As a seasoned researcher with a knack for deciphering market trends and a touch of humor to lighten the mood, I find myself intrigued by this latest development in the crypto sphere. The increasing stablecoin cap could indeed be a game-changer for Bitcoin and the broader cryptocurrency market.

As a researcher delving into the dynamic world of digital currencies, I’ve recently noticed some fascinating trends emerging in the stablecoin market. The latest on-chain data indicates we’re approaching a significant new milestone in terms of valuation. This growth in liquidity could potentially have far-reaching implications for Bitcoin and the broader cryptocurrency market.

Can The Increasing Stablecoin Cap Push Bitcoin Price To $100,000?

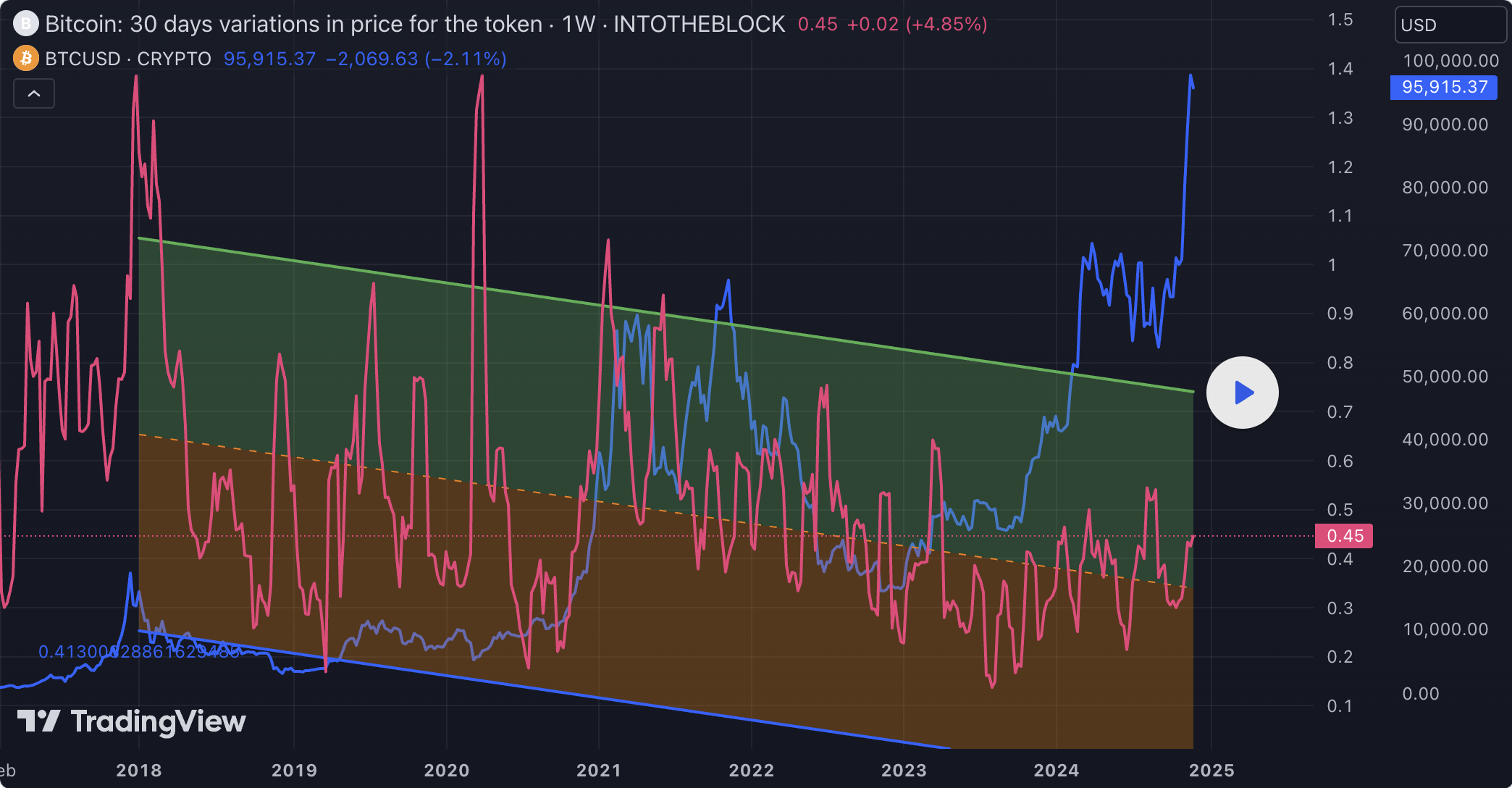

As a researcher delving into the fascinating world of cryptocurrencies, I’ve come across an interesting piece of news. The market intelligence platform, IntoTheBlock, has disclosed in its latest report that the stablecoin market capitalization has seen significant growth over the past month. Remarkably, this week, the stablecoin market cap soared beyond $190 billion for the first time since late April 2022. During this period, Bitcoin’s price was approximately $40,000.

As an analyst, I’ve observed a remarkable surge in value, which can be attributed primarily to Bitcoin’s extraordinary climb towards a six-figure valuation and the overall expansion of the total market capitalization surpassing $3.4 trillion. Notably, data from IntoTheBlock indicates a significant rise in the adoption of stablecoins over the past few weeks, as investors have been increasingly drawn to riskier assets such as cryptocurrencies.

Primarily, this growth has largely benefited Tether’s USDT, maintaining its strong grip on the stablecoin sector. According to IntoTheBlock, USDT controls approximately 72% of the market share, with a capitalization exceeding $133 billion – a figure similar to the crypto market peaks witnessed in 2021.

It’s worth noting that there’s a growing interest in Tether’s stablecoin, as more than $3 billion in new USDT tokens are being created each week. Since November began, a total of over $13 billion USDT has been minted. The majority of these stablecoins have been moving towards centralized exchanges.

The infusion of new funds into centralized trading platforms has visibly impacted the market, particularly noticeable given the robust upward trend seen lately. Traditionally, a surge in stablecoin deposits into these exchanges tends to align positively with market values, as they frequently signify enhanced “purchasing power” for investors.

Moving forward, if this favorable pattern persists, it could be crucial in helping Bitcoin’s value reach $100,000. Despite bouncing back from its recent dip below $93,000, Bitcoin hasn’t yet demonstrated the necessary strength to break through the six-figure barrier.

Currently, Bitcoin’s value remains near $96,500, marking a 2% upward shift over the last day. However, when looking at the data from CoinGecko, it shows that Bitcoin has dropped by about 3% in the past week.

BTC Market Becoming Stable And Mature: IntoTheBlock

In its latest update, IntoTheBlock notes that Bitcoin’s market conditions appear to be stabilizing, with volatility decreasing over time. This reduction in fluctuation is significant because it addresses one of the main concerns about Bitcoin being used as a form of value storage, as high volatility has been repeatedly cited as an issue.

On the other hand, According to IntoTheBlock, as retail and institutional investment in Bitcoin grows, so does its stability. This means that Bitcoin may evolve into a more dependable form of value storage.

Read More

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- ‘Incredibles 3’ Officially Taps ‘Elemental’ Filmmaker Peter Sohn as Director

- What Alter should you create first – The Alters

- Love Island USA Season 7 Episode 15 Release Date, Time, Where to Watch

- Beginner’s Guide to Counter-Strike 2

- CNY RUB PREDICTION

- Apple visionOS 26 to add PS VR2 Controller support

- Gold Rate Forecast

2024-11-30 16:34