As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market fluctuations and trends. However, the recent surge in Bitcoin, breaking past the $100,000 mark for the first time, is nothing short of extraordinary.

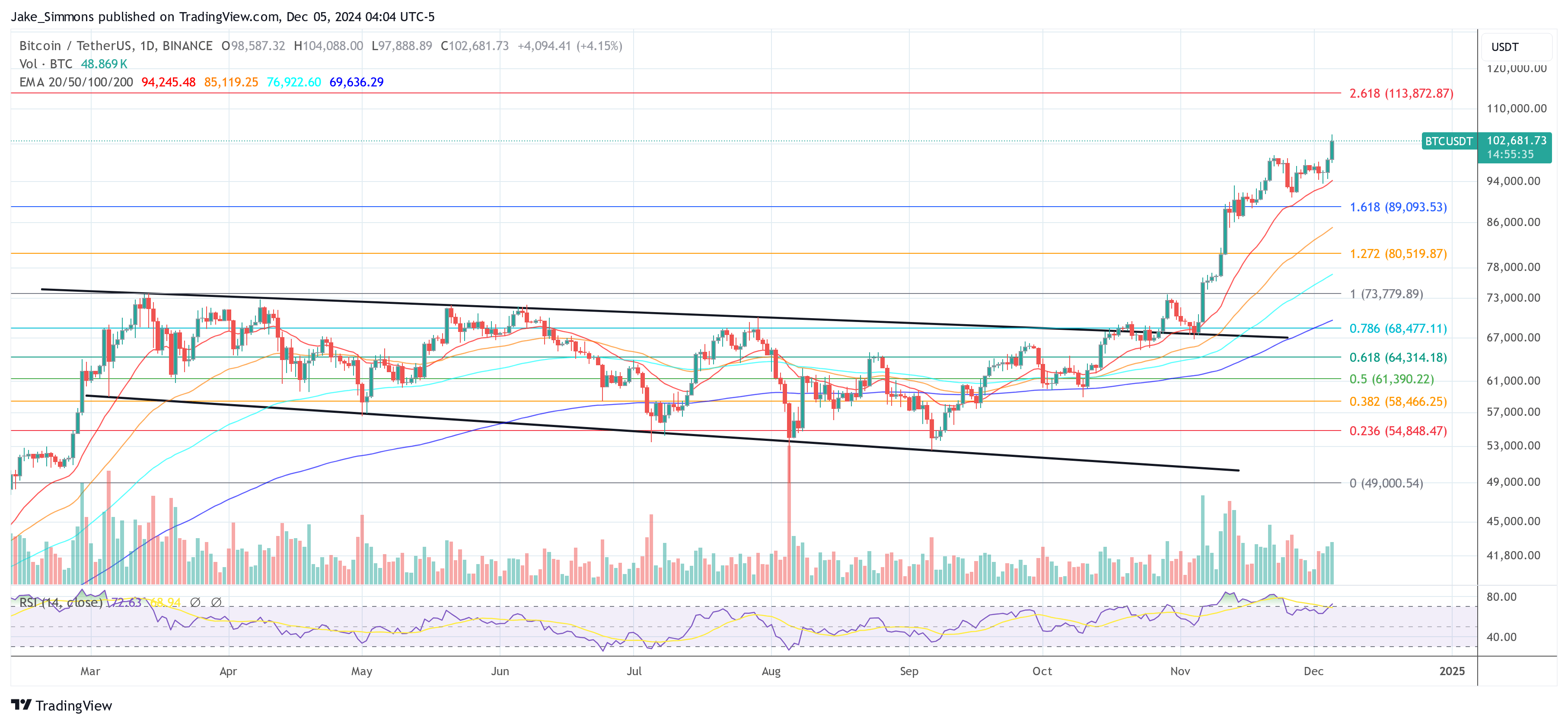

On Wednesday in New York, Bitcoin surpassed its previous highs and hit an all-time record of $104,088 for the first time. Earlier in the day, it had dropped to $94,587 but then experienced a remarkable rebound. Several significant factors likely played a role in this unparalleled increase.

#1 Fed Chair Powell Compares Bitcoin To Gold

At the New York Times DealBook Summit, Federal Reserve Chairman Jerome Powell addressed Bitcoin for the first time from the traditional financial sector’s standpoint. When asked about Bitcoin being viewed as a symbol of distrust towards the U.S. dollar and the Federal Reserve, Powell presented a thoughtful opinion on the matter.

