As a seasoned crypto investor with battle-scarred fingers from past bear markets and a wallet full of digital gold, I find myself cautiously optimistic about Bitcoin’s recent surge above $95,000. The insights shared by CryptoQuant on key indicators for optimal buying opportunities have always served as a beacon in my investment strategy.

Initially dipping to around $90,000 earlier this week, Bitcoin has made a significant comeback, surpassing its previous mark and reaching prices above $95,000.

At the moment, Bitcoin is valued at approximately $95,224. Over the last fortnight, it has experienced a 7% increase, indicating a resurgence in positive market sentiment.

Key Indicators Highlight Best Buying Opportunities

In the ongoing surge of Bitcoin, CryptoQuant – a well-known analytical platform for blockchain data – offers valuable insights about critical indicators, enabling prospective investors to pinpoint ideal moments for investment.

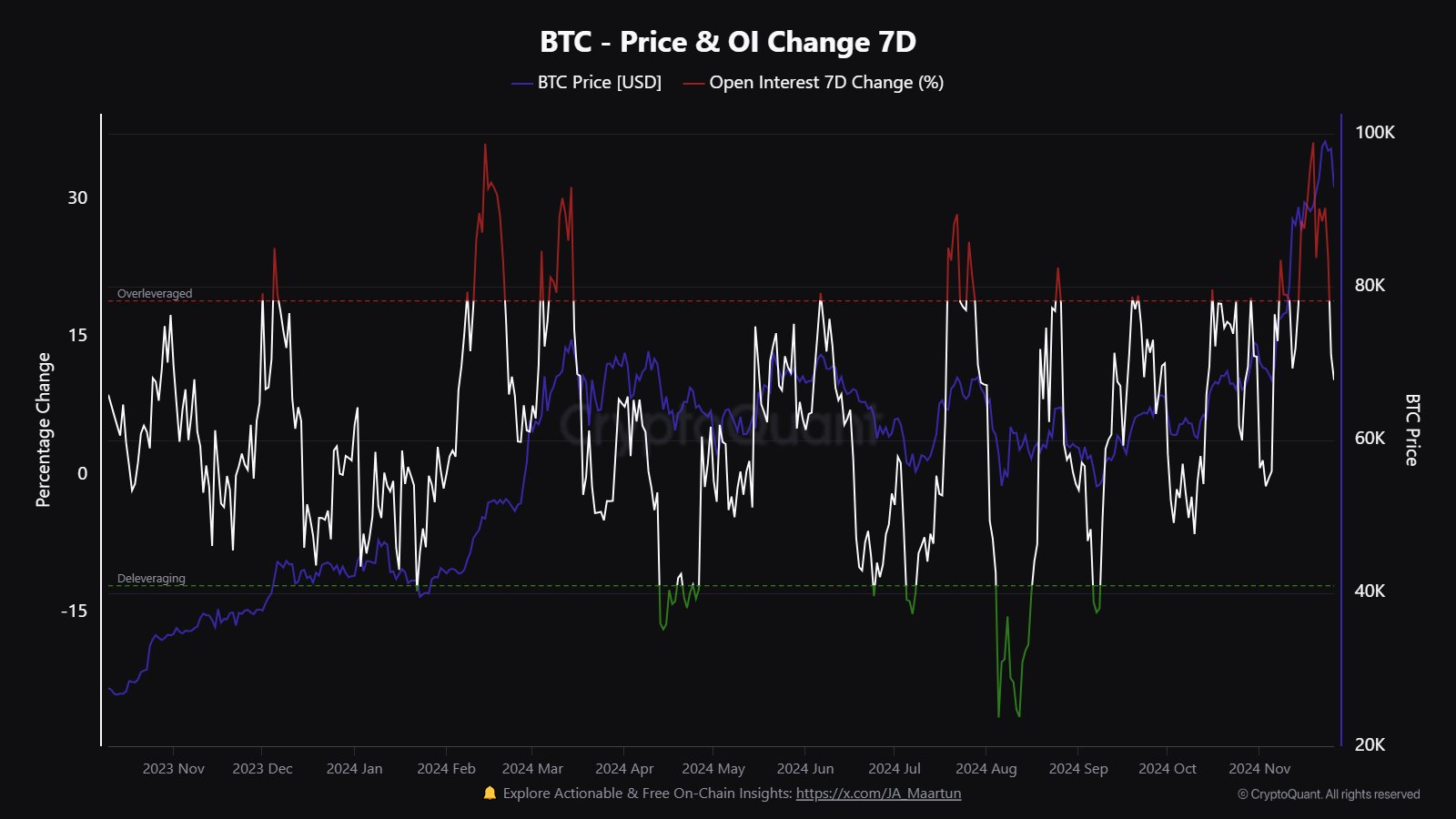

By analyzing past trends and current market dynamics, CryptoQuant offers insights into recurring patterns such as price adjustments, tactics employed by short-term traders, risky investments, and volume fluctuations. These findings serve as a compass for investors seeking to navigate the ongoing surge in Bitcoin’s value.

As per CryptoQuant’s analysis, past bull markets consistently demonstrate that price declines or corrections are unavoidable, even when the market is experiencing continuous expansion.

For example, during the 2017 market surge, there were drops of up to 22%. In contrast, the 2021 rally had dips of 10% and 30%. So far in 2024, we’ve seen decreases of 15% and 20% in the bull run. This indicates that these periodic downturns might provide beneficial buying chances.

