As a seasoned crypto analyst with years of experience navigating the volatile cryptocurrency market, I find TradingShot’s latest analysis both insightful and intriguing. The temporary rejection at $99,000 and the potential for Bitcoin to surpass the $100,000 mark aligns with my own observations of the market trends.

Crypto expert TradingShot recently shared his thoughts on why Bitcoin‘s price didn’t hold at $99,000, questioning if it signaled an end to the bullish trend or just a temporary setback. According to his analysis, this dip was only short-term and Bitcoin is likely to hit $100,000 and potentially go even higher.

Bitcoin Price Rejection At $99,000 Likely Temporary

In a recent TradingView post, TradingShot proposed that the temporary halt in Bitcoin’s price advance at $99,000 might be explained by market participants running out of enthusiasm following the election. The analyst suggested that this dip could be due to the market now fully accounting for the possibility of Donald Trump, who is known to be pro-crypto, becoming the next U.S. president, thus pricing in these expectations into current Bitcoin prices.

The analyst added that there is also the psychological weight of the $100,000 barrier, possibly because investors tend to take profit around such levels. From a technical analysis perspective, the analyst explained what could be causing this Bitcoin price rejection at the $99,000 level.

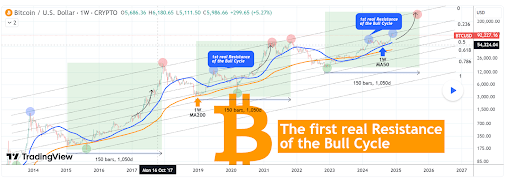

TradingShot pointed out a Fibonacci trend line that’s been present across the past three market fluctuations, including the current one. He mentioned that this pattern was initiated by a robust recovery which marked the peak of Bitcoin’s price in December 2013. This cycle peak occurred on the 0.236 Fib level, a point that has historically thwarted rallies during subsequent market trends.

On November 22, the Fib level halted the upward trend in Bitcoin’s price and serves as the initial significant resistance in the current bull market cycle. As per TradingShot’s analysis, this is the first significant obstacle a bull cycle encounters before reaching its peak in the market. Furthermore, the analyst pointed out that the highest point during the last two cycles occurred at the 0.0 Fib level, which coincides with the upper boundary of this trading channel.

According to the analyst’s chart, the potential peak for Bitcoin price could exceed $200,000 at the channel’s top. However, it’s important to note that the red marking on the current cycle towards late 2025 is not a prediction, but rather a point of comparison.

When The Market Top Could Happen

In addition to their analysis, TradingShot has suggested possible timings for when the Bitcoin price might peak in this particular market phase. By observing previous bull trends, they’ve pointed out that these cycles typically last about 150 weeks (approximately 1050 days). If history repeats itself, the estimated peak for this cycle could be around late September or early October.

The analyst suggested it’s wiser to aim for market peak timing and sell off, rather than setting a specific price. TradingShot noted that although Bitcoin’s technical analysis shows a rejection, the recent rally started from the low point on August 5, which coincides with the 1-week 50-day moving average. As long as this trendline persists, the analyst believes the ongoing cyclical bullish wave will remain strong.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Gold Rate Forecast

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

2024-11-29 07:17