactions on the Ethereum network, other factors are fueling optimism for the second-largest cryptocurrency. These factors include substantial investments into Ethereum spot exchange-traded funds (ETFs), totaling $1.41 billion in net inflows. Furthermore, some experts predict that the altcoin season may be beginning, with potential widespread gains expected around early 2025.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-12-09 00:04