As a seasoned researcher with over two decades of experience in the financial markets, I have seen my fair share of market fluctuations and trends. While Bitcoin still reigns supreme as the world’s top digital asset, the recent dip in its dominance has piqued my interest.

Despite Bitcoin being the leading digital currency at present, with its value fluctuating between $90,000 and $96,000 this week, certain experts are instead focusing their gaze on what lies ahead for Bitcoin and other potential digital assets.

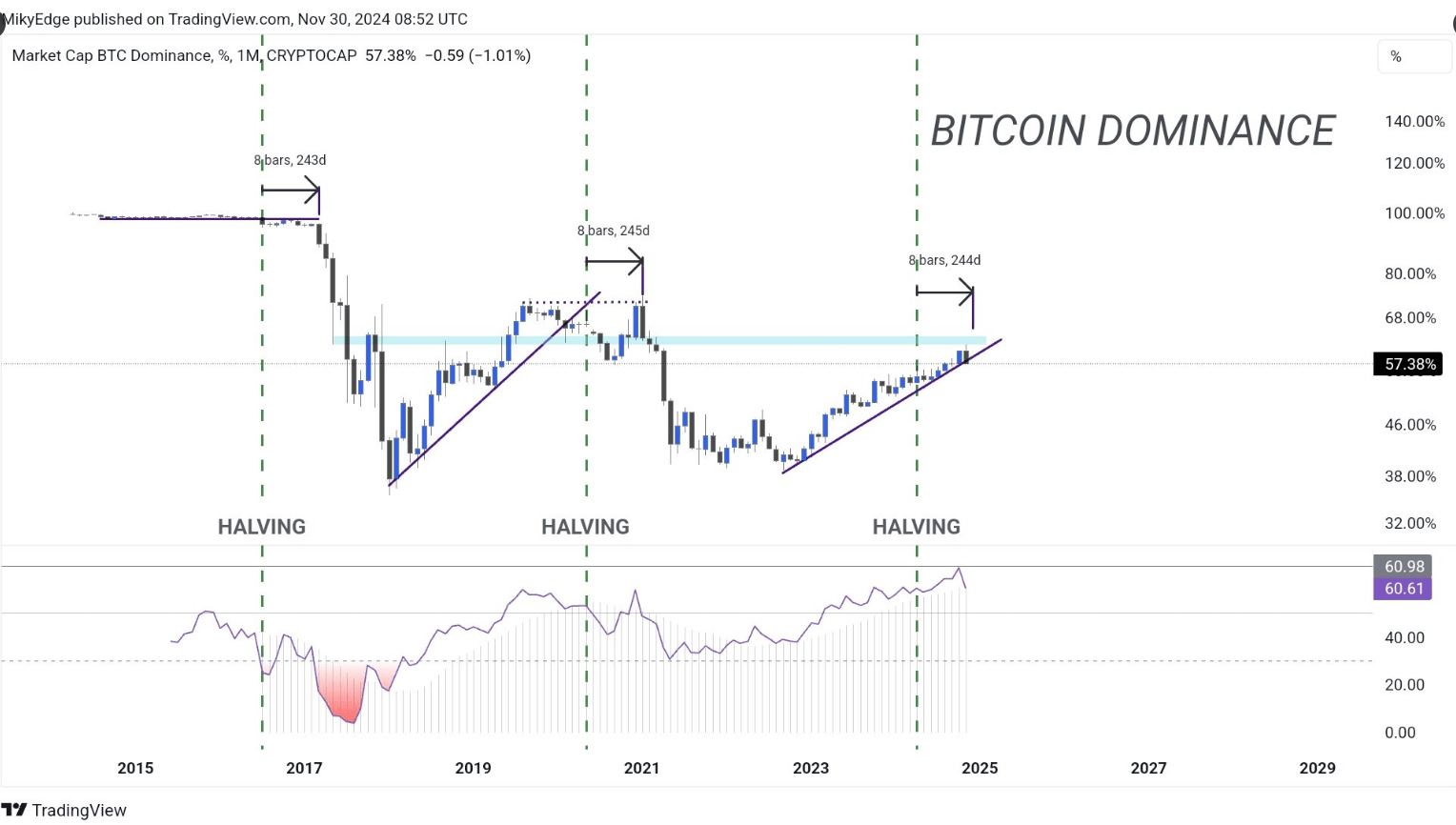

As a researcher delving into the world of cryptocurrencies, I’ve noticed an intriguing shift in the market dynamics. Some insightful analysts on Twitter/X are suggesting that Bitcoin’s market dominance is waning, which could signal the advent of an ‘altcoin season’. To be more precise, MikyBull Crypto pointed out that Bitcoin’s market dominance has dropped beneath its two-year support line, opening up a myriad of opportunities for both holders and traders.

Based on data from TradingView, Bitcoin’s current influence over the cryptocurrency market is approximately 56.67%, down slightly from 57% last week. This marks a break below its significant support level for the past two years. Analysts predict that this decline in Bitcoin’s dominance may have a ripple effect on the broader crypto market throughout December and beyond.

According to both on-chain information and market indicators, it appears that alternative cryptocurrencies (altcoins) might be about to experience a significant surge in the market. As per MikyBull Crypto’s analysis, their season supposedly began on November 30th.

Wow, Bitcoin dominance has just broken down the 2-year support.

We are indeed officially in #ALTSEASON folks!

— Mikybull Crypto (@MikybullCrypto) November 30, 2024

A Look At Bitcoin Market Dominance

When analyzing cryptocurrencies, experts and market players often look at several key indicators to evaluate Bitcoin’s success. One such dependable measure is known as Bitcoin dominance, which helps determine the asset’s relative importance within the crypto market. A higher percentage share of BTC generally means it’s more advantageous for holders and investors.