The platform places great importance on the Short-Term Holder Realized Price statistic, which represents the typical purchase cost for recent investors. This figure frequently functions as a crucial level of support during bull markets because short-term holders tend to buy when they reach their break-even point, thereby strengthening price consistency.

Buy at the Average Cost Basis of Short-Term Holders

The Short-Term Holder Realized Price can be seen as the buy-the-dip level during bull markets.

Investors often purchase stocks when the cost they pay equals their break-even point, thereby creating a visual representation of the price level where buying interest is strong – or in other words, a visual representation of the price level that acts as a support.

— CryptoQuant.com (@cryptoquant_com) November 27, 2024

As a researcher, I’ve noticed an intriguing trend called the “Draining of Open Positions” highlighted by CryptoQuant. During intense market activity, this phenomenon occurs when speculative positions are liquidated. This process can provide opportune entry points for investors seeking to capitalize on temporary market corrections.

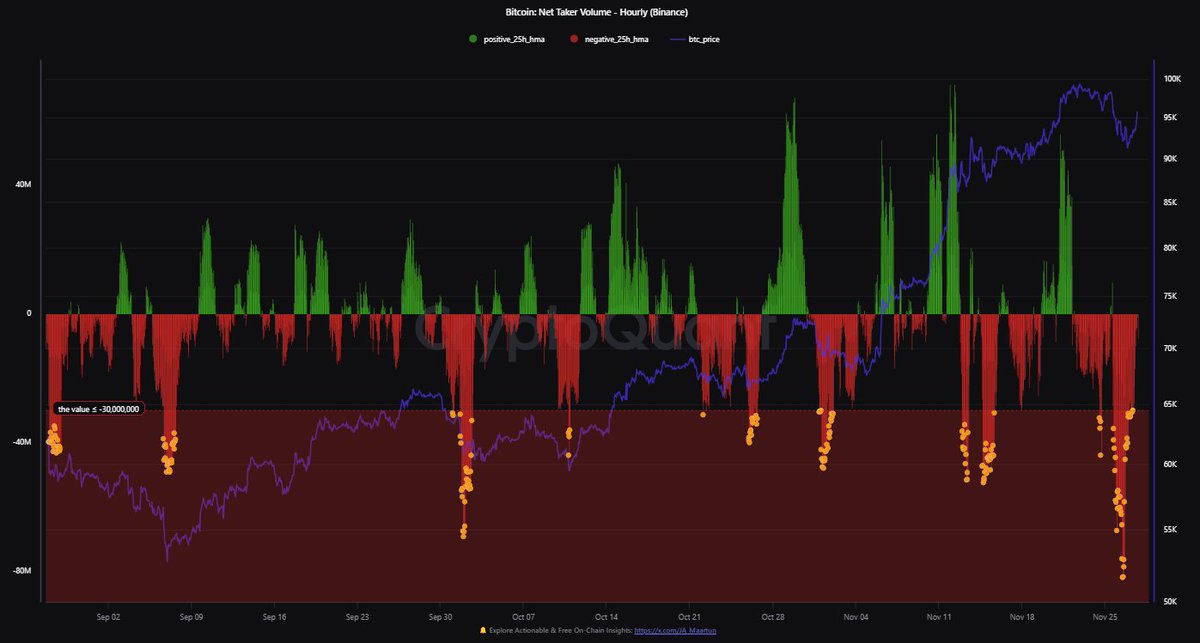

In summary, the Net Taker Volume indicator, a tool that gauges the difference between demand and supply dynamics, indicates that periods of intense selling could potentially indicate chances for future price increases.

Based on data from CryptoQuant, a reading lower than $30,000,000 might suggest that sellers are running out of steam, opening up the possibility for an upward trend.

Key Support Levels For Bitcoin

Currently, Bitcoin appears to be gearing up for another possible surge. However, analysts remind us about the significance of safeguarding essential support points. Crypto expert Ali has pinpointed the $93,580 region as a significant area of interest, with around 667,000 addresses jointly holding nearly 504,000 Bitcoins here.

As per the analysis, it’s important to stay above this threshold to prevent a possible mass selling by investors at this particular price mark.

One key demand zone for #Bitcoin to watch is $93,580, where 667,000 addresses bought nearly 504,000 $BTC. Staying above this support level is a must to prevent these holders from selling!

— Ali (@ali_charts) November 28, 2024

Read More

- How Much Did Taylor Swift’s Eras Tour Contribute to the US Economy?

- The Beauty Cast Adds Rebecca Hall to Ryan Murphy’s FX Series

- IMX PREDICTION. IMX cryptocurrency

- Bitcoin Price Turns Green: Poised for a Major Upswing

- Skeleton Crew Episode 4 Ending Explained: What Happens to Neel?

- What Happened to Richard Perry? ‘You’re So Vain’ Music Producer Passes Away

- Why Is ‘Vexbolts Mass Unfollowing’ Trending on TikTok & What Did He Do?

- The Handmaid’s Tale Season 6 Features ‘A Lot’ of Deaths

- Old Guy Trailer Sets Release Date for Christoph Waltz Action Comedy

- Who Is Kelly Reilly’s Husband? Kyle Baugher’s Job & Relationship History

2024-11-29 10:35