As a seasoned analyst with over two decades of experience in the financial markets, I must admit that the recent XRP price rally has caught my attention. The surge to $2.84, reminiscent of 2018 prices, is indeed intriguing, especially considering the 430% gains since Donald Trump’s victory.

Today, the value of XRP surged as high as $2.84, marking a 100% increase in its weekly gains and pushing its market capitalization over $150 billion. This impressive rally appears to be fueled by large XRP holders, with prices last seen at this level since 2018.

The surge in the value of XRP began shortly after Donald Trump’s election win last month, leading to a remarkable increase of approximately 430%. There is an increasing sense of hope that Ripple may resolve its ongoing legal dispute with the SEC while Donald Trump is still in office.

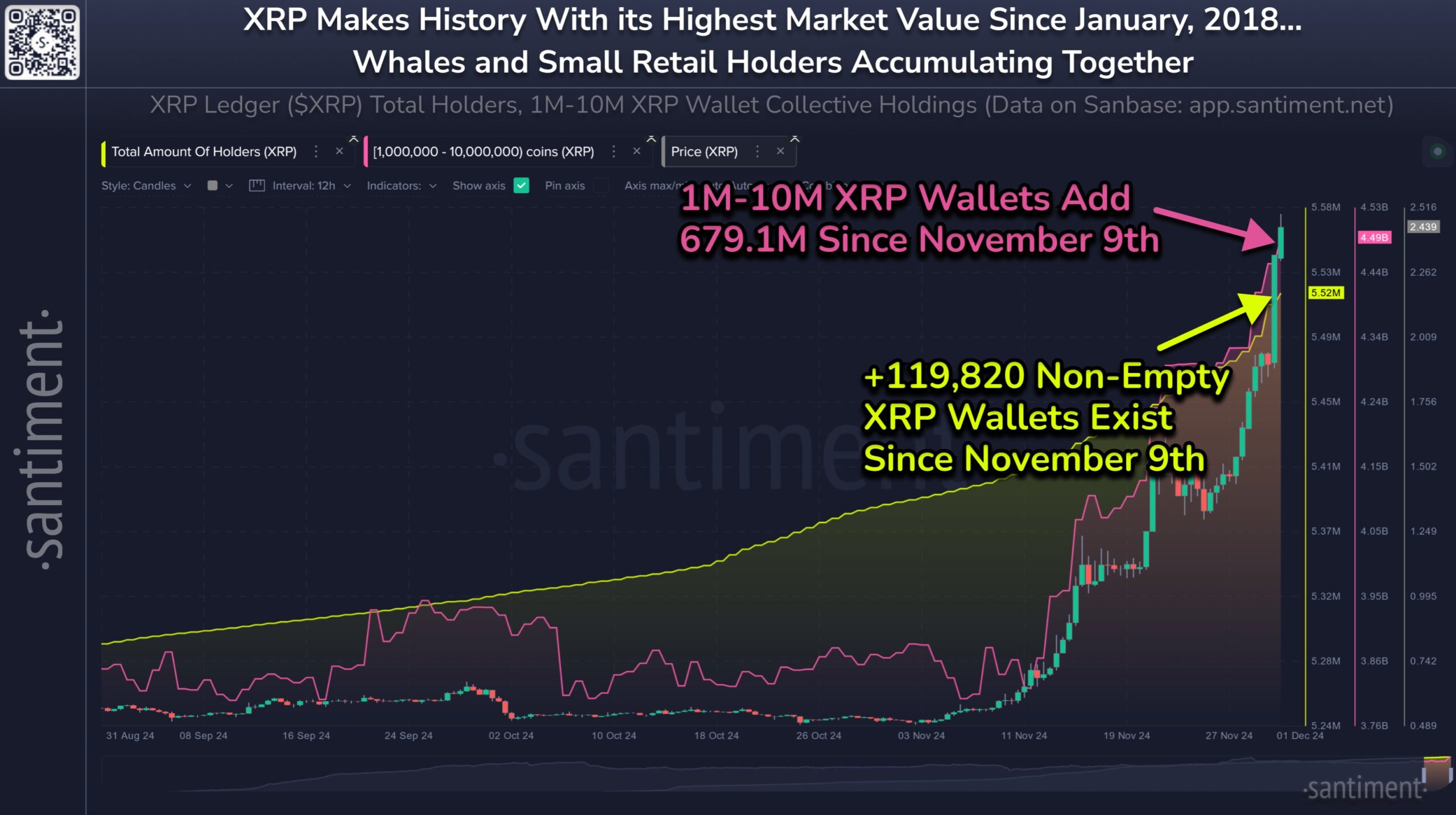

Over the weekend, Ripple Whales boosted their holdings by acquiring an extra 160 million XRP, which equates to a staggering $380 million. This spike in transactions coincides with a period where wallets containing between one million and ten million XRP have amassed a total of 679.1 million tokens worth approximately $1.66 billion over the past three weeks.

Additionally, it’s been reported by Santiment that the count of active XRP wallets exceeded 5.5 million for the very first time, marking a significant milestone in the digital currency’s over eight-year lifespan.

