As a researcher with over a decade of experience in the financial markets, I’ve witnessed many bull and bear cycles, but none quite as captivating as the Bitcoin phenomenon. The recent turbulence in the cryptocurrency market has been particularly intriguing, given its rapid rise from $99,000 to $90,000 and subsequent consolidation above $95,000.

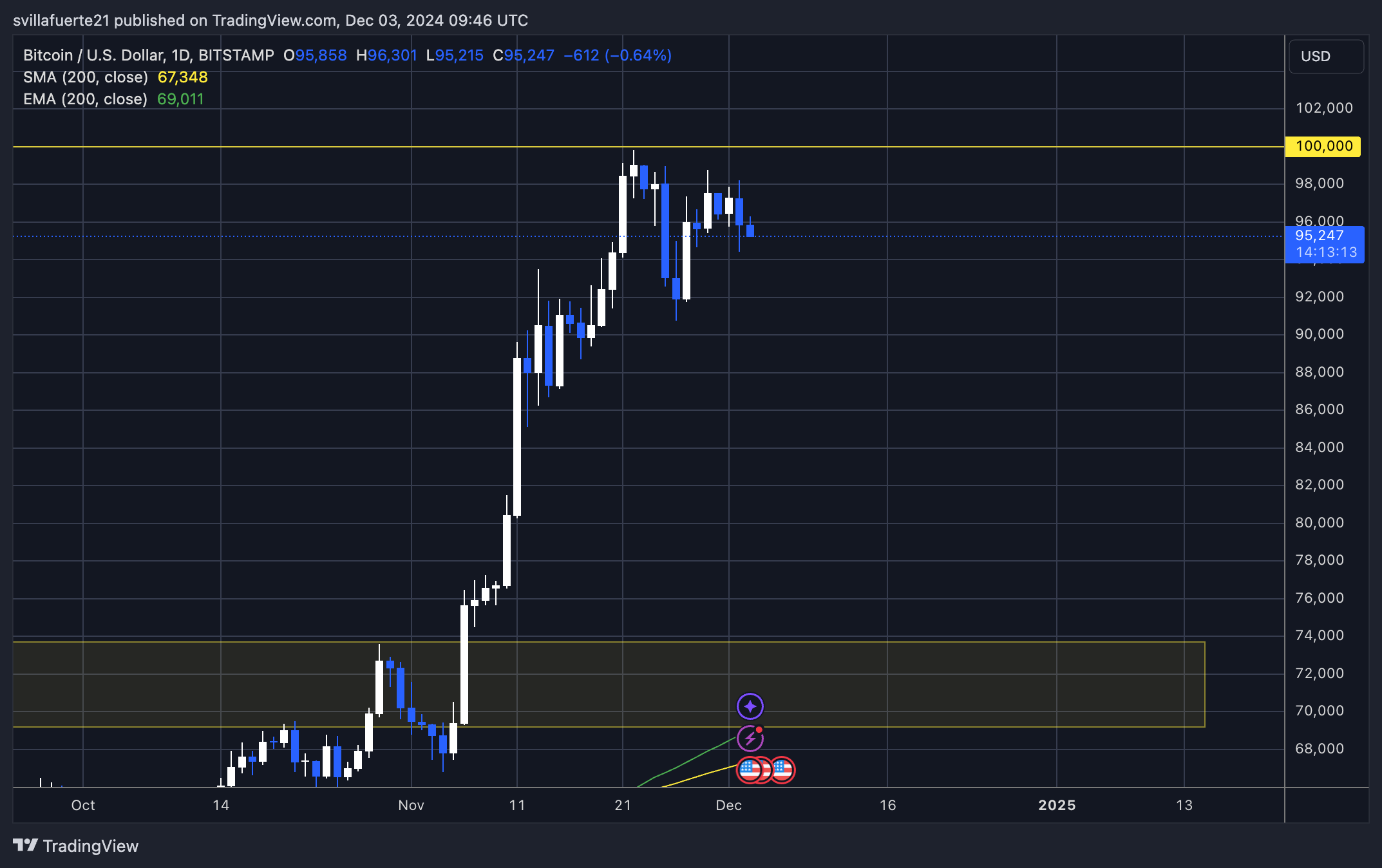

After experiencing a tumultuous drop from approximately $99,000 to around $90,000 within a span of three days, Bitcoin has found relative tranquility and is currently trading above $95,000. This crucial level that Bitcoin now occupies will play a significant role in shaping its next action. Whether it rebuilds upward momentum or looks for lower-level stability to establish more robust support hinges on this important zone.

