As a seasoned researcher with a decade-long immersion in the dynamic world of cryptocurrencies, I find myself intrigued by Bitcoin’s current consolidation phase below the $100,000 mark. Having witnessed numerous market cycles and navigated through the crypto winter, I can attest that this isn’t my first rodeo with BTC.

For the past twelve days, Bitcoin has been gathering strength below the $100,000 threshold, suggesting a brief respite in its recent remarkable surge. The intense upward momentum seen since November 5 seems to be moderating, as traders’ focus begins to move towards alternative cryptocurrencies. Even with this temporary slowdown, Bitcoin continues to serve as a pillar of market robustness, maintaining its position steadily above the crucial $90,000 support line.

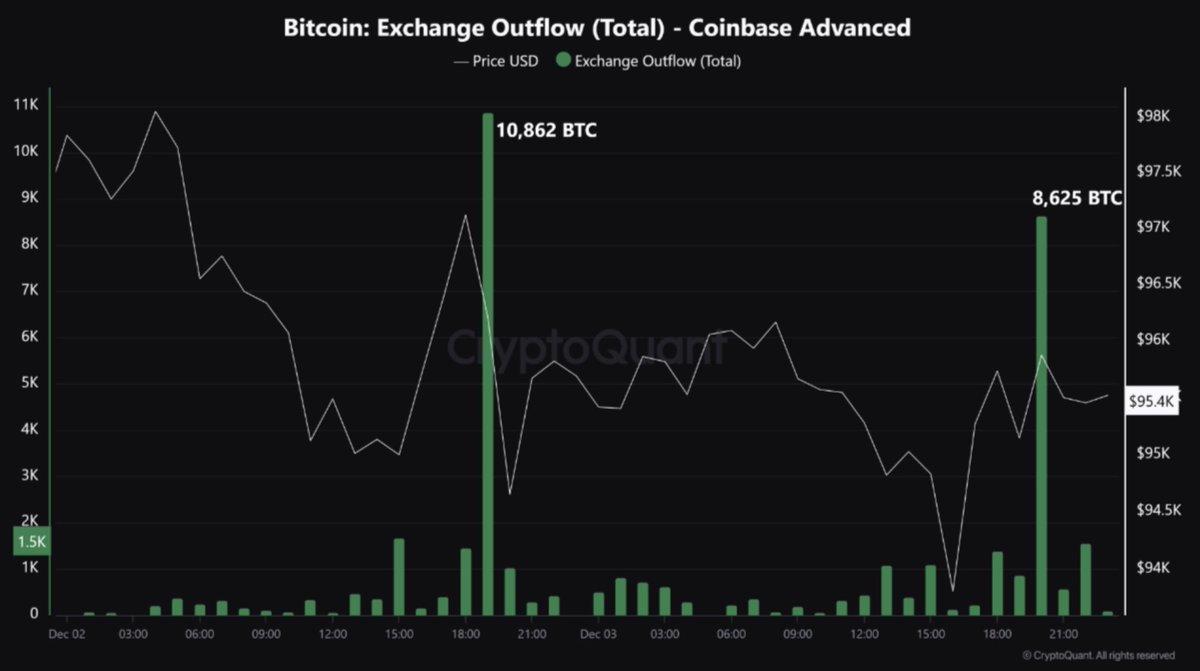

Information from CryptoQuant indicates that over the last 24 hours, two large transfers of more than 8,000 Bitcoins each have been made from Coinbase. This points to continuous institutional investment and potential stockpiling. These outflows imply that prominent investors continue to be bullish about Bitcoin’s future direction, despite short-term price fluctuations stabilizing.

In its current period of stability, Bitcoin is setting the stage for significant shifts within the cryptocurrency market. Experts are keeping a close eye to see if this phase of equilibrium will lead to another surge for Bitcoin or create an opening for lesser-known altcoins to gain prominence. The coming days will be critical in deciding whether Bitcoin regains its momentum or continues moving within its existing range.

Bitcoin Leading A Heated Market

Bitcoin remains at the forefront of the cryptocurrency sector, experiencing significant advancements, though it’s currently holding steady just shy of the anticipated $100,000 mark. This temporary halt in Bitcoin’s upward trend has caused a shift in liquidity, funneling resources into the alternative coin market. Analysts and investors predict that Bitcoin might take a brief breather following its recent aggressive rise, creating a potential opening for other digital currencies to make their move.

According to data from CryptoQuant, there’s been substantial activity on Coinbase over the past day, with two large withdrawals, totaling more than 8,000 BTC each, being made. These transactions amounted to a collective 19,487 BTC, worth about $1.87 billion at an average price of $96,043. Such sizeable transfers suggest the possible participation of institutional investors or high-value individuals who might be preparing for Bitcoin’s next significant market shift.

Historically, significant withdrawals from the market tend to be followed by price drops, as big transactions can indicate either selling for profits or reallocation of assets. Yet, these large movements might also signify increasing trust among prominent investors regarding Bitcoin’s future value.

Should Bitcoin (BTC) sustain its current value over $90,000 and the demand keeps growing, there might be another surge towards seven-digit figures in the coming weeks.

Price Levels To Watch

As a crypto investor, I’m observing that Bitcoin is currently trading at around $96,700, bouncing within a narrow range between $93,500 and $98,700. So far, it seems we’re in a consolidation phase, as the market isn’t showing a clear preference for either upward or downward movement. This pause follows a series of powerful surges, where Bitcoin nearly reached but didn’t quite break its all-time high yet.

Investors are keeping a close eye on the $90,000 threshold, as it’s shown significant importance as a level of support. Maintaining a position above this point is vital in demonstrating market resilience and fostering continued optimism among buyers.

If Bitcoin stays above $95,000 for the coming days, it increases the chances of hitting fresh record highs substantially. Sustained stability at this point could motivate investors to drive Bitcoin beyond the psychologically significant $100,000 threshold.

Instead, if the $95,000 level is lost, it may raise worries and possibly lead us to revisit the $90,000 mark once more. If this crucial point is breached as well, Bitcoin might undergo a more significant correction, seeking lower levels for potential support.

The continued stay of Bitcoin above the $95,000 mark will play a significant role in predicting its future direction. Optimists (bulls) anticipate further price surges, while pessimists (bears) seek indications of fatigue to take advantage.

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- How to get all Archon Shards – Warframe

- Fear of God Releases ESSENTIALS Summer 2025 Collection

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- Gold Rate Forecast

- What’s the Latest on Drew Leaving General Hospital? Exit Rumors Explained

2024-12-04 18:40