As a seasoned analyst with over two decades of experience in traditional finance and more than five years immersed in the cryptosphere, I’ve witnessed countless market cycles, bull runs, and bear markets. However, the current surge of Ethereum (ETH) has piqued my interest like never before.

Ethereum (ETH) is drawing attention as it inches closer to $4,100, hitting a fresh annual peak at $4,096. This latest milestone, only $3 shy of its previous high from March, suggests a possible comeback for the second-largest cryptocurrency by market value. The price fluctuations have piqued the interest of analysts and investors, especially given Ethereum’s strong performance relative to predictions in a market characterized by volatility and unpredictability.

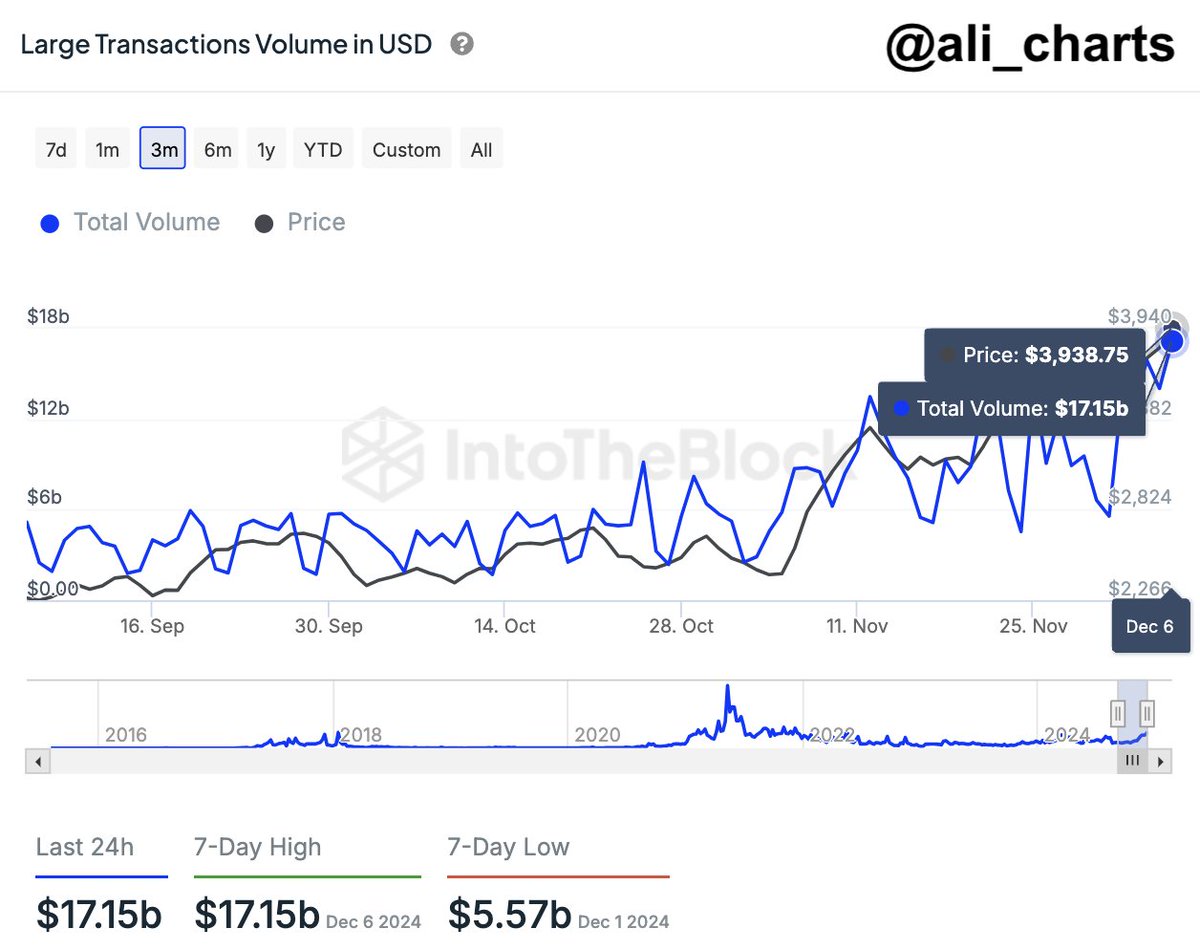

Data provided by analyst Ali Martinez from IntoTheBlock indicates an increase in large Ethereum transactions, suggesting a surge in network activity. Precedents show that such spikes in transaction volume often correspond to major price changes, implying that Ethereum’s current upward trend might still have further growth potential. This trend seems to indicate growing investment from institutional and high-net-worth investors, reinforcing Ethereum’s status as a market frontrunner.

Over the coming weeks, I find myself poised at a critical juncture as Ethereum nears the end of this year. Will it maintain its current momentum and surge past $4,100 before year-end, or will it encounter resistance and potentially retreat? Given the increasing on-chain activity and positive market sentiment surrounding Ethereum, the anticipation is palpable among traders and investors as we all eagerly await its next move. The final act of 2024 could prove to be quite thrilling in the world of Ethereum.

Ethereum Transactions Surge With Price

