As a seasoned researcher with years of experience in the cryptocurrency market, I find the recent signal from Glassnode’s Seller Exhaustion Composite for Bitcoin Weekly-Monthly traders particularly intriguing. Having witnessed numerous market cycles and capitulation events, I am cautiously optimistic about this development.

An analytical tool for Bitcoin, developed by Glassnode, recently provided a hint indicating potential reduction or even depletion of selling pressure within the market.

Bitcoin Seller Exhaustion Has Just Registered A Spike

On their latest post at X, Glassnode discusses the current status of the Seller Exhaustion Indicator for traders who use the weekly-monthly Bitcoin market. This “Seller Exhaustion Indicator” is a tool that helps determine if selling activity on the network has reached its limit or not.

The metric bases itself on a few on-chain indicators, with perhaps the most notable being the Realized Loss, which measures the total amount of loss that the BTC investors are locking in.

Over time, it’s been observed that the price of cryptocurrencies often hits a low when there is a significant amount of holder capitulation. During these periods of heavy losses, cryptocoins are typically transferred from inexperienced or fearful holders to more experienced and resilient entities. This decrease in selling pressure makes it less likely for the asset to continue falling, creating an opportunity for recovery.

From an analyst’s perspective, when delving into the current subject matter, I find myself focusing on the Seller Exhaustion Composite exclusively among the Weekly-Monthly Bitcoin traders. These are individuals who have recently acquired their coins within a timeframe of one day to one month. Glassnode has zeroed in on this particular group because they’ve observed a statistical link between holding duration and propensity to sell.

Conversely, less experienced investors might be susceptible to panic selling. This behavior can lead to loss-taking across all market phases, including during a bull market.

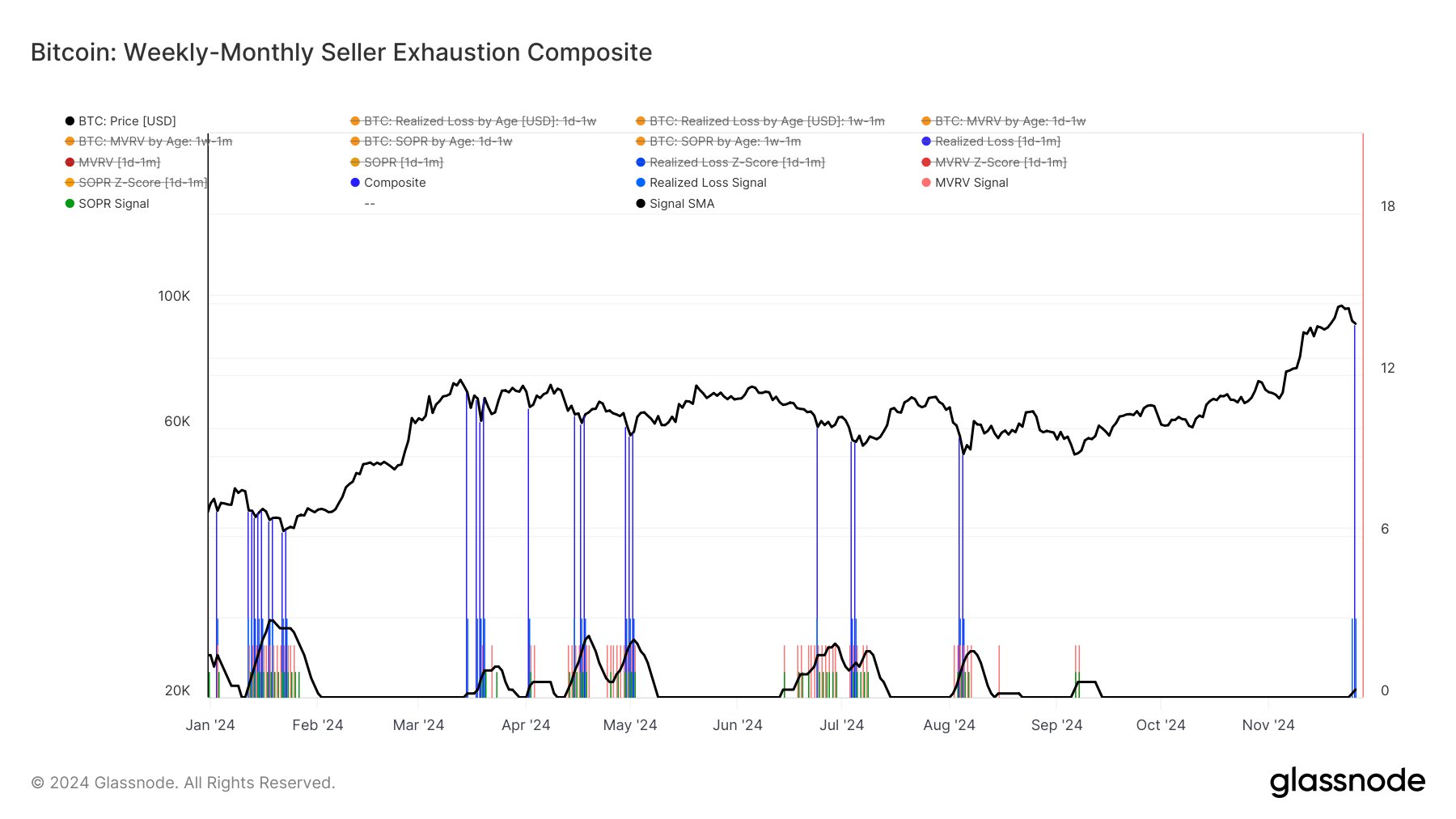

Here’s a chart provided by the analytics company demonstrating the progression in the Bitcoin Seller Burnout Index for first-time market participants:

According to the graph you see, the Seller Exhaustion Composite has recently signaled for Bitcoin traders who have been actively trading for the past week and month. As explained by Glassnode, this indicates a significant amount of locked-in losses among these Bitcoin traders over the last month.

As a crypto investor, I’ve noticed that the recent wave of sell-offs by newcomers has occurred following the cryptocurrency’s price drop from its record high surpassing the $99,000 mark.

Looking at the graph, it appears that every time our group experienced significant losses last year, there was a price bottom. Since this trend seems to persist, it’s plausible that Bitcoin might discover another bottom following the current sell-off too, given its history of price fluctuations due to capitulation events.

BTC Price

A few days ago, Bitcoin dipped close to $90,000, but it appears to be rebounding and currently trades near $95,400.

Read More

2024-11-29 05:47