As a seasoned crypto investor with years of experience navigating the volatile waters of the digital asset market, I find myself intrigued by the bullish pennant that has emerged on Bitcoin’s price chart. Having witnessed numerous market cycles and corrections, this pattern is a familiar sight during strong uptrends.

Despite briefly dipping following its near approach to the $100,000 mark, technical analysis reveals an increasingly optimistic trend in the Bitcoin price graph, suggesting a potential upward movement.

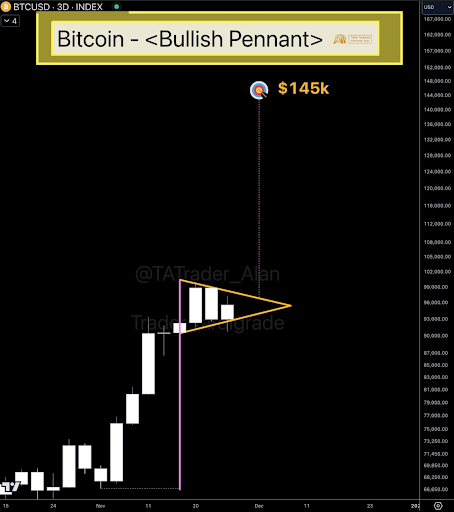

Significantly, the recent adjustment has led to the emergence of a potential bullish pennant pattern on the 3-day Bitcoin price graph. This trend could be the strong push required to surpass the $100,000 mark eventually. Yet, the expected surge is not merely beyond $100,000, but an escalation that could propel the digital currency towards $145,000.

Bullish Pennant Emerges On Bitcoin Price Chart

Over the last 24 hours, Bitcoin’s price has rebounded to approximately $96,000 following a period of decline that made up most of the previous week. Notably, this downtrend reached a minimum at around $91,000 as numerous traders cashed out their profits.

Significantly, the fluctuating Bitcoin price has led to the emergence of a compact bullish pennant pattern. Cryptocurrency expert Trader Tardigrade, recognized for his technical assessments, highlighted this pattern on social media site X. In his post, he emphasized, “Small Pennant, Big Potential,” referring to the pattern visible on the 3-day Bitcoin price chart.

A bullish pennant refers to a technical chart pattern that typically arises during robust upward trends. This pattern starts with a significant price surge (known as the flagpole), which is then followed by a period of sideways movement or consolidation (the pennant). After this phase, there’s a possibility for the price to break out in the same direction as the initial trend.

The appearance of a bullish pennant pattern in Bitcoin’s 3-day chart indicates that the cryptocurrency might prepare for another upward spike. Yet, this formation implies that Bitcoin’s price may continue to stabilize or consolidate for some time as the liquidity within the pennant hasn’t been fully absorbed. Nevertheless, Trader Tardigrade’s analysis points out potential long-term consequences of this pattern. Based on his forecast, once Bitcoin finishes its consolidation and breaks free from the pennant, it might soar towards a lofty goal of $145,000.

Among cryptocurrency experts, the idea of Bitcoin reaching a price point of approximately $145,000 has been frequently mentioned as a potential target. For example, crypto analyst Tony Severino also suggested this price in his analysis, indicating that the peak for this cycle could be around $145,000.

$100,000 Price Target Still In Play

Currently, as I type, the Bitcoin price stands at approximately $96,070 and has increased by 0.5% over the last day, yet decreased by 3.3% in the past week. It’s no longer a question of whether the Bitcoin price will surpass $100,000, but more about when this significant milestone will be reached.

Discussing upcoming events, we’re approaching the significant monthly options expiration of Bitcoin in 2024, taking place this Friday. With a total exposure of approximately $13.6 billion, this event could potentially fuel the momentum necessary for bullish investors to push Bitcoin’s value over the $100,000 mark within the next week.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-11-30 03:04