Discussions about Ethereum remain prevalent in the market following its climb to fresh yearly highs on Friday. The cryptocurrency broke through $4,096, surpassing its earlier peak from March. This bullish trend has sparked renewed curiosity among investors, yet it’s not just Ethereum’s price that is rising – the activity on its network is also experiencing a significant increase.

As a researcher, I’ve been closely monitoring the Ethereum network, and based on data from analyst Ali Martinez at IntoTheBlock, there’s been a substantial increase in large transactions. This week alone, we’ve seen a staggering 300% jump in weekly transaction volume, peaking at an impressive $17.15 billion yesterday. This surge in activity suggests growing confidence among institutional investors and high-net-worth individuals. Historically, such a rise in network activity has often preceded retail adoption during significant bull markets.

The consistent increase in transaction activity tends to align with prolonged price increases for Ethereum, implying its surge might still continue. Given its position as the world’s second-largest cryptocurrency by market capitalization, Ethereum seems poised to achieve new record highs if these trends remain steady.

Even with the positive outlook, Ethereum has a significant hurdle to overcome – its previous all-time high of $4,878, reached in November 2021, is still 20% higher. The recent surge in Ethereum has energized optimistic investors (bulls), but analysts warn that achieving and maintaining prices close to the ATH will necessitate substantial buying activity and a robust broader market condition.

If the present trend continues, Ethereum might reach its all-time high (ATH) sooner than predicted, thereby reinforcing its position as the preferred blockchain for decentralized apps and financial advancements. Currently, investors are keeping a close eye on Ethereum’s price fluctuations and network statistics to determine whether this surge has the power to set new records or if a downturn is imminent.

