As a seasoned crypto investor with a decade of experience under my belt, I find myself at a crossroads with Bitcoin (BTC) right now. The last ten days have been a rollercoaster ride for us veterans, with BTC consolidating above the $90,000 support zone while flirting with its latest all-time high (ATH) of $99,645.

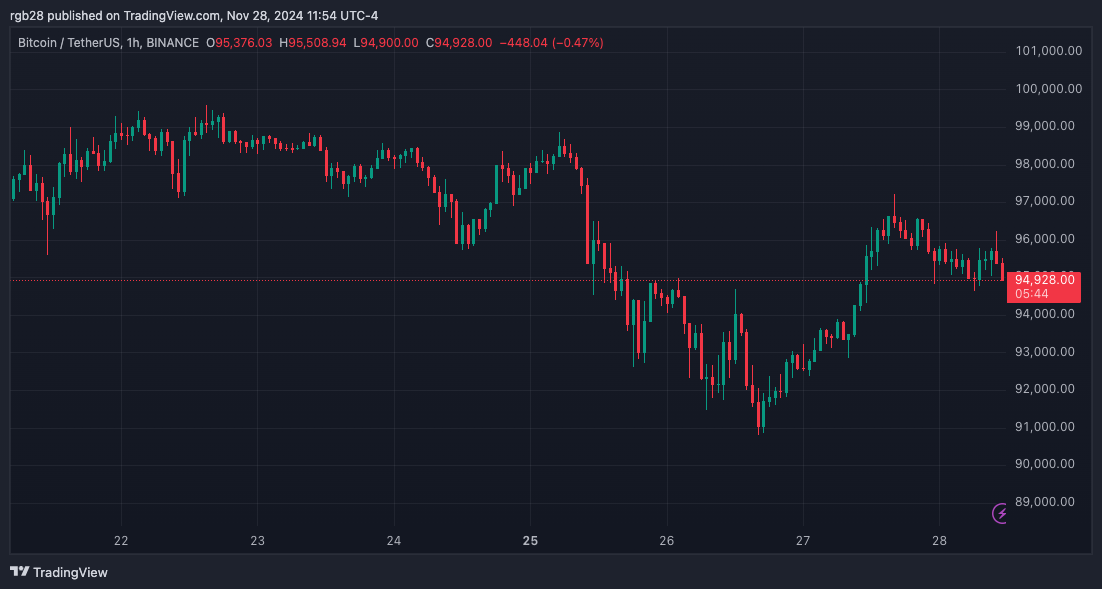

For approximately ten days now, Bitcoin (BTC) has been holding steady above its $90,000 support level. It achieved its most recent all-time high (ATH) of $99,645 around a week back. However, since then, it has ended below a temporary resistance line, failing to surpass it and showing signs of a possible decline towards two-week lows.

Bitcoin Faces ‘Moment Of Truth’

In simple terms, Bitcoin is experiencing one of its best months in a while within the world of cryptocurrencies. It has surged by more than 47% from its starting point this month to its current all-time high (ATH). Since November 18th, the price of Bitcoin has been fluctuating between roughly $90,000 and $99,000. Despite occasional dips (retraces), it has managed to stay above the lower boundary of this range.

Following two instances where it exceeded $99,000, the current surge in value has boosted investors’ confidence that the cryptocurrency could reach the $100,000 mark this month. Yet, over the past week, this leading crypto has encountered resistance at a Lower High level and is being rejected from it.

According to crypto expert Rekt Capital, Bitcoin has been consistently ending its daily sessions under a weekly trendline that shows a series of lower highs. This level serves as a potential barrier for Bitcoin, and if it manages to close above it, Bitcoin could potentially soar towards the $100,000 price point. In other words, closing above this resistance level will be a significant milestone in Bitcoin’s journey towards reaching $100,000.

If BTC continues to close below its current level, it’s likely to encounter rejection at the resistance trendline again. Despite reaching $97,000 the previous day, Bitcoin closed on Wednesday at approximately $95,300 for the seventh consecutive day. For Bitcoin to break free from this trendline, it needs to close above the $97,000 mark on Thursday.

The analyst pointed out that the trendline might act as a “potential rejection spot for Bitcoin, so long as it serves as a resistance.” Furthermore, they suggested that investors may encounter “lower price ranges” once more.

November To Close With A Near 40% Rally

Crypto expert Ali Martinez highlighted that the $93,580 point serves as a significant support area for Bitcoin, since approximately 667,000 investors purchased around 504,000 coins at this price. Martinez advised that maintaining prices above this level is crucial to avoid these investors dumping their holdings.

Furthermore, the analyst’s graph indicates that the most significant barrier to further price increase lies at approximately $96,614, a level where around 155,000 addresses collectively hold 297,000 Bitcoins.

As a researcher, I’ve observed that Martinez proposed a potential increase in Bitcoin’s price approaching the upper range of its current levels, potentially driven by the upcoming Thanksgiving Day. It’s essential to remember that historically, Bitcoin has exhibited significant price fluctuations around this holiday. For instance, the infamous “Thanksgiving Day Massacre” of 2020 resulted in a sudden 17% drop in Bitcoin’s price within a few hours.

According to the analyst, Bitcoin has been following a one-day bullish falling wedge pattern. It’s currently testing the lower boundary of this pattern as support and bouncing back in the morning. If it manages to break out successfully from this pattern, it could lead to a surge towards $99,000.

At present, Bitcoin is showing a 36.6% increase over the past month, based on figures from Coinglass. It appears that there could be additional growth in the final two days of November, potentially making it the second-most profitable month of the year. This sets up for what might be a significant surge in December.

As of this writing, BTC is trading at $95,135, a 1% drop in the last 24 hours.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- Green County map – DayZ

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-11-29 16:16