Courtesy: Santiment

Profit Booking by Whales

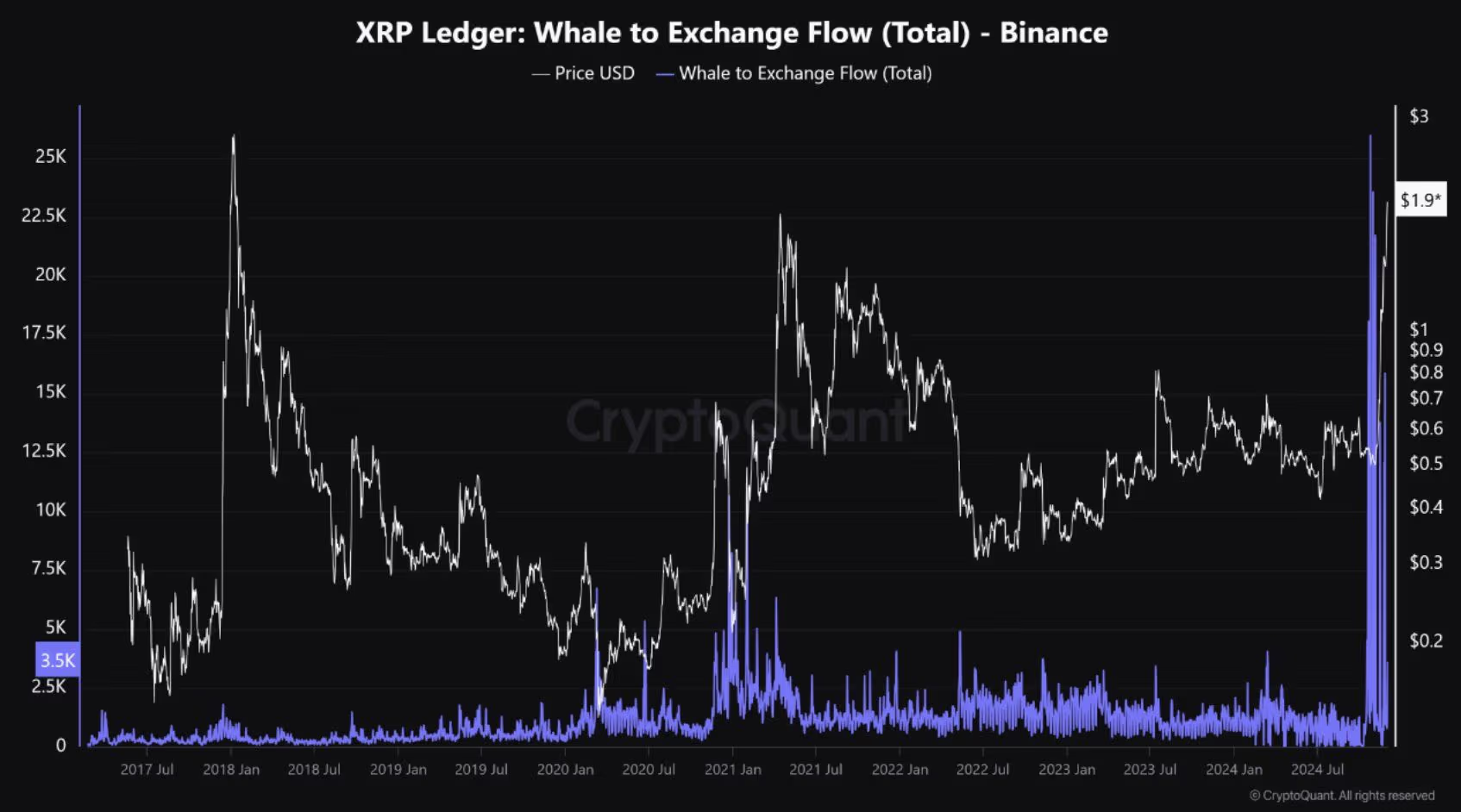

According to information from CryptoQuant, significant investors and XRP’s major holders appear to be driving the current market surge. In fact, their activity over the past month has been significantly higher compared to any other period previously observed.

It appears that whales might be considering taking profits based on the data we see. The graph below from CryptoQuant shows a substantial increase in transactions from whales to exchanges. As reported by CryptoQuant’s analyst Woominkyu, this trend has noticeably risen.

Historically, it has been noticed that periods of high whale transactions to exchanges (indicated by red circles) tend to correspond with peaks in the price of XRP. This observation suggests that whales often transfer large amounts of XRP to exchanges to sell around local or cycle tops. The most recent increase in whale-to-exchange activity occurred when the value of XRP reached approximately $2.3, which might signal whales preparing for potential profit-taking or an uptick in market action.

Courtesy: CryptoQuant

Will the XRP Price Rally Continue?

The XRP/USD trading pair appears to be breaking free from a symmetrical triangle formation, much like it did during the 2017 bullish rally that led to its peak of $3.55. Reminiscent of this event, the XRP price seems to be repeating the breakout pattern after three years of consolidation within the triangle shape, hinting at potential growth in the year 2024.