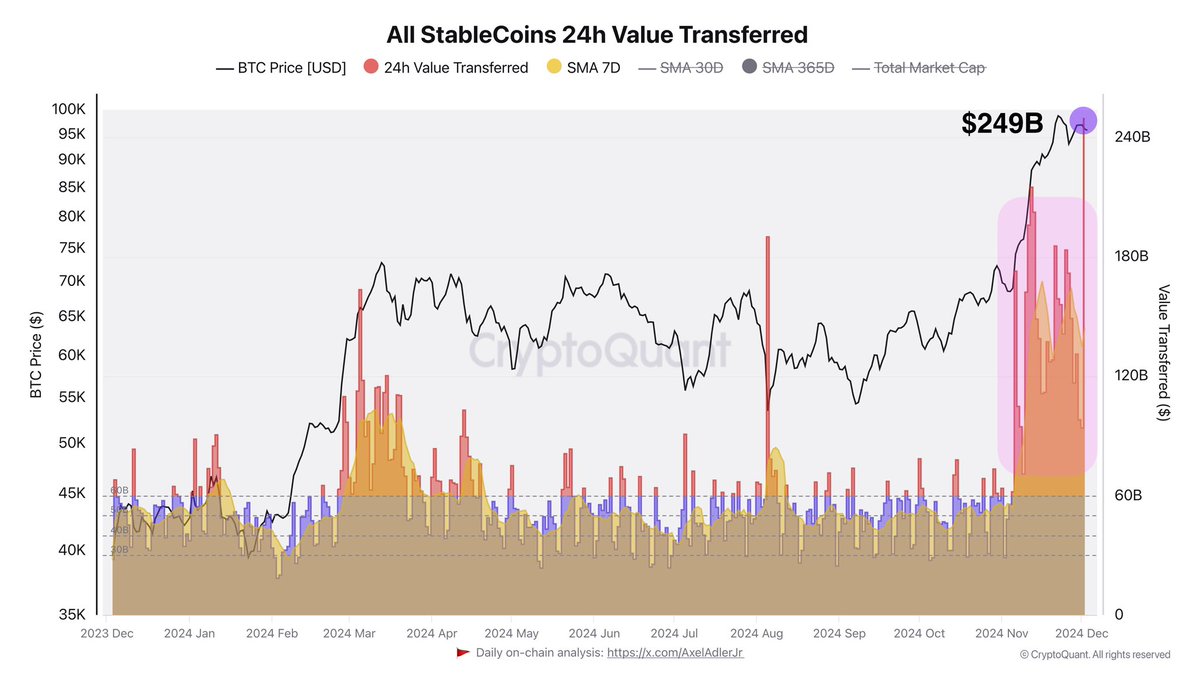

As a researcher delving into the cryptocurrency sphere, I’ve noticed an intriguing pattern amidst the market’s volatility: despite the fluctuations, there’s an underlying optimism among participants. This optimism is substantiated by on-chain data, particularly from CryptoQuant, which indicates a significant surge in stablecoin transfer volumes. Interestingly, this increase in stablecoin transfers seems to align with Bitcoin’s price movements. Historically, such a spike in stablecoin transfers often signals an influx of buying power into the market, potentially foreshadowing renewed interest in Bitcoin purchases.

