As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed many bullish and bearish trends throughout my career. The current trajectory of Bitcoin price, however, has piqued my interest more than ever before.

After hovering near the $96,000 mark for some time, Bitcoin‘s price is currently trending upwards by approximately 1.5%, indicating a potential push towards $100,000 and beyond. Over the last seven days, the Bitcoin price has exhibited minimal fluctuations, staying within the range of around $92,000 to $98,000.

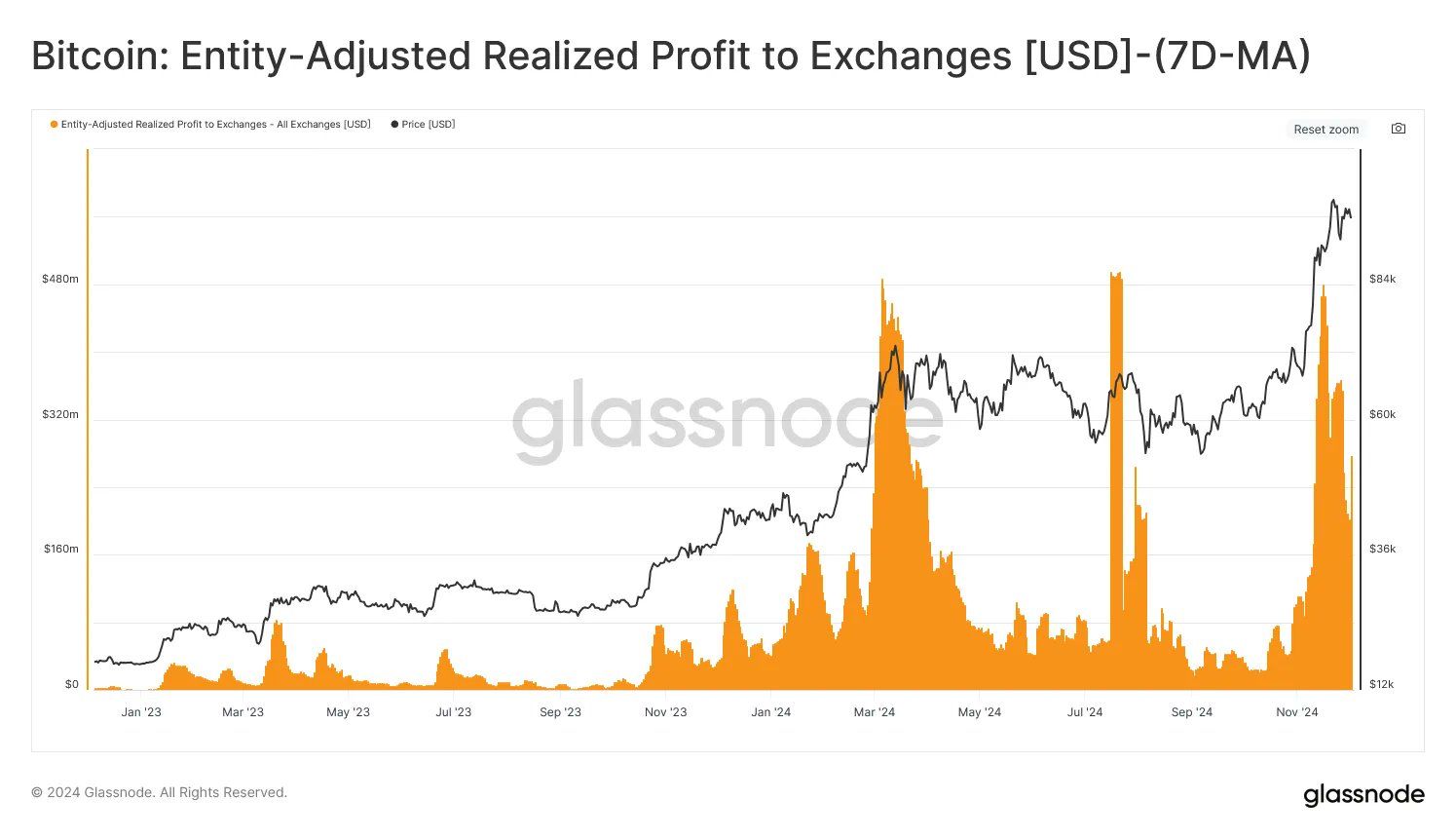

Approaching the $100,000 mark, Bitcoin encountered significant resistance due to intense selling from long-term investors. Interestingly, Glassnode data reveals a decrease in profit-taking activities, as the amount of daily profits being transferred to exchanges fell to approximately $277 million.

This graph indicates a significant drop of 42% from the high of $481 million reached on November 16, suggesting that traders are choosing to maintain their positions instead of withdrawing profits. Experts view this as a favorable sign, implying that Bitcoin is moving into a period of consolidation before a powerful surge in value.

Investors seem to be quietly accumulating positions and limiting their trades within a small span, indicating they’re anticipating a major price shift ahead. Many of them have their sights set on reaching the $100,000 mark.

Courtesy: Glassnode

On Tuesday, Bitcoin saw fluctuations due to political unrest in South Korea when President Yoon Suk Yeol temporarily imposed martial law, only to later rescind the decision. The cryptocurrency’s value exhibited significant variations across exchanges, with it dipping below $65,000 on Upbit due to liquidity issues, while remaining stable around $95,000 on Binance.

Bitcoin Price Rally to Continue as Big Players Buy

Despite Bitcoin’s price fluctuations showing significant volatility, large-scale investors have persisted in their buying spree. Notably, on December 2nd, MicroStrategy declared the acquisition of an additional 15,400 Bitcoins for $1.5 billion, which translates to a purchase price of approximately $95,976 per Bitcoin.

As a crypto investor, I learned that on a particular day, MARA Holdings – a publicly traded Bitcoin miner – declared an intent to offer $850 million in private placement of convertible notes. This move is aimed at acquiring more Bitcoins with the funds raised from this offering.

Apart from that, there’s a lot of anticipation within the Bitcoin community about the upcoming vote among Microsoft shareholders regarding whether or not to include Bitcoin in their company’s financial records. Recently, Michael Saylor revealed a plan suggesting that Microsoft could potentially increase their shareholders’ wealth by approximately $5 trillion if they were to invest all their treasury funds into Bitcoin and take on additional debt to purchase more Bitcoin.

Furthermore, it’s being talked about that the U.S might create a strategic bitcoin stockpile. If this happens, it would mark a significant shift from President Trump’s previous stance emphasizing the US dollar as the leading global currency, as pointed out by TD Cowen analyst Jaret Seiberg.

The analyst stated, “Trump might continue promoting the idea of a Bitcoin reserve through his social media platforms or during speeches. However, it’s important to note that using the substantial political influence needed to actually implement this is a whole different matter.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-12-04 13:00