Lately, the influence of Bitcoin has been decreasing noticeably. Currently, it stands at approximately 55.3%, a drop from 58.9% just a month ago. As stated by MikyBull Crypto, this dip brings Bitcoin below its two-year supporting level.

A decrease in Bitcoin’s dominance provides a glimpse into the investment tactics of traders and investors. One key observation is that investors are shifting their resources towards other digital currencies. Numerous experts suggest that some of these investors are transferring funds to alternative coins, such as XRP, which is currently experiencing growth.

Experts suggest that investors might be considering expanding their investment portfolios by exploring other high-potential cryptocurrencies with strong growth prospects.

Analysts And Crypto Commentators Offer Differing Insights

At present, certain alternative cryptocurrencies are driving the market’s upward trend. The value of Ether is rising sharply along with a significant increase in interest for ETH-backed leveraged exchange-traded funds. Data from the blockchain indicates a 160% surge in demand for these products following the US elections on November 5th. Financial experts are optimistic about ETH, predicting it may reach $4k soon. Moreover, XRP is now trading above $2.

Pav Hundal of Swyftx offers a conservative opinion, saying that Bitcoin’s dominance score may still hit 65%, 67%, or even 70% before it declines. He argues that complex factors make it impossible to pick the right date for altcoin’s surge or Bitcoin’s decline.

Not All Analysts See An Altcoin Surge Soon

While some crypto pundits aren’t convinced that the rise of altcoins is imminent, I myself find it prudent to exercise caution during such volatile periods. As a believer in Bitcoin, I share the optimism expressed by Ki Young Ju, CEO of CryptoQuant, who maintains his bullish stance on Bitcoin. He believes that there’s still robust institutional backing for Bitcoin, making it unlikely for them to shift their focus back towards speculative assets in the near future.

In simpler terms, the CEO stated that for altcoins to set new records in market value, they require a significant increase in investment into cryptocurrency trading platforms. He suggested that rather than depending on Bitcoin’s slow pace, altcoins should come up with strategies to attract capital themselves.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-12-02 23:10