ETH Pushing Above $4k

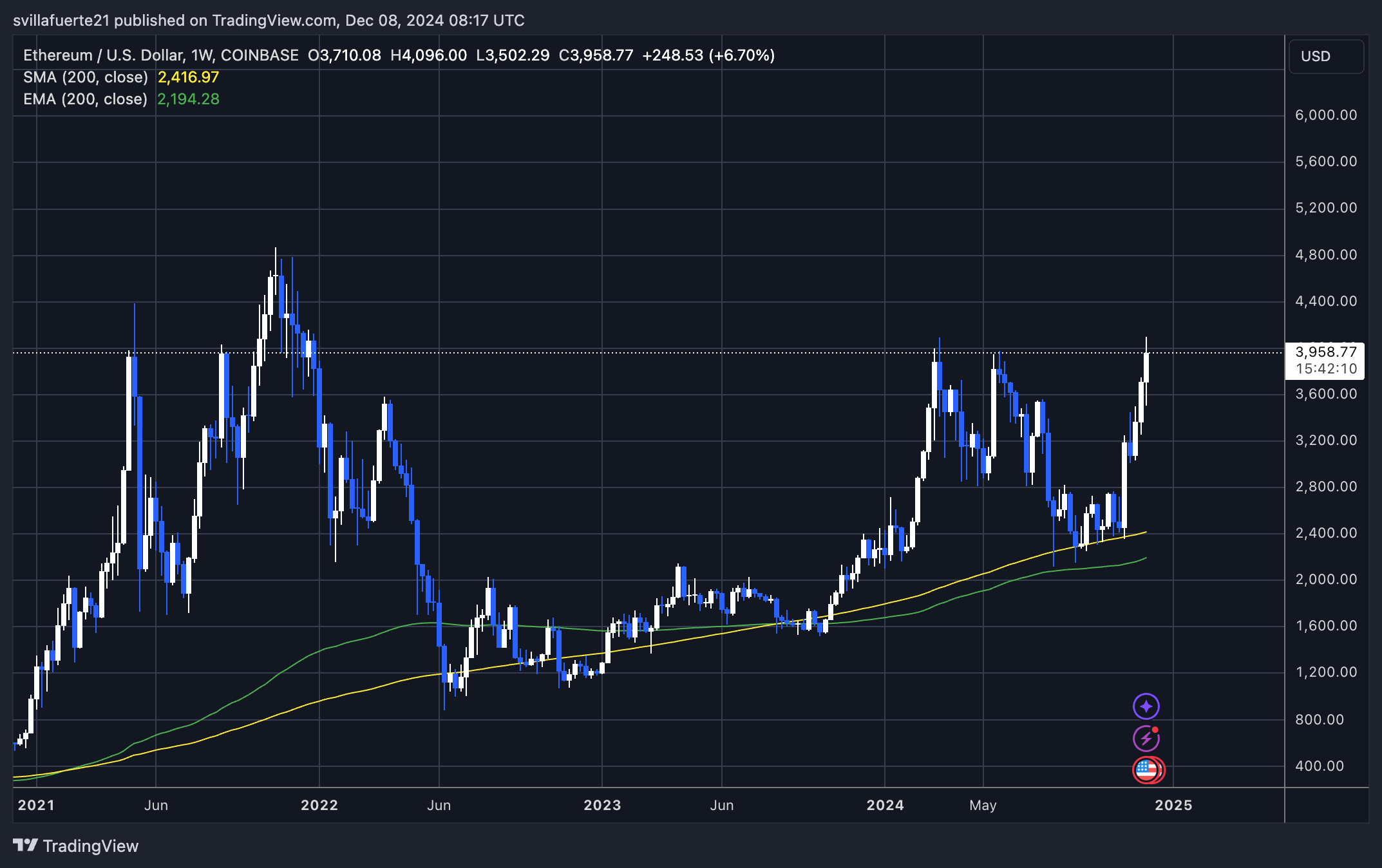

Right now, Ethereum is being traded at approximately $3,960. It’s demonstrating strength after touching a recent peak of $4,096 merely two days prior. This surge has once again put Ethereum in the limelight, as investors closely watch significant points that could influence its future direction.

If ETH manages to end the week above $4,000, it will mark its highest weekly close since December 2021, a significant achievement for the second-largest cryptocurrency. This move would strengthen the positive outlook for Ethereum, possibly encouraging more buying activity and paving the way for further growth towards its previous all-time high of $4,878.

If Ethereum doesn’t manage to finish the week above its previous highest weekly close ($3,880), it might suggest a decrease in momentum. In such a case, Ethereum could move into a period of consolidation. This would occur as traders cash out and the market processes recent increases. A consolidation below this level would probably keep Ethereum’s price within a range for a while, with $3,880 and $4,000 serving as significant resistance points during that time.

Over the coming days, Ethereum’s course will be significant, as it faces a pivotal moment. A conclusive end-of-week price point could either propel Ethereum further in its current upward trend or prompt a pause for consolidation, presenting both opportunities and challenges for traders within this ever-changing market.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-12-08 18:05