With Bitcoin holding steady above $95,000, both traders and investors are keeping a keen eye on its potential to break through the psychological barrier at $100,000. On the flip side, if it fails to hold support, Bitcoin could slide back towards support areas around $90,000 or even dip into deeper price zones with less market activity.

Bitcoin And Stablecoins: What They Have In Common?

Bitcoin is nearing an impressive landmark, standing just under 1% from the significant $100,000 threshold. This surge in price is fueled by a surge in buying from institutions and individual investors. This unprecedented rise signifies a burgeoning global interest, as people from different nations are using stablecoins to buy Bitcoin. Stablecoins have become a popular intermediary, facilitating smooth transactions that traverse borders and currencies.

Based on the analysis of Axel Adler from CryptoQuant, an increase in the transfer volume of stablecoins has occurred simultaneously with Bitcoin’s rising price. This pattern underscores the crucial role that stablecoins play in offering liquidity and propelling market dynamics. The influx of funds through stablecoins strengthens Bitcoin’s price support, enabling it to exert continuous upward pressure as it approaches significant psychological thresholds.

The correlation between stablecoin activity and Bitcoin price action offers valuable insights into market dynamics. Increased stablecoin transfers often signal heightened demand for Bitcoin, providing a reliable indicator of potential price movements. This interplay is particularly relevant in identifying periods of high buying pressure, as stablecoins facilitate quick and efficient market participation.

As Bitcoin nears the significant price level of $100,000, the constant flow of stablecoin investment highlights its universal attraction and robustness. Whether this surge results in a breakthrough beyond $100,000 or a phase of consolidation, the influence of stablecoins on driving demand will continue to play a crucial role in determining Bitcoin’s price trend.

BTC Price Nears Critical Zone

At present, Bitcoin’s value surpasses the significant $95,000 mark, a figure that significantly influences its immediate trend. This level serves as both a psychological and technical support base, which might push Bitcoin towards the eagerly awaited $100,000 milestone this week or postpone the breakthrough until next year.

To reach $100K, Bitcoin needs to maintain its position at approximately $95,000 for an extended period, so it can build demand and attract new investment. If there’s consistent buying interest in this area, it could potentially propel Bitcoin beyond the significant psychological threshold of $100K, continuing its remarkable upward trend.

Despite the current bullish trend, Bitcoin’s advancement may encounter potential risks. If it fails to maintain the $95,000 level, there’s a possibility of a retest at $92,000, a key support. Losing both levels might lead to a substantial correction, pushing Bitcoin towards demand areas around $85,000 or even below $80,000. This downward movement would significantly reverse its recent upward trend, causing uncertainty among investors.

Over the next few days, it’s crucial to keep an eye on whether Bitcoin maintains a steady position above $95,000. If the bullish sentiment manages to hold strong at this level, a leap towards $100,000 could become imminent. However, should this level fail to be defended, we might see a more significant pullback before Bitcoin resumes its upward trajectory again.

Read More

- POPCAT PREDICTION. POPCAT cryptocurrency

- The First Berserker: Khazan Releases Soundtrack Excerpts

- TLC’s The Baldwins Is More Than Just the Rust Controversy

- Nicola Coughlan & Jake Dunn Dating Rumors All but Confirmed by Instagram Photo

- Libre Capital’s Sui Blockchain Move: Money, Magic, and Mayhem! 🚀💰

- LaVar Ball Gets Foot Amputated After Medical Issues — Report

- Who Is Cameron Mathison’s Ex-Wife? Vanessa’s Job & Relationship History

- Dead Rails [Alpha] Codes (February 2025) – Are There Any?

- Who Is Bruce Pearl’s Wife Brandy Pearl? Relationship, Age, Job, Kids Explained

- Who Is Kathy Hochul’s Husband? Bill’s Job & Relationship History

2024-12-03 21:40