As a seasoned researcher with over two decades of experience in the financial markets, I have seen my fair share of market trends and cycles. The correlation between Bitcoin’s price movements and the global M2 money supply is intriguing and has been historically reliable, especially during inflationary periods. However, as Joe Consorti rightly points out, we should not blindly rely on this relationship without considering other factors that could impact Bitcoin’s value.

Bitcoin’s

BTC

$93 643

24h volatility:

1.6%

Market cap:

$1.85 T

Vol. 24h:

$91.11 B

potential for reaching new price peaks faces a significant obstacle, with analysts predicting a 20% or greater decline if its established link with the global M2 money supply persists. The M2 money supply, encompassing cash and short-term deposits, has served as a key indicator of Bitcoin’s price trends historically. Joe Consorti, head of growth at Theya Bitcoin, predicts a price pullback to $70,000 if this pattern continues.

Source: Joe Consorti

On social media platform X, Consorti posted a word of warning, emphasizing the striking similarity between this correlation. He voiced doubts about whether Bitcoin would continue to mimic the descent path of the M2 supply or manage to find support before reaching that point. Since September 2023, Bitcoin has shown a 70-day lag in reflecting global M2 money supply trends.

Bitcoin Trends Mirror Global M2 Shifts

The worth of Bitcoin has typically grown alongside the global M2 money supply, notably during times of inflation. When the M2 increases, it often indicates inflation, causing investors to look at Bitcoin as a protective measure against rising costs. This pattern has been observed in past market surges. Nevertheless, analyst Joe Consorti forecasts a decrease of about 20-25% in Bitcoin’s value, basing this prediction on ongoing trends that might lead to substantial drops.

On November 25, 2024, I, as a researcher, emphasized Bitcoin’s propensity to align with M2 movements, delayed by approximately 70 days. Since mid-2023, I’ve consistently observed this correlation, stressing its relevance for market analysis. I cautioned about the possibility of potential corrections if this trend continues, pointing out the robust historical reliability of this relationship.

Consorti cautioned that if the current trend persists, there’s a possibility of a 20-25% drop in Bitcoin’s value.

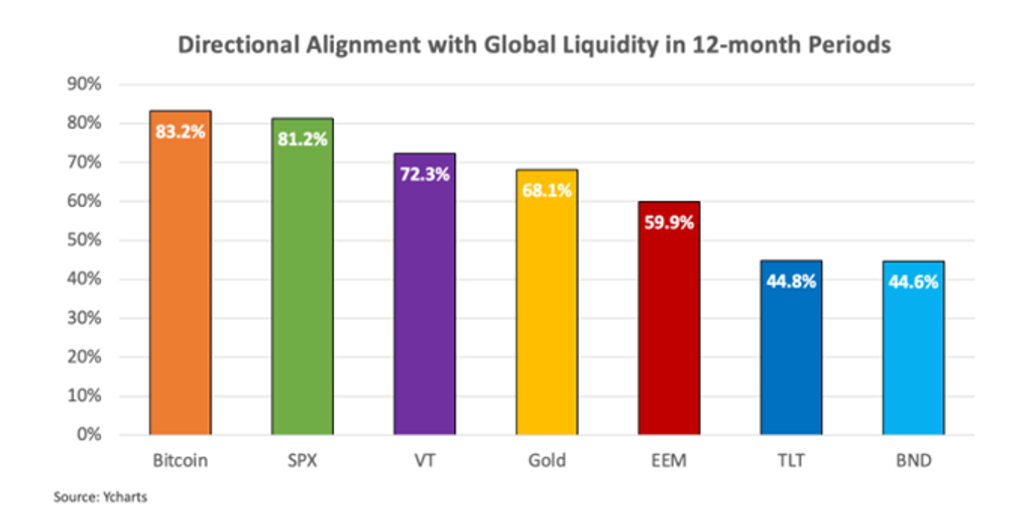

Among specialists, there is a variety of opinions. Macroeconomist Lyn Alden pointed out in her September 2024 report that Bitcoin generally follows global liquidity trends about 83% of the time over a 12-month span, mirroring M2. However, some critics remain unconvinced. Analyst David Quintieri, for instance, disputes such correlations, stressing Bitcoin’s high volatility as a reason why it is not reliably linked to any measurement.

Source: Lyn Alden

David mentioned that Bitcoin’s volatility makes it unsuitable for comparison with other things. He believes this is all a diversion. In his opinion, comparing Bitcoin to the stock market would be a more practical approach.

In another viewpoint, James Check, the leading analyst at Glassnode, suggested that a significant portion of the recent drop in M2 (a measure of money supply) can be attributed to the strengthening US dollar. Essentially, this makes the M2 of other countries less valuable.

Bitcoin Defies Trends amid US Tariff Concerns

As a researcher studying the cryptocurrency market, I’ve noticed some intriguing patterns that have sparked my curiosity. Analysts, including myself, have expressed concerns about potential external factors, such as changes in US tariffs, possibly impacting Bitcoin. On November 22, I observed an interesting anomaly in market behavior pointed out by crypto analyst Sam KB. Typically, Bitcoin rallies coincide with peaks in M2 money supply. However, during this current cycle, despite M2 reaching its lowest level, Bitcoin continues to show remarkable growth, which contrasts with historical trends. This discrepancy warrants further investigation and analysis to better understand the current dynamics of the Bitcoin market.

“Although M2 is almost at its minimum during this cycle, Bitcoin is still on an upward trend, causing people to question what I’m not seeing.

Enhancing the ambiguity, potential tariffs proposed by President-elect Donald Trump on imported items might bolster the U.S. currency even more. Hedge fund manager Scott Bessent discussed this matter in a Bloomberg interview on November 5, highlighting that “Tariffs lead to a stronger dollar,” which could potentially pose problems for Bitcoin.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2024-11-27 14:27