Powell expressed that people tend to view Bitcoin differently. In essence, they see it as more of an investment opportunity rather than a means of exchange or a store of value. Similar to gold, Bitcoin is speculative and volatile, not typically used for transactions. Instead, it’s often compared to digital gold. It’s not challenging the US dollar but competing with the yellow metal in the marketplace.

In simpler terms, comparing Bitcoin to gold, a long-standing symbol of value storage, likely bolstered its credibility within the financial network for many people.

If a central bank holds gold but refuses to embrace digital gold, it may find itself obsolete. History has shown that businesses like Kodak, Blockbuster, Sears, Yellow Pages, Newspapers, Taxis (pre-Uber), Postal Service, Libraries (in the era of online resources), Travel Agents, etc., which resisted digitalization, ultimately faced decline or extinction.

It’s the most obvious trade in history

— David Bailey $0.85mm/btc is the floor (@DavidFBailey) December 4, 2024

#2 Russia’s Putin Signals Openness To Bitcoin

As a crypto investor, I’m thrilled by the recent developments, as Russian President Vladimir Putin’s remarks at the Russia Calling forum seem to suggest a positive stance towards Bitcoin. Many in the community are interpreting these comments as an endorsement, which could potentially boost Bitcoin’s momentum further.

According to Putin, neither Bitcoin nor other digital payment methods can be banned by anyone since they represent new technology. Even if the value of the dollar changes, these tools will continue to advance due to people’s desire to minimize expenses and improve dependability.

The setting for Putin’s remarks involves talk about an upcoming “Bitcoin Space Race” among world powers. During his campaign and at the Bitcoin 2024 conference in Nashville, President-elect Donald Trump promised to establish a Strategic Bitcoin Reserve within the U.S. He also hinted that some of the U.S.’s debt could potentially be repaid using Bitcoin.

David Bailey, CEO of BTC Inc and advisor to Trump’s team, underscored the immediacy of this endeavor on X: “The Bitcoin competition has begun. […] The significance is undeniable. It’s crucial for our nation to establish a Strategic Bitcoin Reserve within the first 100 days of the Trump administration. We should pursue an ambitious strategy to increase America’s share of the Bitcoin supply.

It couldn’t be more clear what’s happening.

It must be a national priority to stand up the Strategic Bitcoin Reserve in the first 100 days of the Trump admin. We need an aggressive plan to grow USA’s proportional ownership of the Bitcoin supply.

— David Bailey $0.85mm/btc is the floor (@DavidFBailey) December 4, 2024

#3 Strong Spot Demand And Institutional Interest

The rise was supported by high trading activity on the spot market and substantial involvement from institutions. As it climbed, the number of open Bitcoin futures contracts grew dramatically by over $4 billion, as indicated by Coinalyze’s data. Additionally, funding rates reached extraordinary heights, surpassing the peaks seen two weeks prior when Bitcoin reached $99,500 for the first time.

As a crypto investor, I’m excited to share that the recent rally wasn’t just fueled by derivative speculation; it was primarily driven by the spot markets. This suggests a robust and enduring demand for cryptocurrencies, which is a positive sign. Moreover, the notorious “Great Sell Wall” at $100,000, a barrier that had previously held back price increases, was successfully surpassed on the second attempt, marking a significant milestone in our journey.

Market analysts suspect that influential figures such as Michael Saylor might have driven the significant demand for purchasing. Interestingly, MARA Holdings, Inc., the leading Bitcoin mining company by market value, managed to secure $850 million through the sale of zero-coupon convertible senior notes maturing in 2031. Although unverified, it’s plausible that MARA used these funds to buy Bitcoins during the price surge.

