As a seasoned analyst with over a decade of experience in the crypto market, I must say that the current Ethereum rally is quite intriguing. The double-digit gains and the breakthrough of significant resistance levels are reminiscent of the 2017 bull run, albeit with a more mature and established market backdrop.

The price of Ethereum, the second largest cryptocurrency by market cap, has started to increase noticeably and is successfully pushing past crucial resistance points.

Due to a roughly 10% rise over the last week, conversations about Ethereum possibly hitting a new record high before the end of this year are gaining traction.

Of particular note, as the price of ETH continues to rise, there’s a growing enthusiasm for Ethereum futures among traders, suggested by optimistic trends in market data.

More Room For Growth?

A CryptoQuant analyst known as ShayanBTC recently shared insights into the ongoing rally in Ethereum, emphasizing the role of funding rates—a crucial metric in futures trading. Funding rates reflect the sentiment of traders and indicate whether the market is predominantly bullish or bearish.

As Shayan points out, the funding rates on Ethereum have been significantly increasing over the past few weeks, indicating a rising interest in holding long positions.

Although the optimistic outlook is present, the analyst noted that funding rates are still beneath Ethereum’s prior record high of $4,900, suggesting it hasn’t reached a point of excessive heat or overheating yet.

As I analyze the current market trends, it’s important to note that high funding rates can signal a surge in bullish sentiment. However, these rates also serve as a cautionary flag for potential market corrections. In the past, significant spikes in funding rates have often been preceded by sudden market corrections or liquidation cascades.

On the other hand, Shayan points out that Ethereum’s present funding rates remain within reasonable limits, suggesting that there is potential for further growth in the market before the risks escalate to a critical point.

Ethereum Market Performance And Outlook

At the moment, Ethereum is surging significantly, recording impressive gains of approximately 15.6% over the last fortnight. This robust surge has allowed Ethereum to breach a significant barrier at $3,500, aiming now for the next substantial resistance point at around $4,000.

Right now, Ethereum stands at approximately $3,563, which is a 1.3% rise over the past 24 hours. Yet, this current price point is a slight dip compared to its peak of $3,682 that was reached earlier today.

Moreover, the current cost of Ethereum stands at approximately 73.22% of its maximum historical value ($4,878), indicating a steady climb in its market value.

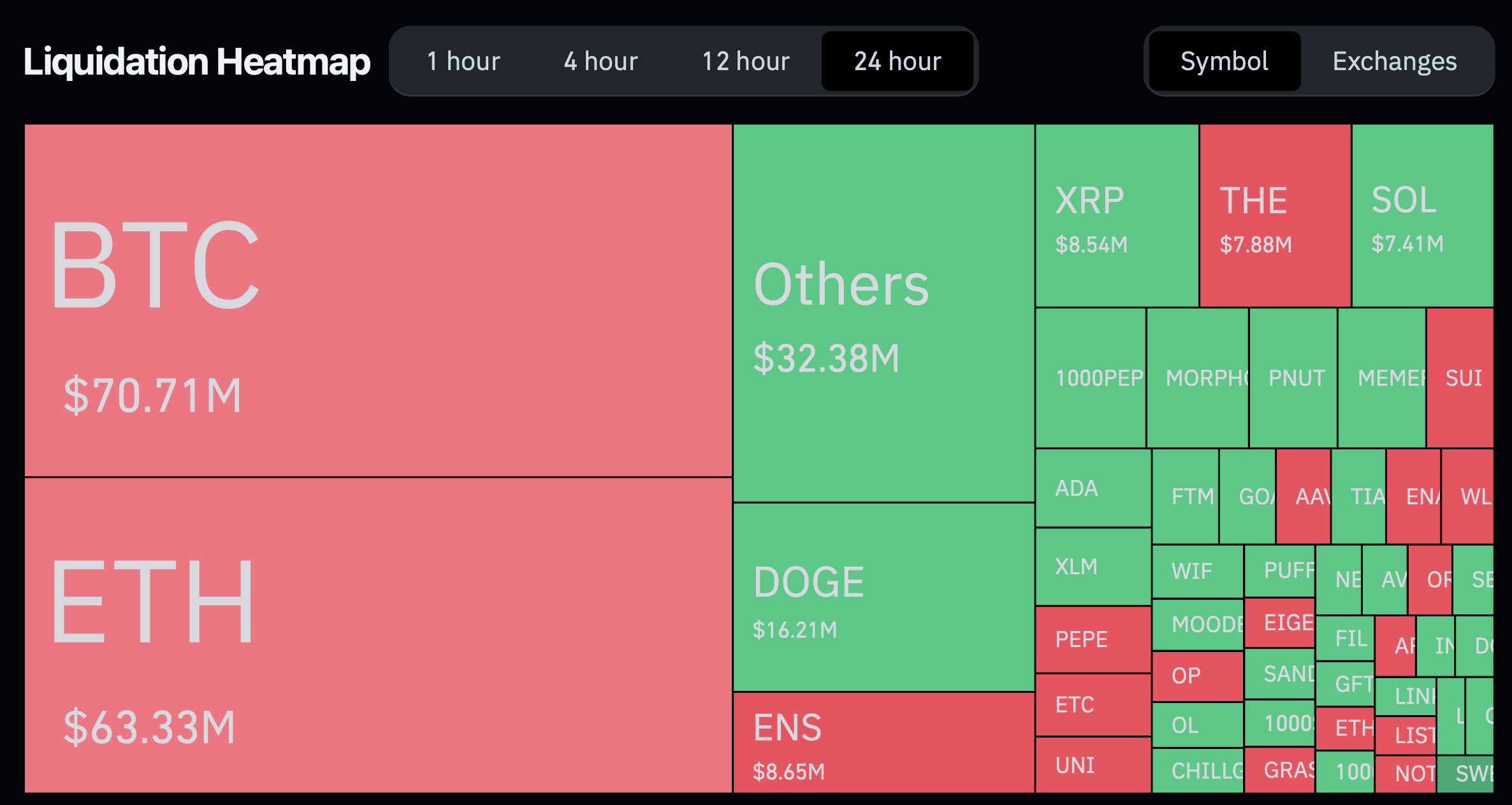

Regardless of the bullish sentiment, Coinglass data shows that in the past 24 hours alone, 98,389 traders have been liquidated, with the total liquidations coming in at $278.03 million.

Approximately $63.33 million worth of the overall liquidated funds can be attributed to Ethereum, where about $40 million was from short positions and around $23.3 million originated from long positions.

In light of recent fluctuations in Ethereum’s price, well-known cryptocurrency analyst Ali from platform X has again expressed his prediction for Ethereum. According to him, the intermediate goal is still set at $6,000 and the long-term objective remains at $10,000.

Our mid-term target for #Ethereum $ETH remains $6,000… Long-term target: $10,000!

— Ali (@ali_charts) November 27, 2024

Read More

- The Last of Us Season 2 Episode 2 Release Date, Time, Where to Watch

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- Paradise Season 2 Already Has a Release Date Update

- Who Is Christy Carlson Romano’s Husband? Brendan Rooney’s Job & Kids

- Who Is Kid Omni-Man in Invincible Season 3? Oliver Grayson’s Powers Explained

- Why Is Ellie Angry With Joel in The Last of Us Season 2?

- What Happened to Daniel Bisogno? Ventaneando Host Passes Away

- Jr NTR and Prashanth Neel’s upcoming project tentatively titled NTRNEEL’s shoot set to begin on Feb 20? REPORT

- Gold Rate Forecast

- Why Was William Levy Arrested? Charges Explained

2024-11-29 13:16