As a seasoned researcher with years of experience in crypto analysis and market trends, I have to admit that the recent developments in Dogecoin’s price action have piqued my interest. The 50-day Moving Average (MA) as a technical indicator is one that I’ve found particularly insightful in the past, and its current role in Dogecoin’s trajectory is undeniably intriguing.

The price of Dogecoin has been preparing for a significant bull run ever since it hit the $0.4 mark and started testing that resistance level. A crypto expert has shared insights on Dogecoin’s potential bullish trend, emphasizing the role of the $0.22 50-day Moving Average (MA) in guiding Dogecoin’s price fluctuations during this bull run phase.

How The 50-Day MA Impacts The Dogecoin Price Rally

The 50-day MA is a technical indicator that highlights a cryptocurrency’s average price over the last 50 trading days. It is primarily used to identify price trends, determine resistance and support levels, and generate buy and sell signals.

Kevin, an analyst specializing in cryptocurrency (previously known as Twitter), emphasized the importance of a key technical indicator in recent fluctuations of Dogecoin’s price and its potential impact on future bullish trends for the meme coin. Specifically, he pointed out that during past Dogecoin market surges, its value usually remained above the 50-day Moving Average (MA), even though it occasionally dipped near this level. Generally, maintaining a position above the 50-day MA is considered bullish, while consistently dropping below it indicates a bearish trend.

In simpler terms, Kevin recently shared a comprehensive timeline of Dogecoin’s price fluctuations during its previous bull run in late 2020 up until now. He noted that the moving average for this meme coin stands at approximately $0.22 at present. Yet, it appears this value is increasing rapidly as each new day ends for Dogecoin.

Furthermore, the fast rise indicates that if Dogecoin manages to hold its value near or above the 50-day Moving Average, it could witness a substantial upward price movement, establishing a robust base for potential further growth in price.

Dogecoin Enters Distribution Phase, $9.5 Target In Sight

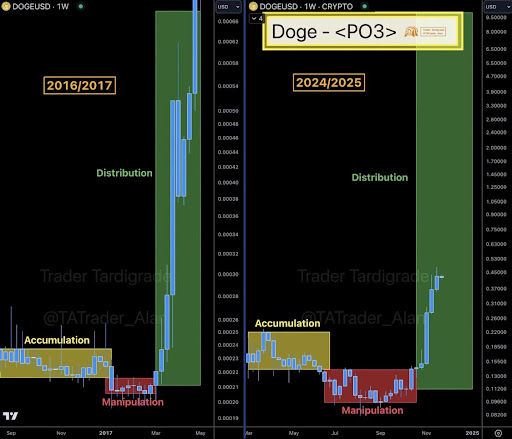

In another discussion, well-known crypto analyst Trader Tardigrade asserted that Dogecoin has now moved into the Distribution phase according to the Power of Three (PO3) market model, a widely-used technique in technical analysis for pinpointing significant market stages: Accumulation, Distribution, and Manipulation.

As an analyst, I find myself observing Dogecoin now in its Distribution phase, a period where large holders might choose to sell off their assets, possibly cashing in on the gains after the recent surge in DOGE‘s price. However, it’s essential to remember that this Distribution phase could be seen as a tranquil pause before an enormous price surge, much like the calm before a storm. In other words, while we might see some sell-offs and a slowing momentum, the bull rally may not be over just yet.

The analyst presented two graphs showing Dogecoin’s price fluctuations during the 2016-2017 bull run and projected prices for 2024-2025. In 2017, during the bull market, Dogecoin entered a phase of distribution, triggering a powerful surge in its price to heights beyond $0.00066.

According to predictions made by Trader Tardigrade, if the current distribution pattern of Dogecoin continues, the price could potentially rise significantly – reaching up to $9.5 from its current level of $0.4.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-11-27 00:04