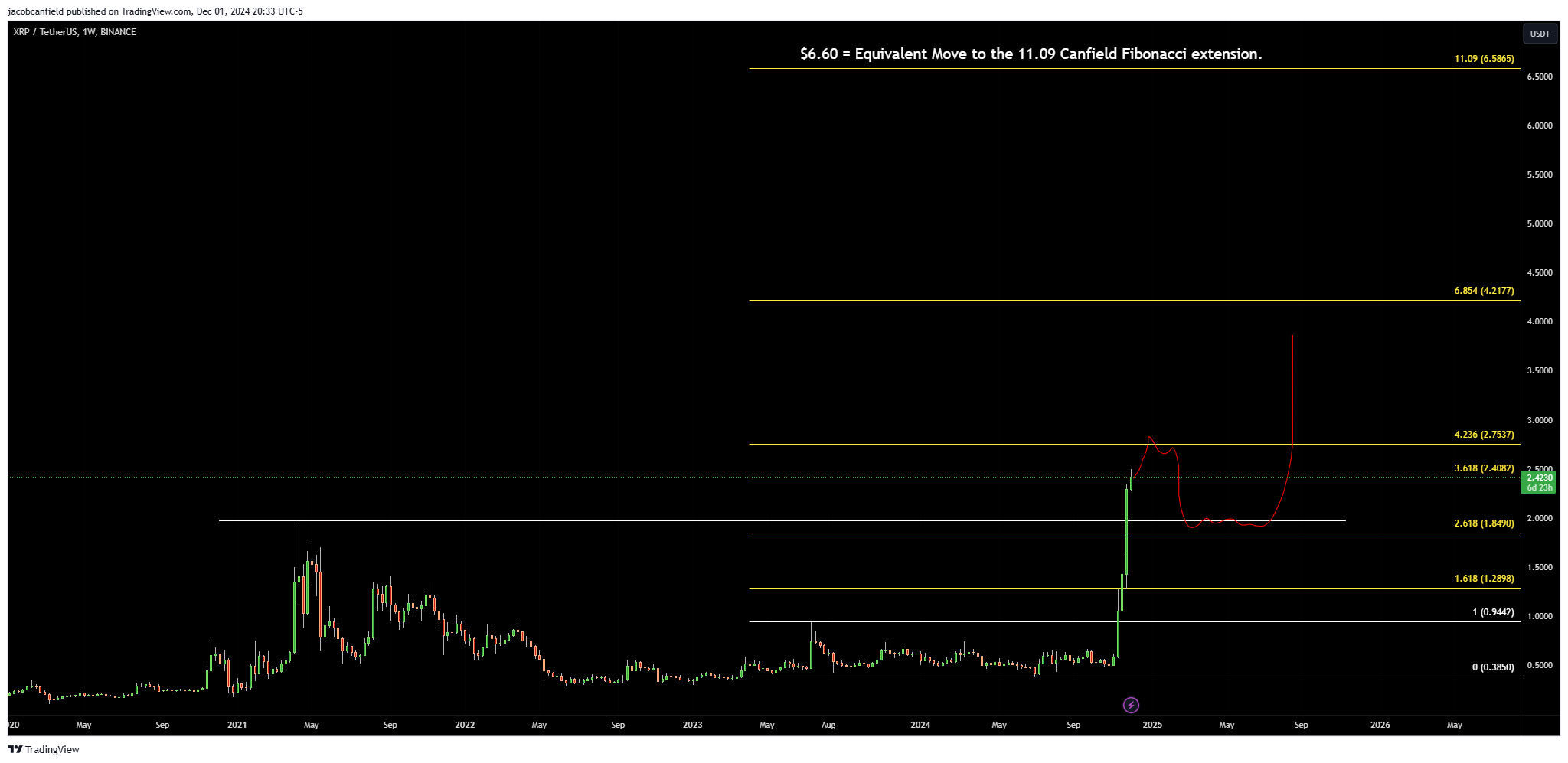

Courtesy: TradingView

The recent breakout has pushed XRP price past important Fibonacci levels, including 0.236 ($0.96), 0.382 ($1.46), and 0.618 ($2.25). This movement mirrors the 2017 triangle breakout, which led to a rise to the 1.618 Fibonacci level of $0.06.

Analysts specializing in cryptocurrencies predict that the value of Ripple’s altcoin could significantly increase by the year 2025, with some estimating a potential rise of up to 100% beyond its previous record high. Independent crypto trader Jacob Canfield posits this possibility based on Fibonacci extensions and drawing comparisons between XRP’s past trajectory and Bitcoin‘s surge in 2017. Notably, Bitcoin’s current price stands at around five times greater than XRP’s all-time high from early 2018.

Courtesy: Jacob Canfield

According to Canfield’s Fibonacci analysis, a potential price point for this move could be around $6.60, which represents a 2X increase from its previous high. This level seems to be the optimal target for those looking to capitalize on the fear of missing out (FOMO). Canfield suggests that we should not anticipate prices exceeding double digits at this juncture, as this target appears very logical based on the analysis.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2024-12-03 15:43