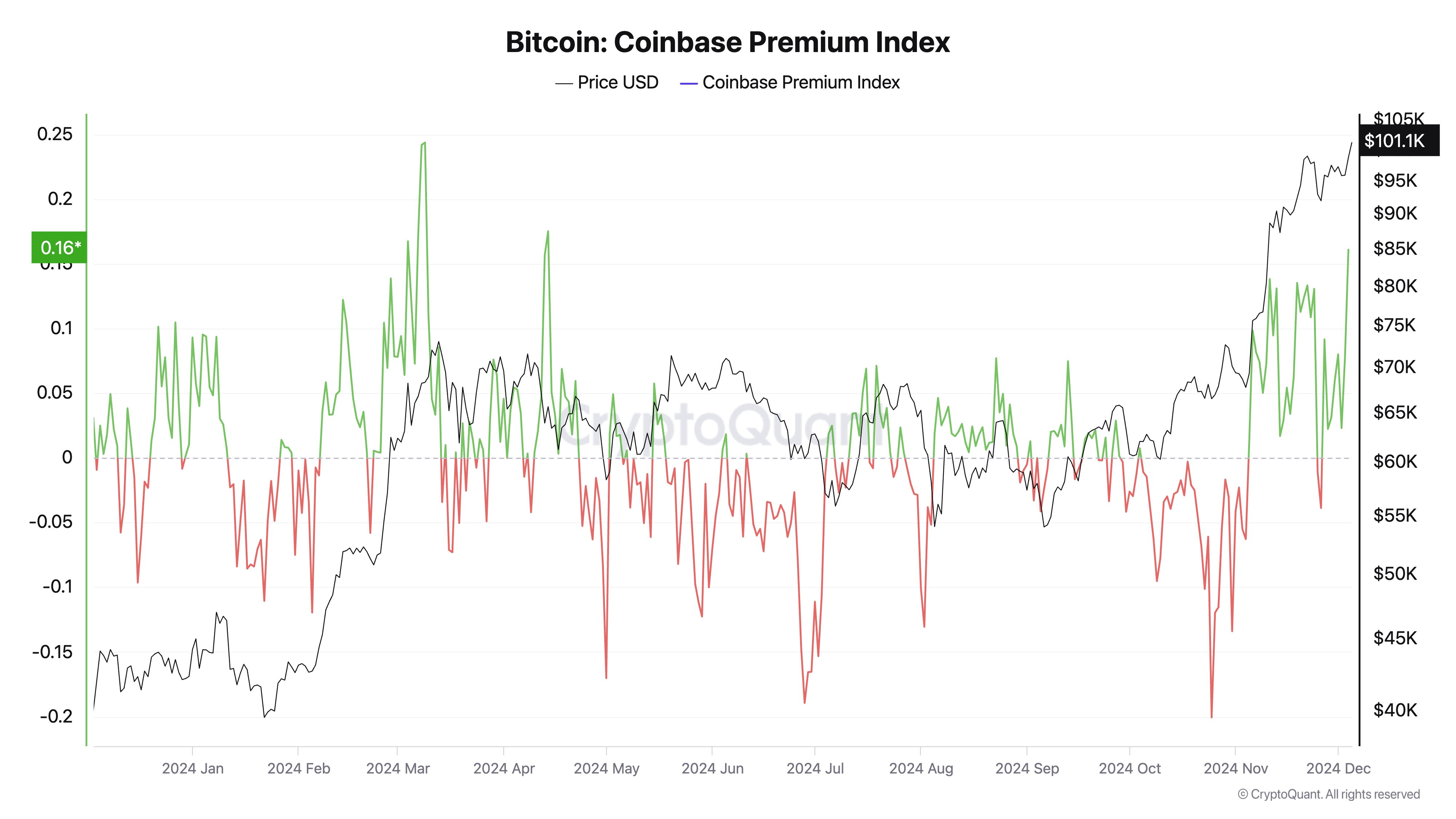

In line with this idea, CryptoQuant states: “The price of Bitcoin surpasses $100k due to increasing institutional interest and a strong demand from American investors, as indicated by the Coinbase Premium Index.

Although there’s a lot of optimism in the market, it seems retail investors are expressing skepticism. According to data from on-chain analysis firm Santiment, even though whales are increasing their holdings, retail traders are showing caution in their investment decisions.

Santiment observed: “Whale accumulation remains robust, but retail traders’ enthusiasm is the sole factor preventing a new BTC record at $100K. The firm pointed out that December began with growing doubts and predictions of a substantial price dip after November’s unprecedented increases. However, the current social media sentiment indicates ‘caution and doubt among traders,’ as there are more negative comments than positive ones.

For years, it has been shown that crypto markets often move in ways that go against what most traders expect. This means we might find optimism in others’ fear, uncertainty, and doubt (FUD), and high profit-taking. The struggle between bulls (optimists) and bears (pessimists) may be more intense now, but a significant milestone could soon be reached if key players continue to accumulate more Bitcoin.

At press time, BTC traded at $102,681.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Green County map – DayZ

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-12-05 12:23